According to FiinRatings data, the mobilization of capital from corporate bonds in 2021 is VND 715,000 billion, exceeding the value of new medium and long-term loans of commercial banks, which is VND 700,000 billion, and 7 times the capital from the stock market, which is VND 101,000 billion. In which, the real estate group ranks second in terms of market share, after the banking group.

“The intoxication” of the years 2019 – 2022 has brought a series of events to the real estate industry in general and to businesses in particular. Until now, despite the forecasted positive signs, many businesses still face the pressure of bond maturities.

According to the Ministry of Finance, in 2024, the total volume of individual business bonds due is about VND 310,131 billion. The real estate business sector is one of the two industries with the largest percentage of bond maturities in 2024, accounting for nearly 35%.

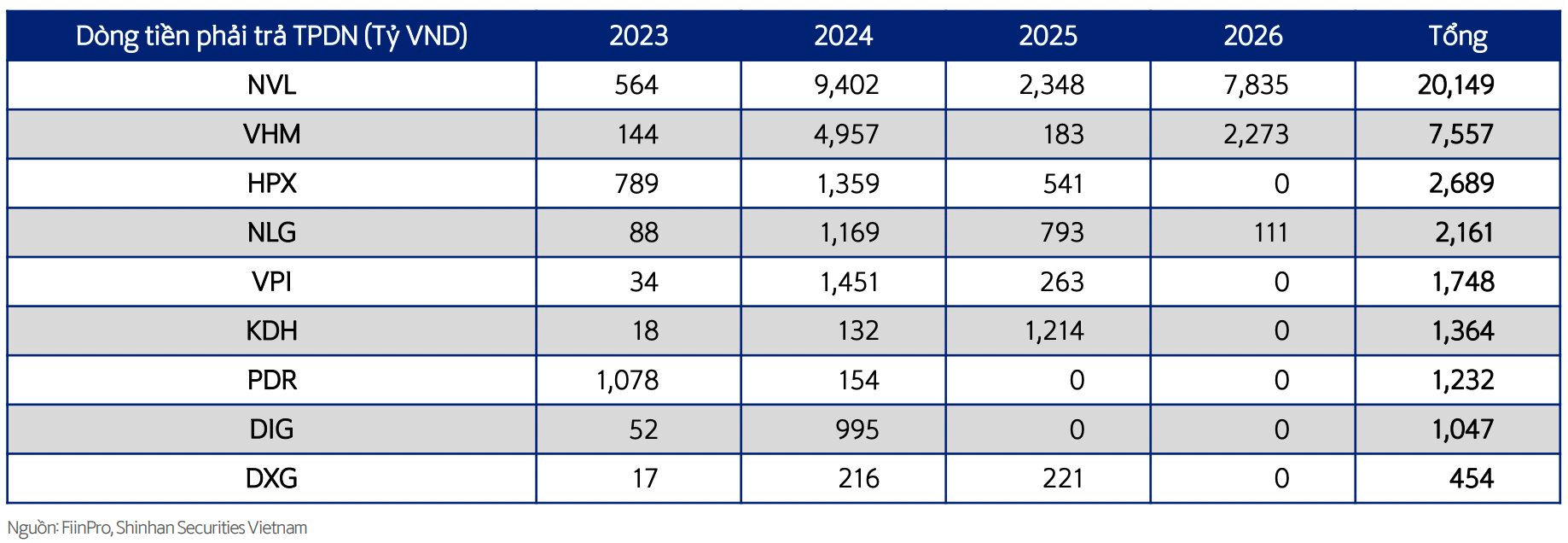

Statistics from Shinhan Securities in a recent analysis report showed that there are up to 8 listed real estate companies with outstanding bond debts of over VND 1,000 billion. In particular, Novaland (NVL) accounts for over VND 20,000 billion, and the due amount in 2024 is VND 9,402 billion.

The path ahead for major southern real estate developers may still have many challenges with a huge debt, while the cash and cash equivalents of the Company as of December 31, 2023 is only VND 3,412 billion. The Company is known to have over VND 40,000 billion in savings deposits in banks, however, this amount is currently managed by the banks for loans to Novaland.

On the other hand, Novaland’s total debt by the end of 2023 reached VND 195,874 billion. In which, the loan debt is over VND 57,705 billion, and the bond debt is VND 38,626 billion.

In addition, many other real estate businesses including Vinhomes (VHM), Hai Phat (PHX), Nam Long (NLG)… also have billions of bonds maturing in 2024.

From the perspective of experts, in its latest report, FiinGroup does not deny that the pressure of bond maturities in 2024 on the real estate business group is quite significant, with a total payment value of bonds reaching VND 154,800 billion. Of which, the bond par value is VND 122,200 billion and the bond interest expense is estimated at VND 32,600 billion.

Meanwhile, the market in the first months of the year is still very bleak, the banking system maintains strict loan conditions, not to mention investors are still very cautious with their money in the real estate industry. Therefore, finding capital sources for business reinvestment, creating bond maturity cash flows is a matter causing great pressure for real estate businesses.