The pure stock groups soaring helped VN-Index break through strongly in the trading session at the beginning of the week. The closing price of the session on February 26 increased by 12.17 points to 1,224 points, almost regaining what was lost in the previous end-of-week session. Liquidity decreased compared to the previous session, but the transaction value on HOSE maintained a level above VND 19,500 billion.

In terms of foreign transactions, they net bought VND 70 billion across the market.

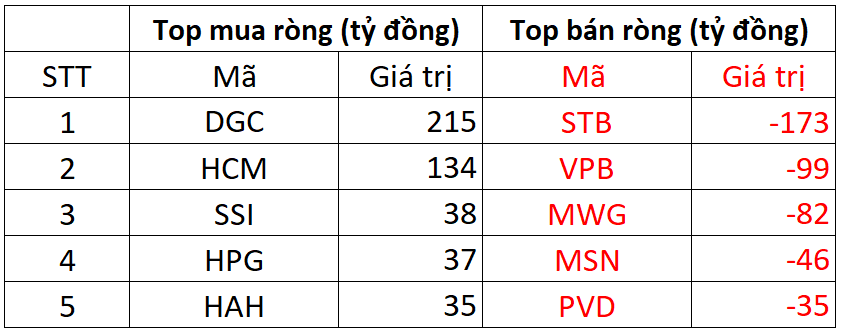

On HOSE, the net buying foreign force was approximately VND 34 billion.

Regarding buying positions, the net buying focus was on DGC and HCM stocks with values of VND 215 billion and VND 134 billion, respectively. The net buying action of foreign investors occurred in the session when both DGC and HCM stocks increased the ceiling price. Besides, SSI and HPG stocks were also net bought on HOSE with VND 38 billion and VND 37 billion, respectively.

Conversely, STB suffered the most selling pressure from foreign investors with a value of VND 173 billion, followed by VPB and MWG with each stock being sold for VND 99 billion and VND 82 billion.

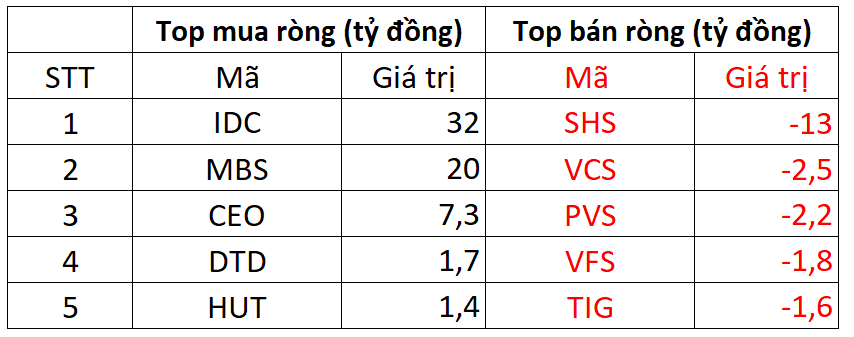

On HNX, foreign investors net bought VND 45 billion.

Regarding buying positions, IDC was net bought the strongest with a value of VND 32 billion. Besides, MBS ranked second in the list of strong net buying on HNX with VND 20 billion. In addition, foreign investors also net bought CEO, DTD, HUT with not too large values.

Conversely, SHS was the stock that faced the most selling pressure from foreign investors with a value of VND 13 billion; VCS followed and was sold for about VND 2.5 billion.

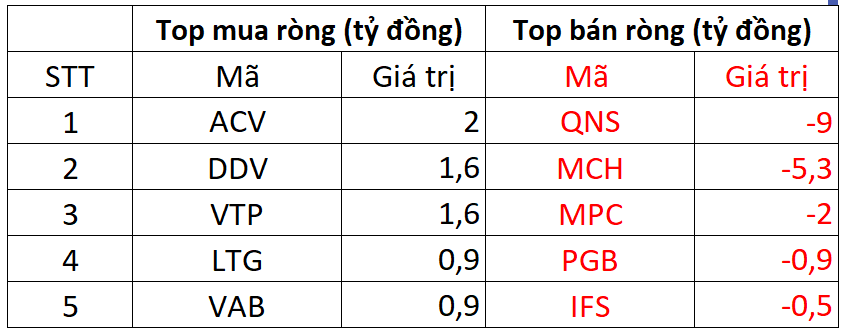

On UPCOM, foreign investors net sold VND 9 billion.

In the buying positions, ACV stock was bought by foreign investors for VND 2 billion. Following, DDV and VTP were also net bought with each stock being net bought for VND 1.6 billion.

Conversely, QNS today was net sold for about VND 9 billion; in addition, they also net sold at MCH, MPC, PGB,…