Recently, Tan Tao Investment and Industry Corporation (stock code: ITA) has sent a letter to the State Securities Commission (SSC) and the Ho Chi Minh City Stock Exchange (HoSE) requesting a temporary postponement of the announcement of the audited financial statements for 2023 and the annual report for 2023, citing reasons related to the auditor. According to the letter, ITA stated that on May 5, 2023, the company signed a contract for auditing the 2023 financial statements with South Accounting and Auditing Financial Advisory Services Co., Ltd. (AASCS).

However, on December 29, 2023, AASCS notified that they would not perform the auditing work for ITA due to inability to arrange personnel and lack of time, and simultaneously terminated the auditing contract that was signed on May 5, 2023. Specifically, AASCS stopped the auditing work because two auditors, Mr. Phung Van Thang and Mr. Ta Quang Long, who had conducted the auditing for ITA’s financial statements for 2022 and interim review for 2023, had their professional licenses revoked by the SSC for a period of 2 years.

ITA believes that this is a force majeure case warranting the temporary postponement of the publication of the aforementioned reports, in accordance with Circular 96/2020 of the Ministry of Finance. ITA also mentioned that although they have contacted 30 approved auditing companies in the market, these companies are worried as the auditing firms for ITA have all been intentionally causing difficulties and revoking professional licenses, such as the two individuals mentioned above at AASCS. ITA further added that the auditor for ITA at Ernst & Young Vietnam was also revoked their license.

In the aforementioned communication, ITA requested the SSC and HoSE to instruct their staff to immediately stop activities that put pressure on auditors and to demonstrate objectivity and support for businesses in accordance with their functions and duties.

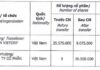

In terms of ITA’s financial performance, based on the unaudited financial statements for the fourth quarter of 2023, the company has generated revenue of VND 566.7 billion in the past year, compared to a loss of VND 1.545 trillion in the same period last year. As a result, the company reported a net profit of VND 202 billion after tax for the shareholders of the parent company, while in the same period last year, it incurred a loss of VND 206 billion.