The market liquidity slightly decreased compared to the previous trading session, with the trading volume of the VN-Index reaching nearly 900 million shares, equivalent to a value of over 21 trillion VND; the HNX-Index reached over 91 million shares, equivalent to a value of over 1.8 trillion VND.

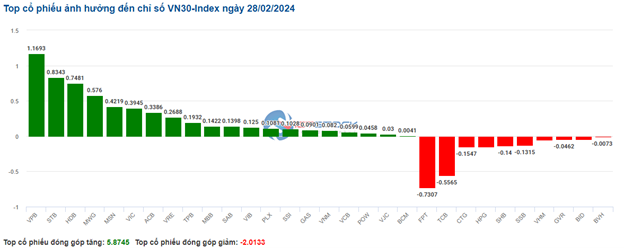

The VN-Index opened the afternoon session quite positively, with buying pressure appearing right from the beginning of the session, pushing the index continuously upwards and closing at the highest level of the day. In terms of influence, VCB is the stock with the most positive impact on the VN-Index, with a increase of more than 9 points.

| Top 10 stocks affecting the VN-Index on 2/28/2024 session |

The HNX-Index also had a similar trend, with the index being positively affected by stocks like TIG (4.07%), PVC (3.42%), NRC (1.96%), PVS (1.92%),…

|

Source: VietstockFinance

|

Among them, the banking sector is the sector with the strongest recovery, with an increase of 2.61%, mainly driven by stocks like VCB (+6.92%), BID (+1.7%), VPB (+2.84%), and TCB (+0.6%). Following that is the manufacturing of machinery and mining sector, with increases of 2.3% and 2.12% respectively. On the other hand, the other financial sector had the largest decrease in the market with -0.86%, mainly due to stocks like IPA (-1.24%) and TVC (-2.27%).

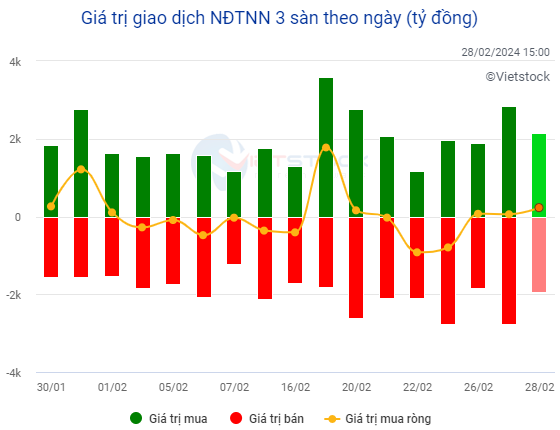

In terms of foreign trading, this group continued to be net buyers with over 247 billion VND on HOSE, focusing on stocks like HPG (129.25 billion), SSI (54.65 billion), TPB (42.68 billion) and VPB (41.82 billion). On HNX, foreign investors were net sellers with nearly 11 billion VND, focusing on stocks like SHS (15.46 billion) and MBS (9.34 billion).

Source: VietstockFinance

|

Morning session: Prolonged indecision

At the end of the morning session, the indecisiveness was still present, leading to the lack of a strong breakthrough in the upward momentum of the VN-Index as it continued to fluctuate around the reference level. The VN-Index increased slightly by 2.15 points, reaching 1,239.61 points; the HNX-Index increased by 0.11 points, reaching 235.59 points. Temporary gainers were dominating with 345 gainers and 263 decliners.

The trading volume of the VN-Index recorded in the morning session exceeded 415 million units, with a value of over 9.6 trillion VND. The HNX-Index recorded a trading volume of nearly 48 million shares, with a trading value of over 994 billion VND.

At the end of the morning session, BID, CTG, FPT were the stocks with the most negative impact, deducting nearly 1.5 points from the index. On the other hand, VRE, VIC, VPB were the stocks with the most positive impact, adding more than 1.6 points to the index.

Source: VietstockFinance

|

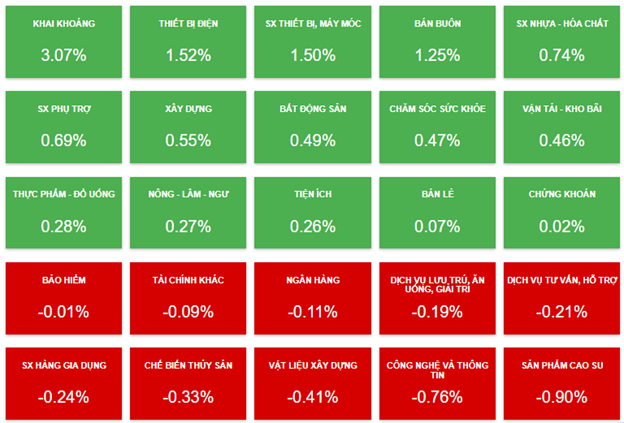

The mining sector continued to maintain its leading position in contributing the most to the index’s growth at the end of the morning session. Stocks in this group were all on the rise, with PVD hitting the ceiling right from the start with a 6.94% increase, followed by PVS (+3.01%), PVC (+3.42%), PVB (+2.38%), C32 (+2.19%), DHM (6.4%),…

Additionally, the plastics and chemicals sector was also one of the positive sectors in the morning session. Specifically, stocks in this group all performed well, with GVR increasing by 1.04%, DCM increasing by 2.08%, DPM increasing by 2.17%. The remaining stocks PHR, LAS, APH, DPR, CSV all maintained a positive trend.

Developments of industry groups at the end of the morning session on 2/28. Source: VietstockFinance

|

At the end of the morning session, the overall stock market leans towards the green side. Among them, the mining industry is the most prominent with an increase of 3.07%. On the other hand, the rubber product sector is the most negative with a decrease of 0.9%.

10:30: Tilted towards the increase

The VN-Index increased by 3.37 points, trading around 1,240 points. The HNX-Index increased by 0.52 points, trading around 235 points.

Most of the stocks in the VN30 basket were in the green. In particular, 4 banking stocks like VPB, STB, HDB, and ACB contributed 1.17 points, 0.83 points, 0.75 points, and 0.34 points respectively to the VN30 index. On the other hand, FPT, TCB, CTG, and HPG were still under selling pressure as they deducted more than 1 point from the index.

Source: VietstockFinance

|

The mining sector led the gains at the beginning of the session. In particular, oil and gas stocks increased strongly, with PVS (+4.11%), PVC (+4.11%), PVB (+4.29%)… Meanwhile, PVD and DHM hit ceiling limit with increases of 6.94% and 6.9% respectively.

Crude oil futures contracts rose on Tuesday (2/27), amid uncertainty about the outlook for a ceasefire in the Israel-Hamas conflict and as some investors expect OPEC+ to extend production cuts after the first quarter.

In addition, Russia has approved a ban on gasoline exports for 6 months starting from 01/03/2024. These developments may be factors that are driving the prices of oil and gas stocks

The wholesale group also recorded good growth, making a positive contribution to the index with an increase of 1.19%. With a significant contribution from stocks like PLX (+2.1%), PET (+1.64%), PSH (+3.95%), SHN (+6.76%),…

In addition to the above two groups, many Large Cap stocks are also performing positively. GAS, PLX, SAB, VIC, BCM are also contributing to supporting the index.