VPBank (Vietnam Prosperity Joint Stock Commercial Bank) has recently updated its new deposit interest rates for individual customers, which will be effective from February 26, 2024.

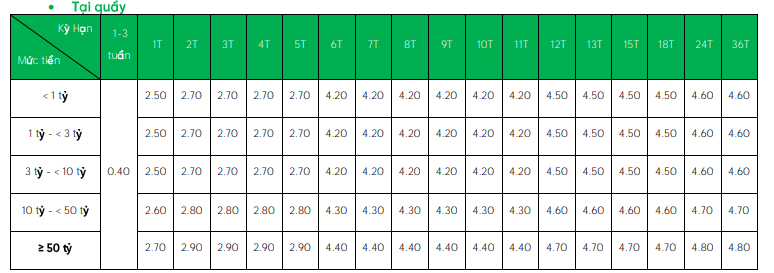

For in-person savings, VPBank’s interest rates for various terms have decreased by 0.4-0.6 percentage points. Specifically:

The interest rate for a 1-month term deposit has decreased from 3-3.3% per annum to 2.5-2.7% per annum, which is a decrease of 0.5-0.6 percentage points.

The interest rate for a 3-month term deposit has decreased from 3.2-3.5% per annum to 2.7-2.9% per annum, which is a decrease of 0.5-0.6 percentage points.

The interest rates for 6-month and 9-month term deposits have decreased from 4.2-4.6% per annum to 4.2-4.4% per annum.

The interest rate for a 12-month term deposit has decreased from 5% per annum to 4.5-4.7% per annum, which is a decrease of 0.3-0.5 percentage points. In particular, customers who deposit 50 billion VND or more will enjoy an interest rate of 4.7% per annum. Customers who deposit less than 10 billion VND will enjoy an interest rate of 4.5% per annum.

The interest rates for 24-month and 36-month term deposits have decreased from 5% per annum to 4.6-4.8% per annum. Customers who deposit less than 10 billion VND will enjoy an interest rate of 4.6% per annum. Customers who deposit from 10 billion VND to less than 50 billion VND will enjoy an interest rate of 4.7% per annum. Customers who deposit 50 billion VND or more will enjoy the highest interest rate of 4.8% per annum when depositing at VPBank counters.

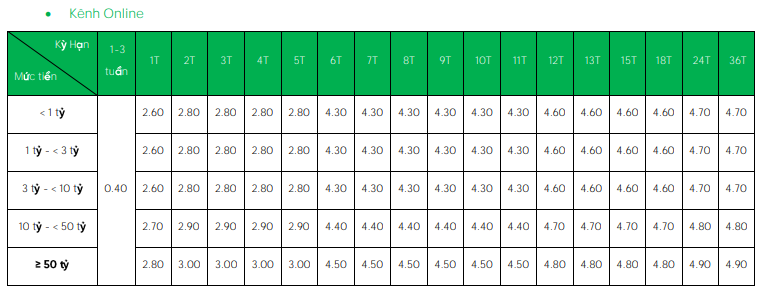

Similarly, for online channels, VPBank’s deposit interest rates have also decreased by 0.4-0.6 percentage points. Compared to in-person deposits, the advertised interest rates on the online channel are 0.1 percentage points higher. The current highest interest rate for deposits on VPBank’s online channel is 4.9% per annum, available for customers who deposit 50 billion VND for a 24-month or 36-month term.

According to VPBank, customers who prioritize depositing with a minimum balance of 100 million VND and a minimum term of 1 month will enjoy an interest rate equal to the corresponding rate on the current deposit interest rate table, plus 0.1% per annum.