FLC Faros (code: ROS) is a key player in the “Stock market manipulation” and “Asset misappropriation” case of Mr. Trinh Van Quyet (former Chairman of FLC Group) and his accomplice.

According to the conclusion of August 25, 2022 of the Investigation Police Agency – Ministry of Public Security, Mr. Trinh Van Quyet, Ms. Huong Tran Kieu Dung (FLC Faros), Ms. Trinh Thi Thuy Nga and Ms. Trinh Thi Minh Hue (both are Quyet’s sisters) have committed fraud and misappropriated assets by artificially increasing the capital of FLC Faros and then selling ROS shares on the stock exchange.

Specifically, from 2014 to 2016, the above-mentioned defendants fraudulently increased the charter capital from VND 1.5 billion to VND 4,300 billion – equivalent to 430 million shares of FLC Faros; after 430 million ROS shares were listed on the stock exchange, the 4 defendants sold the shares and misappropriated investors’ money.

With the fraudulent increase of the charter capital and the “dramatic” price manipulation of Mr. Trinh Van Quyet and his associates, FLC Faros quickly transformed itself into a “blue chip” and became one of the largest capitalized companies on the stock exchange.

Purchased over VND 100,000 billion

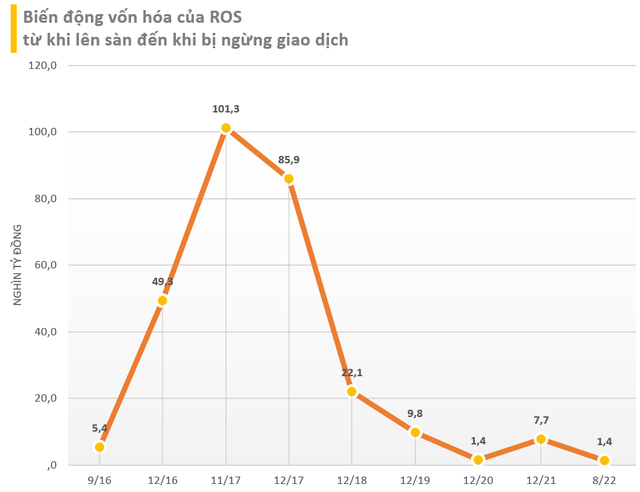

In September 2016, after completing the fraudulent capital increase to VND 4,300 billion, FLC Faros had its shares listed on the Ho Chi Minh City Stock Exchange (HoSE) with a reference price of only VND 10,500 per share.

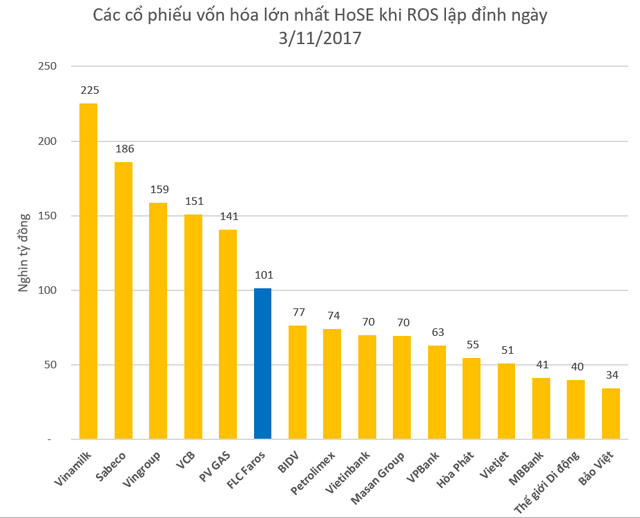

However, the price of ROS reached VND 210,000 per share, 20 times higher after just one year. This price level helped FLC Faros become the 6th largest capitalized company on HoSE, reaching VND 101,000 billion. It is noteworthy that at that time, there were only 6 companies with capitalization above VND 100,000 billion, including a series of “blue chips” like Vinamilk, Sabeco, Vingroup, Vietcombank, and PV Gas.

Moreover, at that time, the capitalization of FLC Faros exceeded a series of large companies on the market such as BIDV, Petrolimex, Vietinbank, Masan Group, VPBank, Hoa Phat, MB, The Gioi Di Dong… These were all companies in the VN30 index basket in 2024. At that time, FLC and ROS were also included in the VN30 index basket.

With the “meteoric” increase in capitalization in just one year, many ETF funds included ROS in their portfolios and profited greatly from investing in this stock. Not only ETF funds, FLC Faros also made Mr. Trinh Van Quyet one of the richest people on the stock exchange.

However, after reaching its peak, the stock price continuously declined since December 2017, turning from a blue chip into a penny stock on the stock exchange.

On September 5, 2022, ROS shares were officially delisted from HoSE. The reason given by HOSE was that FLC Faros seriously violated the obligation to disclose information and other violations that SSC or the State Securities Commission found necessary to delist to protect the interests of investors.

Before being delisted, ROS still does not meet the conditions for trading shares on UPCoM. In the last trading session, the market capitalization of this company was only VND 1,400 billion, although the charter capital of FLC Faros at that time was VND 5,676 billion.

FLC Faros was originally the Construction and Infrastructure Investment Corporation Vinh Ha, specializing in road construction, high-rise building construction, and other civil works. This company was established in 2011 with an initial capital of VND 1.5 billion. Subsequently, in just 3 years, FLC Faros increased its charter capital three times by artificially paying dividends in shares in 2017 at a ratio of 10% and granting shares in 2018 at a ratio of 20%. Accordingly, the charter capital of FLC Faros increased to VND 5,676 billion, equivalent to 567.6 million outstanding shares.