The owner of 75 million shares of BHI has been revealed

Korean life insurance company DB Insurance has reported becoming a major shareholder, owning 75% of BHI’s capital after buying 75 million shares. This also means that BHI will become a subsidiary of DB Insurance.

On February 19, 2024, BHI recorded the highest trading volume in history with 75 million shares being transferred to foreign investors. The transaction value was over 1,628 billion VND, equivalent to 21,708 VND per share.

It can be easily inferred that the owner who received the transferred shares in the trading session on February 19 is DB Insurance. Through the event on June 14, 2023, the BHI shareholder group signed a contract to transfer 75% of the shares to DB Insurance.

The transfer shareholder group includes 2 major shareholders, Saigon – Hanoi Securities Joint Stock Company (9.98 million shares, equivalent to 9.98% of the charter capital) and International Investment and Financial Consulting Joint Stock Company (9.83 million shares, equivalent to 9.83% of the charter capital), along with 19 other individuals (nearly 55.19 million shares).

DB Insurance (DBI) is a non-life insurance company that was established in 1962, headquartered in Seoul, South Korea. DB Insurance belongs to the DB financial ecosystem, which is part of the DB Group. Currently, DB Insurance is the second-largest non-life insurance company in South Korea. In 2022, DB Insurance had total assets of 48.93 billion USD and equity of 5.22 billion USD.

Tratimex P&L has divested almost all of its capital in Doan Xa Port

Tratimex P&L Joint Stock Company has sold 3.25 million shares (equivalent to 13.03%) of Doan Xa Port Joint Stock Company (HNX: DXP), almost all of the DXP shares it held, during the period from January 11 to February 9, 2024. In the end, the company only had 60 unmatching shares left.

With an average trading price during the period of 13,040 VND per share, Tratimex P&L is estimated to have earned about 42 billion VND, officially leaving its position as a major shareholder in DXP.

In terms of relationship, Tratimex P&L is an organization related to the Chairman of the DXP Board of Directors, Mr. Hoang Van Quang. In addition, Mr. Tran Viet Hung, Vice Chairman of the DXP Board of Directors, is also the CEO of Tratimex P&L.

Chairman of Viet Thanh Plastic has sold 3.2 million shares

Mr. Nguyen Van Tuan, Chairman of the Board of Directors of Viet Thanh Plastic Production and Trading Joint Stock Company (HNX: VTZ), has successfully divested 3.2 million shares as registered during the period from January 24 to February 19, 2024.

After the transaction, the number of VTZ shares owned by Mr. Tuan decreased from 8 million shares (18.64% ratio) to 4.8 million shares (11.2% ratio).

The average closing price of VTZ shares during the trading period mentioned above was 8,043 VND per share. It is estimated that Chairman VTZ has earned nearly 26 billion VND.

The family of the CEO of DP3 has increased ownership to over 24%

Ms. Le Thanh Thuy, the wife of Mr. Nguyen Dinh Khai, a member of the Board of Directors and CEO of Central Pharmaceutical Joint Stock Company No. 3 (Foripharm, HNX: DP3), acquired nearly 2.085 million DP3 shares during the period from January 18 to February 5, 2024.

Previously, Ms. Thuy registered to buy exactly 2.085 million DP3 shares, but failed to buy the remaining shares (73 shares in total).

After the transaction, the number of DP3 shares owned by Ms. Thuy increased from 1,405 shares (0.01% ratio) to over 2.086 million shares (9.7% ratio). During the aforementioned trading period, the average closing price of DP3 shares was 71,531 VND per share. It is estimated that Ms. Thuy has spent 149 billion VND on the transaction.

|

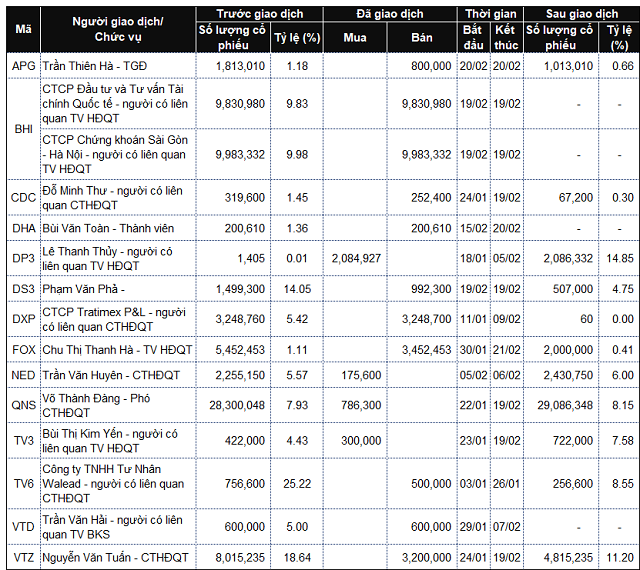

List of company executives and related individuals who have traded from February 19-23, 2024

Source: VietstockFinance

|

|

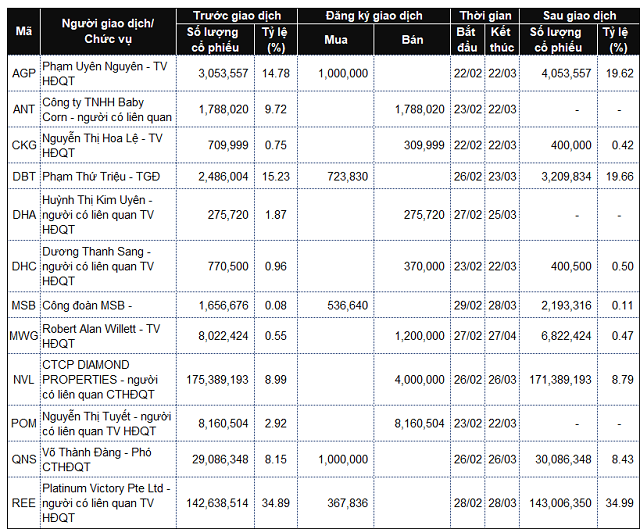

List of company executives and related individuals who have registered to trade from February 19-23, 2024

Source: VietstockFinance

|