In particular, this lot consists of 1,000 bonds with a face value of 100 million Vietnamese dong, equivalent to a total amount of 100 billion dong. The bonds were issued on November 21, 2023, but were not completed until February 16, 2024. The bond term is 12 months, with a maturity date of November 21, 2024.

The interest rate applicable to this bond lot is 11.5% per year, with an interest payment period of 3 months. The offering is open to individuals and professional organizations. The bonds are held by the Vietnam Securities Depository (VSD).

Regarding the bond buyback provision, after 9 months from the issuance date, bondholders can request F88 to repurchase a portion or all of the bonds they hold, provided that they submit a buyback request at least 50 days prior to the expected repurchase date. F88 has the right to approve or reject the request, depending on the financial situation.

In addition to the newly issued bond lot, F88 also has another bond lot with the code F88CH2324001, consisting of 2,000 bonds with a face value of 100 million Vietnamese dong, equivalent to a total value of 200 billion dong. This lot was issued in November 2023, also with a 1-year term (due on August 14, 2024), and is offered to individuals and professional organizations. The declared interest rate is 12% per year, with interest payments every 3 months at the end of each period.

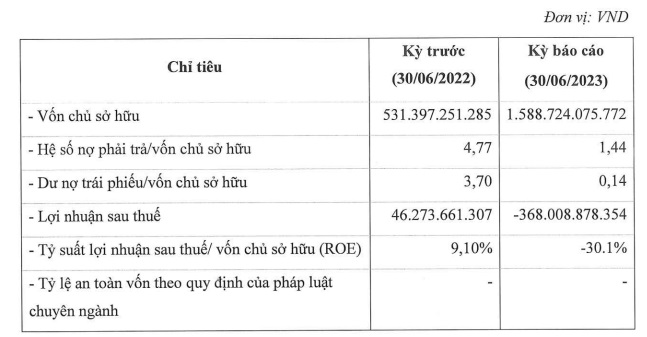

In terms of business performance, as of the end of the first 6 months of 2023, F88 had a net loss of 368 billion dong after tax, compared to a profit of over 46 billion dong in the same period of the previous year. When considering the period from 2019 to the end of 2022, the total net profit after tax of over 324 billion dong is not sufficient to compensate for the loss in the first 6 months of this year.

Source: HNX

|

The company stated that the main reason for the loss is the high risk costs. In addition, F88 has recently faced controversies regarding its debt recovery process and operations, as its branches nationwide have been continuously investigated by law enforcement agencies, with allegations of the company resorting to threatening borrowers and using coercive asset seizure tactics.

As of the end of June 2023, F88 had outstanding liabilities amounting to nearly 2,300 billion dong, although it has decreased compared to the beginning of the year, it still represents a ratio of approximately 1.44 times the equity, with bond liabilities of over 222 billion dong, corresponding to 0.14 times the equity, contributed by the two bond lots with the codes F88CH2223008 and F88CH2223009. However, both of these bond lots have already matured on July 15 and September 15 of 2023, respectively. Therefore, as of the current time, F88 has two bond lots in circulation (including the newly issued lot mentioned above).

Prior to September 2023, F88 also announced the successful raising of a new external loan of USD 50 million (approximately 1,200 billion dong) from Lending Ark Asia fund, increasing the total borrowing amount from this fund to USD 100 million.

F88 is known for its consumer loans and pawn services through its subsidiary, F88 Business JSC. The company was established on June 30, 2016, with an initial charter capital of 54.5 billion dong, and three founding shareholders including F88 Investment JSC holding 99.99% of the capital, Mr. Ngo Quang Hung holding 0.005%, and Mr. Phung Anh Tuan holding 0.005%.