The Investigation Agency of the Ministry of Public Security (C01) issued its supplementary investigation conclusion on the case of Stock Market Manipulation and Fraudulently Misappropriating Assets involving Chairman of FLC Group, Trinh Van Quyet, on February 24th. In this conclusion, C01 for the first time proposed the prosecution of four former leaders of Ho Chi Minh City Stock Trading Center (HOSE), including Tran Dac Sinh, former Chairman of the Board of Directors; Le Hai Tra, former Member of the Board of Directors, Deputy General Director in charge, independent member of the Listing Council; Tram Tuan Vu, former Deputy General Director, Deputy Chairman of the Listing Council; Le Thi Tuyet Hang, Director of the Listing Appraisal and Management Department, member of the Listing Council.

All four defendants are proposed to be prosecuted for the crime of Abuse of power or position while performing official duties, while Mrs. Hang is subject to being outside the country.

In addition, three others are also accused of the offense of Disseminating false or concealing information in securities activities, including Le Cong Dien, Head of the Supervision Division of Public Companies under the State Securities Commission; Duong Van Thanh, Director General of the Vietnam Securities Depository Center; Pham Minh Trung, Head of the Securities Registration Department of the Vietnam Securities Depository Center.

Trinh Van Quyet and 7 others are being investigated for two crimes: Market Manipulation and Fraudulently Misappropriating Assets; 13 people are accused of Market Manipulation and 22 people are accused of Fraudulently Misappropriating Assets.

Table:

Mr. Tran Dac Sinh before he was arrested. Photo: HOSE

|

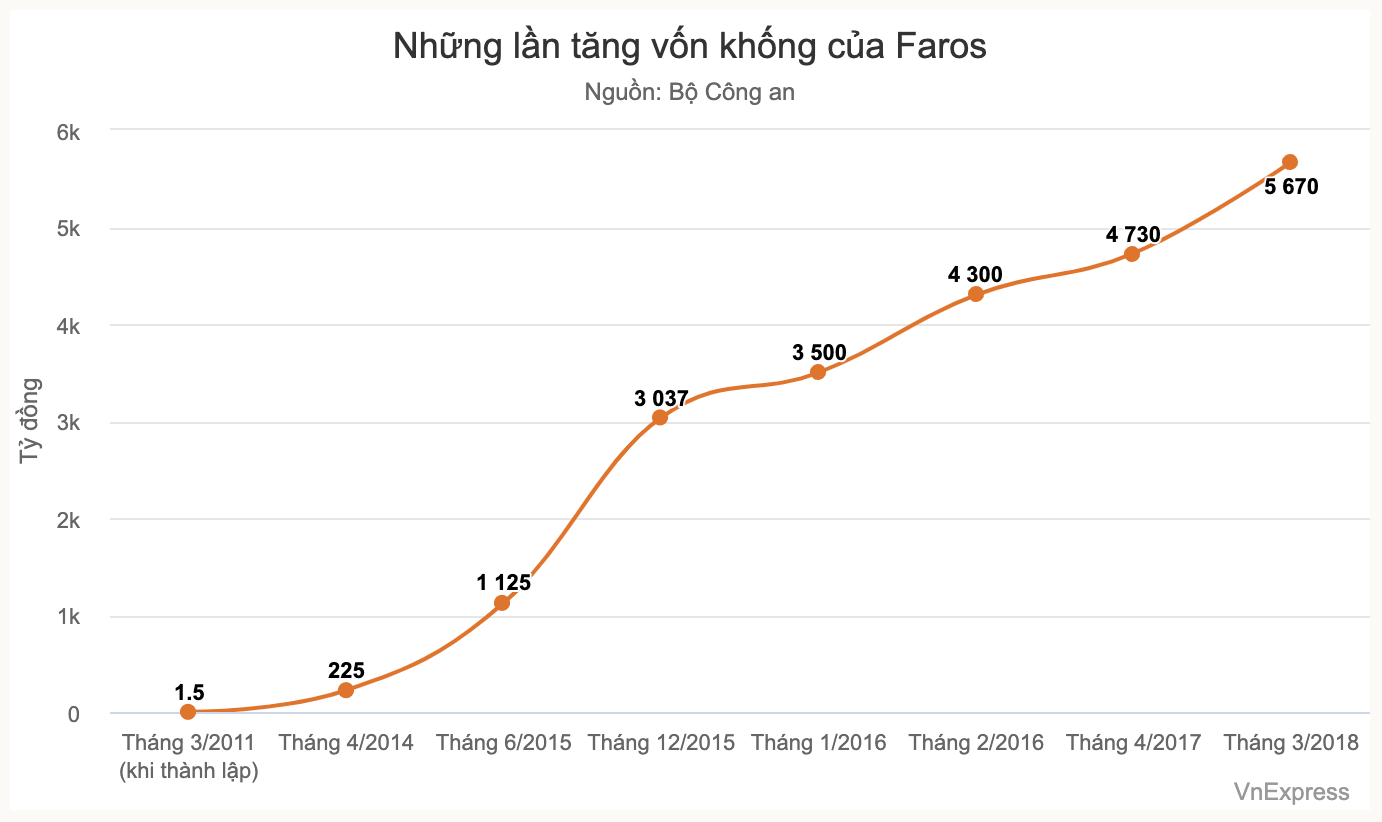

According to the investigation conclusion, Faros Construction Joint Stock Company, which is part of FLC Group’s ecosystem, was originally a heavily indebted company that Mr. Quyet instructed his subordinates to acquire and change its name several times. After years of almost no activity, in April 2014, the company started to undertake the construction of real estate projects under the investment of FLC Group.

Despite its initial capital contribution of only nearly VND 1,200 billion, with the aim of misappropriating investors’ money, from April 2014 to September 2016, Mr. Quyet instructed his sister and some others as leaders of Faros to submit fraudulent capital contribution documents totaling over VND 3,100 billion five times.

As a result, Faros’ charter capital increased from VND 1.5 billion to VND 4,300 billion. At this time, Mr. Quyet proposed a plan to transform Faros into a public company for listing on HOSE. This journey encountered many obstacles due to conflicts over the basis for determining the contributed capital, but Mr. Quyet received support from four leaders of HOSE.

Chairman of FLC Group, Trinh Van Quyet. Photo: Ngoc Thanh

|

The supplementary investigation determined that HOSE operates as a Limited Liability One Member Company with the State holding 100% of the charter capital, represented by the Ministry of Finance. HOSE is responsible for organizing listings, securities transactions, and supervising compliance with the securities market regulations.

After receiving Faros’ share listing application, Mr. Sinh, in his capacity as Chairman of HOSE’s Board of Directors, knew that the financial audit reports for 2014 and 2015 of this company did not comply. The audit report had a significant disclaimer stating “insufficient basis to determine the contributed capital”. However, due to personal relationships and support from Mr. Quyet and Doan Van Phuong (former CEO of FLC Group, who has fled), Mr. Sinh provided support for Faros’ listing. As a result, Mr. Sinh directly ordered his subordinates, including Tra, Vu, and Hang, to facilitate Faros as soon as possible.

According to HOSE’s operating regulations, the appraisal and approval of listing applications are not under the authority of the Board of Directors. However, in August 2016, when Faros had not completed the required documents, Mr. Sinh instructed the HOSE Board of Directors’ Office to issue a notice, requesting the Listing Council to report on the appraisal results.

Mr. Sinh and other members of the Board of Directors then approved the listing and issued a resolution stating that “Faros’ documents meet the listing requirements.” Due to Mr. Sinh’s continuous guidance, Faros’ stock was approved for listing with a face value of VND 10,000 per share.

As Mr. Sinh’s subordinate, Mr. Le Hai Tra is identified as someone who has expertise and experience in state management of securities. Mr. Tra is responsible for directly studying and appraising listing applications to provide independent opinions on whether to approve the listing on HOSE.

During the study and appraisal of Faros’ listing application, Mr. Tra was aware that the financial audit report was flawed because “there was not enough basis to determine the contributed capital.” He then had two meetings with members of the Listing Council and unanimously agreed that the requirements were not met, and the company had to explain. However, when presented with Faros’ explanation, Mr. Tra and the members of the Listing Council did not study it but “agreed immediately.”

During questioning at the investigative agency, Mr. Tra admitted his actions “due to his relationship with Mr. Quyet and Phuong.” “The approval of the listing helped Faros attract capital from investors in the market, and HOSE had revenue from listing fees and securities transaction fees, thereby enhancing its own reputation,” Mr. Tra stated.

Mr. Le Hai Tra. Photo: HOSE

|

Head of the Supervision Division of Public Companies

Mr. Le Cong Dien, in his capacity as Head of the Supervision Division of Public Companies, when appraising Faros’ application, found that there was insufficient basis to determine the contributed capital. However, he did not verify it but signed the approval document and publicly announced it. Faros was successfully listed with a charter capital of VND 4,300 billion.

Mr. Dien stated that since Faros was a large company and Mr. Quyet “had many relationships with leaders at various levels, and there was a law consulting company,” he was afraid. During the appraisal, Mr. Dien requested additional evidence, but Faros complained twice that he was “overstepping his authority and causing difficulties for the company.” Due to concerns about the impact on his work, Mr. Dien “did it even though he knew it was wrong.”

ROS stock once reached nearly VND 180,000 before dropping to VND 2,500 and being delisted.

|

In addition to the above defendants, C01 also found the lack of responsibility of Mr. Vu Bang, former Chairman of the State Securities Commission; Le Thi Thu Hang, Deputy Director, and Nguyen Thi Thuy, Officer of the Supervision Division of Public Companies. However, there is insufficient evidence for criminal prosecution, so administrative handling is recommended.

In August 2016, Faros was accepted by the Vietnam Securities Depository Center for registering ROS shares, with a face value of VND 10,000 per share and a registered quantity of 430 million shares. One month later, ROS was officially listed on HOSE with a reference price of VND 10,500 per share.

After ROS was listed, Mr. Quyet continued to direct his subordinates to use various means to falsely increase the charter capital to VND 5,600 billion twice. In fact, all of these actions were “illusory” to attract many securities investors to buy, thereby increasing the value of ROS shares.

With the purpose of misappropriating assets, from September 2016 to March 2022, Mr. Quyet instructed Hue to sell nearly 400 million shares to more than 30,400 investors, collecting VND 4,800 billion.

According to the investigation conclusion, Mr. Quyet misappropriated VND 3,600 billion from investors and used it for various purposes.