CTCP Novagroup has registered to sell 4.4 million NVL shares of No Va Investment Corporation (Novaland) to restructure the investment portfolio and support debt restructuring.

The transaction will be carried out from February 28 – March 8 through match and/or agreement methods. If the above transaction is completed, Novagroup is expected to reduce its ownership in Novaland to 363 million shares, equivalent to 18.611% of the capital and still the largest shareholder of this company.

On February 22, Novagroup was also sold over 60,043 NVL shares held by securities companies, thereby reducing its ownership rate to 367.3 million shares as at present.

Previously, Diamond Properties Joint Stock Company registered to sell 4 million NVL shares of No Va Investment Corporation (Novaland). The transaction is expected to be carried out from February 26 to March 26 through match and/or agreement methods. If completed, Diamond Properties will reduce its ownership in Novaland to 171.4 million shares (8.79% of capital).

Currently, the price of NVL shares on the market is around 16,750 VND/share. Therefore, after the two above-mentioned transactions, Novagroup could bring in nearly 74 billion VND, while Diamond Properties could receive 67 billion VND.

Both NovaGroup and Diamond Properties are organizations related to Mr. Bui Thanh Nhon – Chairman of the Board of Directors of Novaland.

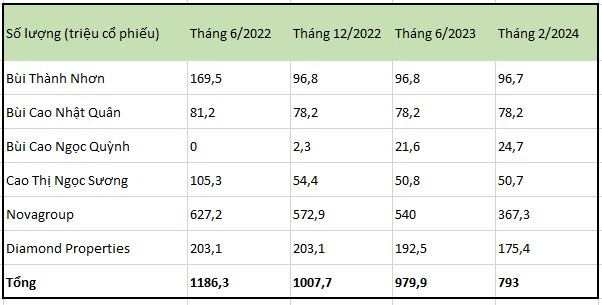

Shareholders related to Mr. Nhon are still losing ownership due to foreclosure sales, although the number is less than in previous periods. Currently, the group of shareholders related to the family of Novaland Chairman still holds about 793 million NVL shares (40.66% of capital).

In June 2022, before the NVL share breakdown occurred for 17 consecutive sessions, this group of shareholders held nearly 1.19 billion NVL shares (60.85% of capital). Thus, after about a year and a half, about 393.3 million NVL shares (20.1% of capital) have slipped from Mr. Bui Thanh Nhon and related shareholders.

As of December 31, 2023, Novaland’s financial debt is about 57,704 billion VND, a decrease of nearly 7,000 billion VND compared to the beginning of the year. Of which, bond debt is 38,262 billion VND, a decrease of 5,900 billion VND. Bank debt is 9,400 billion VND.

In 2023, information such as Novaland announcing delayed payment of principal and interest on bonds or reaching agreement on debt extension… happened regularly. However, the company has used various methods to repay the debt. Among them are using real estate to secure the debt, or large shareholders registering to sell shares to raise money to help Novaland repay the debt, which has somewhat eased the difficulties for this enterprise.