The USDVND exchange rate has increased significantly since the Lunar New Year holiday in 2024. On the morning of February 27th, the State Bank of Vietnam announced the central exchange rate at 24,014 VND/USD, an increase of 10 dong compared to the previous trading session. With the exchange rate fluctuation range of +/- 5%, the floor exchange rate is 22,813 VND/USD, and the ceiling exchange rate is 25,214 VND/USD.

The reference exchange rate for USD at the State Foreign Exchange Reserve Management Agency is 23,400 (buying) and 25,154 (selling). The USD exchange rate remains unchanged for buying and selling compared to the previous trading session. The free market USD rate in Vietnam is at 25,200 – 25,220 dong (buying – selling).

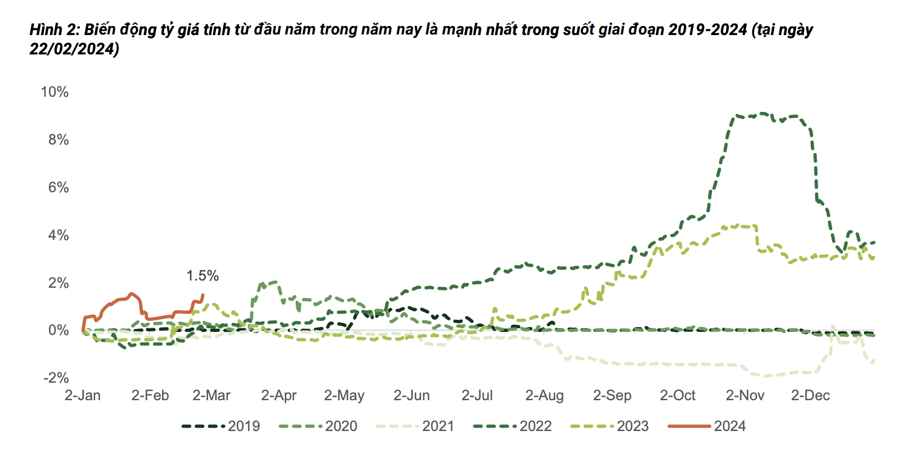

The exchange rate movement this year is different from previous years as it has increased significantly early in the year. According to data, the exchange rate has been relatively stable in the early months of the year due to strong remittances and FDI inflows. However, the context of 2024 is different, especially as the interest rate differential between USD and VND has been negative throughout the period.

According to Securities Phu Hung, the first reason for the exchange rate increase is that the market believes that the Fed may not cut interest rates as expected earlier this year. As a result, the USD interest rate is expected to remain high until mid-year, and the rate of reduction will not be as strong as previously optimistic forecasts due to the reversal in commodity prices causing inflationary pressures in the US. This will prolong the deep negative interest rate differential between VND and USD.

The second reason is the continuous recovery of imports through the months as businesses increase imports of raw materials for production and import petroleum. The total import value in January reached nearly $31 billion – the highest level since July 2022, with domestic imports alone exceeding $11 billion (15% higher than the annual average of 2023).

The third reason is businesses paying off foreign loans and repatriating profits from abroad.

The fourth reason is the hoarding of foreign currencies in the context of continuous USD appreciation in both the domestic and global markets. The free market USDVND exchange rate has continuously increased since the end of last year and is currently trading around 25,300, maintaining a large difference (around 600 pips ~ 2.5%) compared to the interbank exchange rate. Coupled with the low interbank interest rate, this has created depreciation pressure on the VND.

However, the VND is still a strong currency compared to other countries in the region, with a -1.5% decrease since the beginning of the year. Among 10 Asian countries, Thailand’s THB has depreciated the most compared to the beginning of the year, falling by 5.0%, followed by the Malaysian Ringgit (-3.8%), the South Korean Won (-3.1%). India, on the other hand, maintains its appreciation against the USD (+0.4%).

Securities Phu Hung believes that the exchange rate will still face pressure at least until the end of the first quarter because imports will continue to increase in the coming period, while investment inflows, remittances, and exports will be slower than expected.

According to PHS, credit is still growing slowly and improvements are expected from the end of the first quarter, so the banking system still maintains a large liquidity surplus in the first quarter (especially after money returns to the system after the Lunar New Year), creating motivation for hoarding.

Interbank interest rates have been trending strongly upward recently, and the State Bank of Vietnam had to conduct OMO operations on February 20th and 21st, 2024. Some information suggests that state-owned banks are proactively raising interest rates – actions usually taken when the exchange rate rises sharply. PHS predicts that the interbank interest rate will establish a new balance around 2.0 – 3.0% for the ON – 1W term, reducing the interest rate differential with the USD and not ruling out the possibility that the State Bank of Vietnam will resume issuing Treasury bills as in December 2023.

It is expected that the USDVND exchange rate could increase to around 24,750 (equivalent to a 2% increase compared to the beginning of the year – unchanged from PHS’s previous forecast). The probability of the exchange rate surpassing the old peak (24,875) is quite low, and the State Bank of Vietnam has all the tools to control the exchange rate in the current context.

Lastly, PHS does not believe that the rising exchange rate will stimulate exports because, as mentioned above, the VND is still strong compared to other currencies in the region (most of which are export competitors with Vietnam).