CTCP Tập đoàn Hoa Sen (mã CK: HSG) has recently released the documentation for its Annual General Meeting NDTSC 2023 – 2024 on March 18, 2024. The event is expected to take place in Ho Chi Minh City.

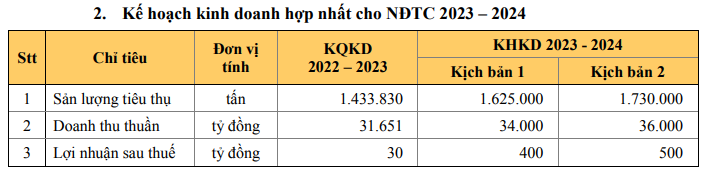

Hoa Sen Group stated that 2023 was a year with many fluctuations and challenges for the global business environment, and the Vietnamese steel industry was not exempt from the impact. The disadvantages of the market have created many objective and subjective reasons, significantly affecting post-tax profit targets. At the end of NDTSC 2022 – 2023, Hoa Sen Group achieved a total revenue of VND 31,651 billion and a post-tax profit of over VND 30 billion, a decrease of 36% and 88% respectively compared to the same period.

It is known that in NDTSC 2022 – 2023, Hoa Sen Group set business plans with two scenarios.

Scenario 1: Revenue of VND 34,000 billion and post-tax profit estimated at VND 100 billion.

Scenario 2: Revenue of VND 36,000 billion and post-tax profit estimated at VND 300 billion.

Thus, at the end of NDTSC 2022 – 2023, Hoa Sen Group only achieved 93% of the revenue plan and 30% of the profit plan of scenario 1.

Based on these results, Hoa Sen Group plans to propose a dividend payment plan for NDTSC 2022-2023 with a cash dividend rate of 5%.

In NDTSC 2023-2024, Hoa Sen Group continues to set business plans with two scenarios.

Scenario 1: Consumption of 1.625 thousand tons, estimated revenue of VND 34,000 billion, an increase of 7.4% compared to the same period, and estimated post-tax profit of VND 400 billion, 13 times higher than the achievement in NDTSC 2022-2023.

Scenario 2: Consumption of 1.730 thousand tons, estimated revenue of VND 36,000 billion, an increase of 13.7% compared to the same period, and estimated post-tax profit of VND 500 billion, 17 times higher than the achievement in NDTSC 2022-2023.

Hoa Sen Group stated that its plastic joint stock company, after receiving the transfer of the plastic production and business sector, has been operating successfully. In the future, the plastic joint stock company is planning to go public and list its shares on the stock exchange.

At the General Meeting, the Board of Directors is expected to present to the shareholders for consideration and approval the restructuring plan, improvement, and professionalization of the steel pipe business segment of the Group.

Accordingly, Hoa Sen Phu My One Member Limited Liability Company will be considered for conversion into Hoa Sen Pipe Joint Stock Company, with Hoa Sen Group owning 99% of the charter capital.

Hoa Sen Pipe Joint Stock Company will receive the entire infrastructure serving the steel pipe production and business operations (land, factories, machinery, production lines, etc.) and become the managing unit in the Steel Pipe Business segment to directly coordinate and operate steel pipe production activities according to current standards and regulations; proactively seek material sources for production; develop and expand the market; establish and implement reasonable business policies for steel pipe products nationwide.

After Hoa Sen Pipe Joint Stock Company completes the reception of the Steel Pipe Business segment and operates stably with profits, the Board of Directors will continue to build and submit to the General Assembly of Shareholders for consideration a plan to issue shares to the public and list the shares of Hoa Sen Pipe Joint Stock Company on the stock market.

The implementation time for the restructuring plan and professionalization of the Steel Pipe Business segment is estimated from 1 to 5 years.

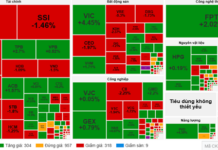

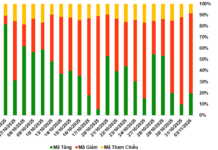

In the stock market, at the end of the trading session on February 26, the price of HSG shares closed at VND 22,450/cp, an increase of 1.35%.