Expected on March 19, the Hanoi People’s Court will commence the first-instance trial of defendant Do Anh Dung (Chairman of the Board of Directors and General Director of Tan Hoang Minh Group) on charges of “fraudulent misappropriation of assets.”

Accompanying Dung at the trial is his son, Do Hoang Viet (born in 1994, Deputy General Director of Tan Hoang Minh Trading and Hotel Services Company), and 13 other accomplices.

The judging panel consists of 3 judges led by Judge Nguyen Xuan Van as the presiding judge, along with 3 lay judges. The Hanoi People’s Procuracy assigned prosecutors Dang Nhu Vinh, Nguyen Nhat Tuan, Nguyen Duc Long, Nguyen Thanh Lam, and Vu Thi Anh Dao to exercise the right to prosecution and participate in the trial.

About 30 lawyers are defending the defendants, including Do Anh Dung, who is represented by the only lawyer, Giang Hong Thanh (Giang Thanh Law Firm – Hanoi Lawyer’s Association).

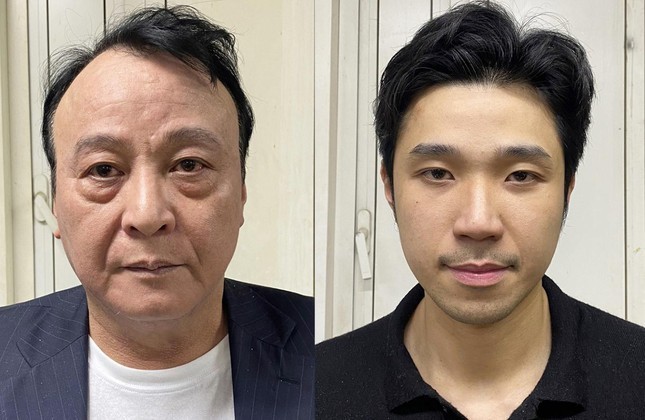

Mr. Do Anh Dung with his son, Mr. Do Hoang Viet.

According to the charges, since June 2021, Tan Hoang Minh Group has accumulated a large amount of debt. Due to the impact of Covid-19, the company faced financial difficulties and had a credit debt of over 18,500 billion VND.

By January 2022, Tan Hoang Minh’s debt increased to nearly 20,000 billion VND, not including the debts from 8 bond issuances in 2021.

In order to repay the debt, the defendant Do Anh Dung instructed his son Do Hoang Viet and other subordinates at Tan Hoang Minh Group to implement the issuance of separate corporate bonds to raise capital.

Under this plan, Tan Hoang Minh agreed that it would not directly issue bonds due to the presence of multiple subsidiary companies, making it difficult to conduct timely audits. Instead, three subsidiary companies within the group, Ngôi Sao Việt, Soleil, and Cung Điện Mùa Đông, would proceed to sell separate corporate bonds.

According to the charges, these subsidiary companies subsequently carried out 9 rounds of separate bond offerings, with a total value of over 10,000 billion VND. Through this process, the total amount of nearly 14,000 billion VND was raised by Mr. Do Anh Dung and his accomplices.

The money raised was then used by Dung and his cohorts for various purposes unrelated to the bond issuance.

According to the prosecution, Dung and the other 15 defendants in the case embezzled 8,643 billion VND. This amount has now been returned to the victims.

The prosecution also determined that during the bond issuance process, the Ngôi Sao Việt, Soleil, and Cung Điện Mùa Đông companies signed asset management contracts to secure with several banks. According to regulations, these banks were supposed to monitor the purpose of using the funds raised from the bond issuance. However, the banks failed to fulfill this task.

For example, one branch of a bank transferred 1,890 billion VND to the accounts of two individuals without proper monitoring, citing a lack of account management regulations.

During the investigation, the police determined that the individuals from the aforementioned banks did not show signs of collusion or agreement with the issuing organizations to embezzle investor funds. Therefore, they were not subject to criminal prosecution.