What is the 2-in-1 integrated card?

In the face of increasing strong and fierce competition, banks must actively develop innovative products to attract and meet the diverse needs of potential customer segments – the young, tech-savvy generation who favor creativity and demand personalized financial products.

The emergence of the 2-in-1 integrated card, combining both debit and credit card functions on the same chip, is evidence of the bank’s efforts to diversify card products, providing users with a new payment experience and attracting the future digital banking generation.

The 2-in-1 card integrates the features of both credit and debit cards, allowing customers to use both their credit limit provided by the bank and the cash in their payment account to make transactions.

Using this card is also very simple with signs on both ends of the card, allowing customers to choose between credit and debit card usage based on their needs.

Specifically, the two chip ends for credit and debit cards on the same card allow users to quickly and easily select the desired chip end, similar to the cards they are familiar with today. The card clearly displays the chip end for Credit (credit card) and Debit (debit card). When making transactions at the POS terminal, users will select the Credit chip end for credit card transactions and use the Debit chip end for debit card payments.

Similarly, when making transactions at ATMs, cardholders can easily withdraw cash using the credit card chip and make withdrawals using the debit card chip without having to spend time selecting the credit or debit card account when integrated on a single chip.

Even the sales staff at service providers can provide faster and more convenient payments for customers without having to select the credit or debit card account, as with single chip cards. The bank’s choice of a 2-chip solution also demonstrates its convenience as not all POS machines support transactions on an integrated chip.

As a result, all user transaction needs can be easily handled with just one card, one touch, one click.

Despite its convenience, users can still feel secure thanks to the enhanced safety and security provided by the separate debit and credit card accounts, making it more difficult for attacks to occur. With the dual security mechanism of the 2-chip solution, if hackers want to penetrate a customer’s account, they have to go through two layers of security.

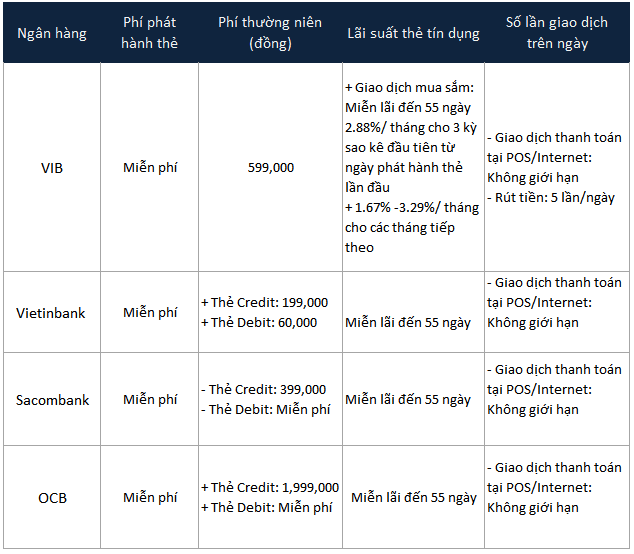

Currently, four banks, including VIB, VietinBank, Sacombank, and OCB, have deployed this dual card product with the requirement that cardholders must provide income verification documents and employment contracts – the same as the requirements for opening a regular credit card. The fees applied to this card include credit card fees and regular debit card fees.

Source; Compiled by the author

|

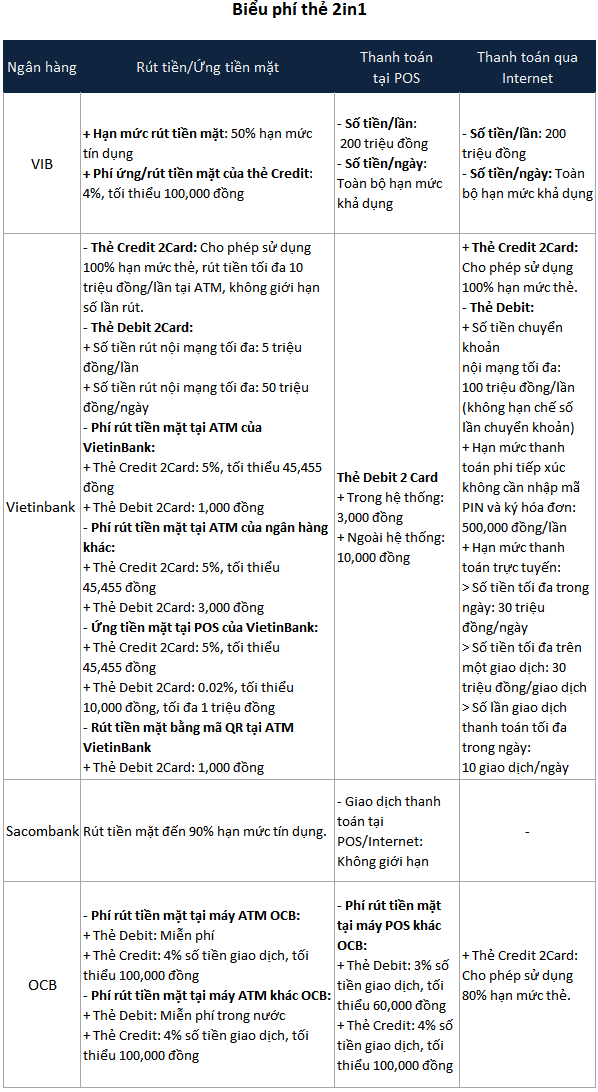

Source: Compiled by the author

|

Source: Compiled by the author

|

According to the sharing of Ms. K. (30 years old, residing in HCMC): “I have heard about the 2-in-1 integrated card through advertisements, but I feel that I don’t need to open this card because I already have 4 credit cards from different banks. Moreover, I have also switched to making payments with my phone. Having an additional physical card for me is unnecessary“.

Through Ms. K.’s sharing, it can be seen that the biggest challenge for this integrated card is the difficulty of accessing customers who already have long-standing credit card usage habits. Based on the psychology of individual security needs, most people tend to choose services or products they have used before. If the product or service they choose is “good enough”, customers usually do not have the motivation to try other products, even if in reality the new product may be much better. Therefore, the integrated card is considered suitable for young people who do not yet have a bank card product. Building habits for customers is the key to converting new customers into loyal customers.

|

Debit Card is a type of payment card that is used based on the prepaid mechanism. The card is directly linked to the bank account. When making a payment, the money is deducted directly from the account. The card can also be used to withdraw cash and pay for various services. Credit Card is a type of “spend first, pay later” card. This means that you borrow money from the bank to pay for your expenses. Cardholders must repay the borrowed amount to the bank within 45 days from the date of the first transaction. After 45 days, the unpaid balance will accrue additional interest. |