After rising sharply in the morning session to 79 million VND/tael, the SJC gold price reversed course to decrease by 200-300 thousand VND/tael in the afternoon of February 26.

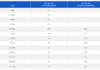

At Sai Gon Jewelry and Phu Nhuan Precious Stone, the SJC gold bar is being quoted at 76.6-78.8 million VND/tael, down 200 thousand VND/tael compared to this morning.

DOJI Group also adjusted downward by 200 thousand VND/tael to 76.55-78.75 million VND/tael. Bao Tin Minh Chau lowered to 76.80-78.70 million VND/tael.

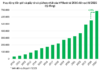

In fact, this development has also been repeated in many recent trading sessions. The SJC gold price was unexpectedly pushed up to around 79 million VND/tael despite the sideways or declining international gold price. However, SJC gold can only maintain the 79 million VND/tael level for a very short time, only a few hours, before reversing sharply. For example, in the trading session last weekend (February 23), the SJC gold price surged in the morning from 78.7 million VND/tael to 79 million VND/tael, then turned around in the early afternoon to return to the 78.7 million VND/tael level.

Meanwhile, the plain 24k gold ring price is tending to increase today. Specifically, Sai Gon Jewelry has increased by 200 thousand VND/tael to 63.65-64.95 million VND/tael. Bao Tin Minh Chau also increased by about 200 thousand VND/tael compared to this morning to 64.73-65.83 million VND/tael.

In the international market, spot gold price is currently at 2,035 USD/ounce, equivalent to about 61 million VND/tael when converted according to the VND/USD exchange rate. The price difference between domestic and international gold is quite large, nearly 18 million VND/tael.

The revision of Decree 24 on the management of gold trading activities is still the focus of attention in the market recently. In Instruction No. 06/CT-TTg on accelerating the implementation of key tasks after the Lunar New Year holiday, Prime Minister Pham Minh Chinh urged the State Bank to promptly review Decree 24 on the management of gold trading activities. Alongside that, the State Bank also needs to propose effective solutions to manage the gold market in the new situation within the first quarter of 2024. Since late 2023 until now, the Prime Minister has continuously directed state management agencies to assess and reconsider the gold market.

According to experts, in this revision, the elimination of the SJC gold bar monopoly is the most important content. At a recent seminar organized by the Government’s Electronic Information Portal, Prof. Hoang Van Cuong, Vice Rector of the National Economics University, Member of the Finance and Budget Committee of the National Assembly, said that we are still maintaining Decree 24/2012/ND-CP, which stipulates that “The State is the sole agency for producing gold bars, having a monopoly in the management of imports and exports of gold raw materials for the production of gold bars,” which has caused many illogicalities. According to Prof. Cuong, it is not necessarily the state’s monopoly of a gold brand, instead, many businesses can participate in the gold bar production process to meet the needs of the people. When supply is free, and there is fair competition, people will have easier access and accumulation of gold, and there will no longer be a scarcity situation that pushes up the gold price.