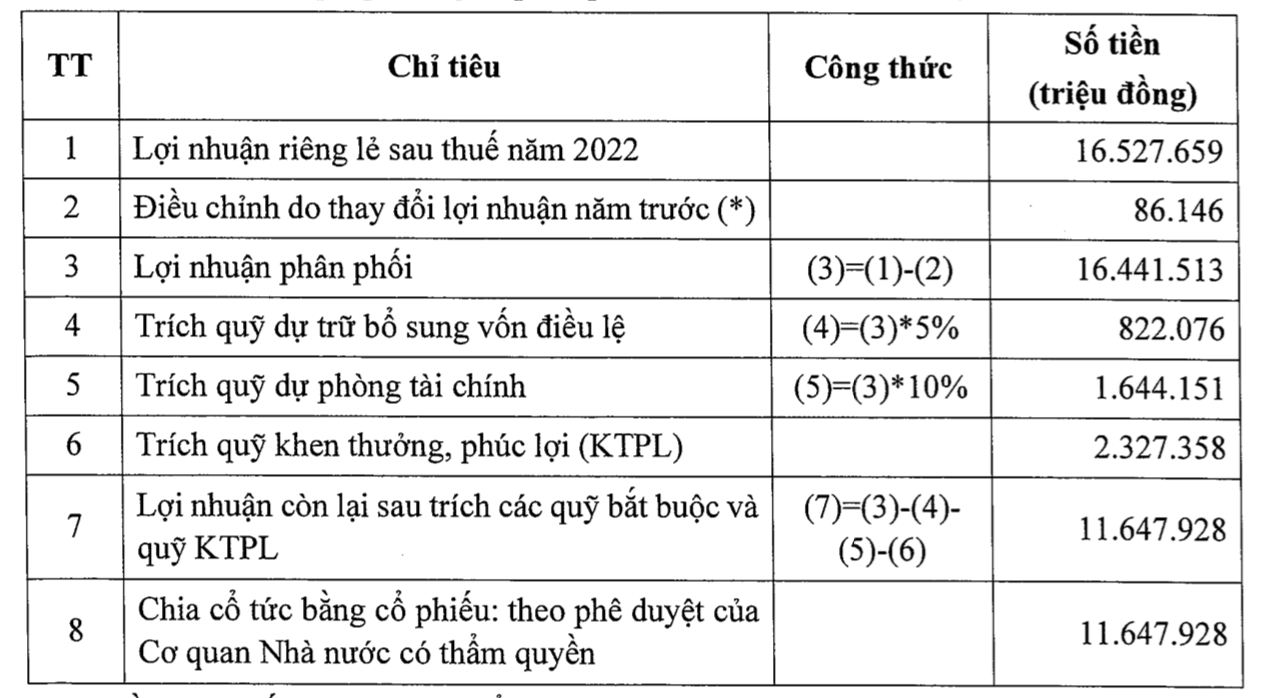

In particular, the bank recorded a standalone profit after tax for 2022 of 16,528 billion VND, along with an adjustment for the prior year’s profit of 86 billion VND. The distribution profit is 16,442 billion VND.

After setting aside additional capital reserves (822 billion VND), financial provision reserves (1,644 billion VND), rewards and welfare reserves (2,327 billion VND), VietinBank’s remaining profit is 11,648 billion VND. According to the approval of the authorized state agency, the bank will use the entire remaining profit to distribute dividends in the form of shares.

Currently, VietinBank’s charter capital is at 53,700 billion VND. Therefore, if the entire profit for 2022 is retained to distribute dividends in the form of shares, VietinBank’s charter capital will increase to over 65,300 billion VND.

Prior to the conference on implementing the bank’s tasks for 2024, it was proposed to create conditions for VietinBank and other state-owned commercial banks to increase capital and enhance financial capacity. Currently, VietinBank has received the opinions of the State Bank of Vietnam and the Ministry of Finance to retain the entire profit for 2022 to increase capital through dividend distribution in the form of shares. Based on this basis, VietinBank proposed that the competent authorities allow the bank to retain the entire profit for 2023 to increase capital and approve the policy to allow VietinBank to retain the entire annual profit for the period 2024-2028 to increase capital, enhance financial capacity, and expand credit growth potential.

Distribution plan for VietinBank’s profit in 2022