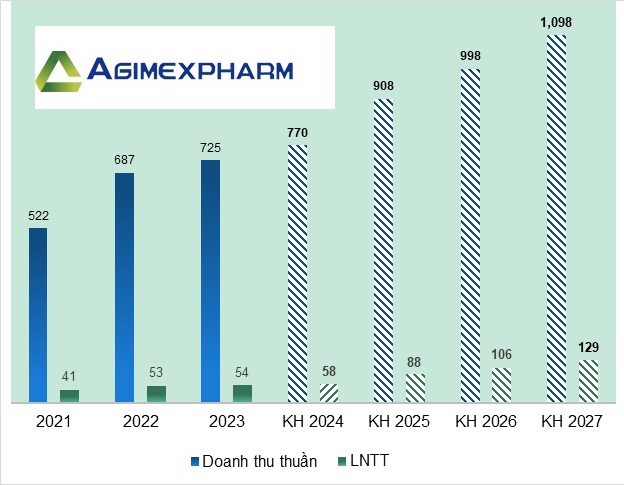

In 2024, AGP aims to achieve a revenue of VND 770 billion and a pre-tax profit of VND 58 billion. These targets represent a slight increase compared to the performance in 2023 – with a revenue of VND 725 billion (a 6% increase compared to the previous year) and a pre-tax profit of VND 54 billion (a 7% increase).

In addition, the company has announced targets for the period from 2025 to 2027. Specifically, in 2025, the revenue target is VND 908 billion and the pre-tax profit target is VND 88 billion; in 2026, the targets are VND 998 billion and VND 106 billion; and in 2027, the targets are VND 1,098 billion and VND 129 billion.

The business targets from 2021 and the 2024-2027 plan of AGP are shown in the following table:

Source: VietstockFinance

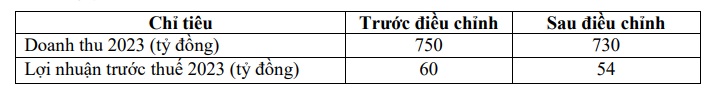

Regarding the business situation, in 2023, AGP experienced a decline in profit in the fourth quarter, but the full-year results still showed growth compared to 2022. Despite the adjustment of the business plan from November 2023, the company still achieved its annual plan.

AGP’s adjusted business plan for 2023 is summarized in the following table:

Source: AGP

As for the profit distribution plan, the company plans to propose to the General Meeting of Shareholders a dividend distribution for 2023 in the form of stock dividends, with a ratio of 12% (for every 100 shares held, shareholders will receive 12 new shares), using undistributed after-tax profits. If the proposal is approved, AGP’s charter capital will increase by 12% to VND 231 billion.

Furthermore, AGP’s documentation also mentions the plan to issue private placement shares. However, the company has not yet announced any related proposal.

Chau An