|

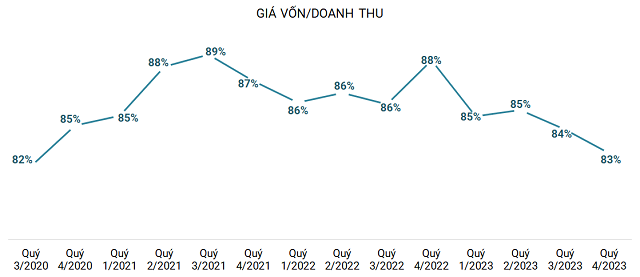

Plastic industry cost-to-sales ratio from Q3/2020

Source: VietstockFinance

|

The results were better than the same period of 2022, when high raw material prices accounted for 88% of the industry’s total revenue, while in Q4/2023 it was only 83%.

According to statistics from VietstockFinance, compared to the previous year, 19 plastic companies listed on the stock exchange (HOSE, HNX, and UPCoM) had increased profits in Q4/2023. Among them, 3 companies turned losses into profits and 2 companies reduced losses; 9 companies had declining results, including 3 companies that turned profits into losses.

Gross profit margin in Q4 reached a high level in many years

In addition to familiar names that brought in billions of dong in revenue such as AAA, DNP, BMP, NTP, there was also TDP this time. The top 5 plastic giants achieved nearly 9 trillion dong, a decrease of 12% and accounting for 64% of the whole industry. The net profits of this group accounted for 80%, reaching 533 billion dong, more than double that of Q4/2022.

|

The net profits of the top 5 billion dong-generating plastic companies (Unit: billion dong)

Source: VietstockFinance

|

One of the most positive developments may be An Phat Xanh Plastic (HOSE: AAA) with a gross profit margin of 11.5% in Q4/2023, a significant improvement from 1% before and higher than the average of the last 19 quarters, helping the company earn nearly 94 billion dong in net profit, compared to 100 billion dong loss in the same period. AAA attributed the positive result to stable resin prices, which led to profitable commercial activities, as well as a 21% reduction in financial expenses.

| The gross profit margin trend of AAA from 2019 to now |

Similarly, the gross profit margin of DNP Holding (HNX: DNP) improved from 12% to 15.3%. However, the increase in operating and management expenses led to a narrowed net profit, which remained positive at 850 million dong but still better than the 540 million dong loss in the same period.

| The gross profit margin trend of DNP from 2018 to now |

The gross profit margin of the long-standing plastic giant Nhua Thieu Nien Tien Phong (HNX: NTP) also followed this trend, increasing gradually from 19% in Q3/2022 to 33.2% now. The net profit also increased significantly by 138%, reaching 164 billion dong, and continuously recorded higher results in the following quarters. This result was achieved thanks to a sharp drop in raw material prices and cost savings in interest expenses.

| The gross profit margin trend of NTP from 2020 to now |

Nhua Binh Minh Plastic (HOSE: BMP) had the highest gross profit ever recorded at 591 billion dong and maintained a gross profit margin of over 40%. While most companies reduced their scale, BMP showed the opposite trend with a 3% increase in revenue and a 4% increase in net profit. As a result, the company achieved a record net profit of over 1 trillion dong, and the gross profit margin for the whole year was also above 40%.

| The net profit and gross profit margin trend of BMP from 2004 to now |

The group of companies with increasing profits has achieved remarkable milestones.

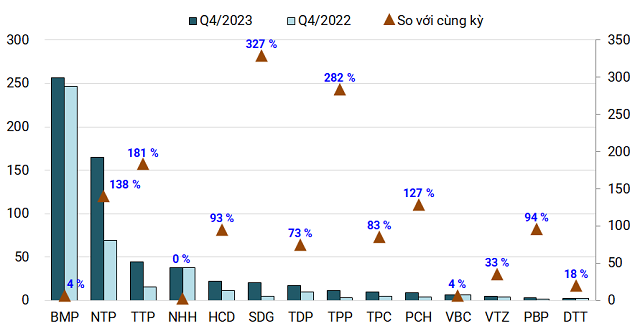

In the profit increase group, the packaging and cement production company Sadico Can Tho (HNX: SDG) saw a 327% increase in net profit, reaching nearly 21 billion dong despite a decrease in revenue. SDG attributed the positive result to the reduction in costs, which led to lower selling prices, compensating for the lower revenue. The gross profit margin of SDG was also low at 8.91%, the lowest since Q1/2019.

|

The net profits of the companies with increasing profits in Q4/2023 compared to the same period (Unit: billion dong)

Source: VietstockFinance

|

Together with SDG, other companies that achieved double-digit growth included TPP (282%), TTP (181%), NTP (138%), PCH (127%), HCD (93%), PBP (94%), which all benefited from low raw material prices.

For example, Bao bi Tan Tien (UPCoM: TTP) achieved a gross profit margin of 16% in Q4/2023, the highest level since Q4/2016, despite a 12% decrease in revenue. TTP explained that, although the company faced challenges from competitors and the difficult economic situation in 2023, it managed to control production costs and reduce expenses, resulting in a net profit of 450 billion dong, the highest quarterly profit in its history.

| The net profit and gross profit margin trend of TTP from 2013 to now |

Tan Phu Viet Nam (HNX: TPP), on the other hand, saw an increase in revenue of 21% and achieved the highest gross profit margin in its history at 135 billion dong, with a net profit of nearly 12 billion dong.

| The gross profit margin trend of TPP from 2008 to now |

The gross profit margin and net profit trend of Picomat Plastic (HNX: PCH) were also the highest since its listing, reaching 10 billion dong and 9 billion dong, respectively. However, due to increased operating costs, the net profit was narrowed.

| The net profit and gross profit margin trend of PCH from 2021 to now |

HCD Investment and Trading (HOSE: HCD) achieved 258 billion dong in revenue, 28 billion dong in gross profit, and 23 billion dong in net profit, all the highest since its listing in 2016, primarily thanks to its wood plastic production segment.

The companies that turned losses into profits, besides AAA and DNP, also included VICEM Packaging But Son (HNX: BBS), which achieved a net profit of 1.7 billion dong, compared to a loss of 512 million dong in the same period last year.

Vietnam Plastic (UPCoM: VNP) and Da Nang Plastic (HNX: DPC) also reported reduced losses. However, if compared to other quarters in 2023, these companies are still experiencing setbacks.

The group with decreased profits also made an impact… in the opposite direction.

For the group with decreased profits, 6 prominent companies were SFN, PBT, STP, ALT, PMP, and BXH. Therefore, the contribution of these companies to the industry’s profits accounted for only less than 2%, with a small share compared to the whole industry.

|

The net profits of the companies with decreased profits compared to the same period (Unit: billion dong)

Source: VietstockFinance

|

The most affected was VICEM Hai Phong Packaging (HNX: BXH), which almost lost all its profits, with only around 25 million dong left, far below 831 million dong a year earlier. BXH attributed the poor result to reduced consumption of bags and decreased selling prices in some markets due to intensified competition. The gross profit margin of BXH was also low at 8.91%, the lowest since Q1/2019.

Bao bi dam Phu My (HNX: PMP) and Culture Tan Binh (HNX: ALT) achieved some of the highest gross profit margins ever. However, the sharp increase in costs led to a narrower net profit.

The most challenging situation may be for RDP, BPC, and DAG, which reported losses in Q4/2023. The largest loss belonged to Eastern Asia Plastic Group (HOSE: DAG), with 22 billion dong, compared to a profit of 66 million dong in the same period. Revenue, gross profit, and net profit seem to be against DAG with numbers like “the worst in history.” 2023 became a forgettable year for DAG shareholders as the company incurred a record loss of 257 billion dong.

| The revenue and gross profit margin trend of DAG from 2010 to now |

DAG explained that due to the difficult economic and real estate market situation, all the products that the company serves in the real estate sector have been affected, not to mention the expenses that still need to be paid. Especially the increase in borrowing and business management costs.

The whole corporation is struggling to maintain, restructure, reduce organization size, and expand the search for partners, distributors, and agents to promote growth and restore production and business activities, DAG said.

Another long-standing plastic company, Rang Dong Holding (HOSE: RDP), also recorded the heaviest loss ever in the last quarter of 2023, at 15.3 billion dong. RDP faced challenges from decreased revenue scale, high management costs, and unexpected additional costs.

| The net profit trend of RDP by quarter from 2009 to now |

The construction plastic segment continues to maintain its momentum.

FPT Securities (FPTS) forecasts that the selling prices of plastic pipes in 2024 will decrease slightly compared to the peak in 2023 but will still be higher than the pre-2021 period. This is a supporting factor that helps the gross profit margin of this industry maintain around 30%, higher than the average of 25% for the 2018-2022 period.

FPTS states that due to the recovery in demand, large companies can maintain high selling prices. In addition, resin prices are currently at a very low level, and it is expected that they will recover in 2024 as global demand improves.

PVC resin prices are expected to recover to around 900 USD/ton this year, equivalent to the average price for the 2018-2020 period but lower than the 2021-2022 period due to improved global resin consumption and Brent crude oil prices reaching 85 USD/barrel.