The VN-Index continued to have a positive trading session with money flowing in various stock groups. The selling pressure was not too strong, helping many stocks to increase well, especially large market capitalization stocks such as “bank, steel”.

At the end of the session, VN-Index increased by 13.29 points (+1.09%) to 1,237.46 points, close to the highest price of 1,240.81 points on February 23, 2024.

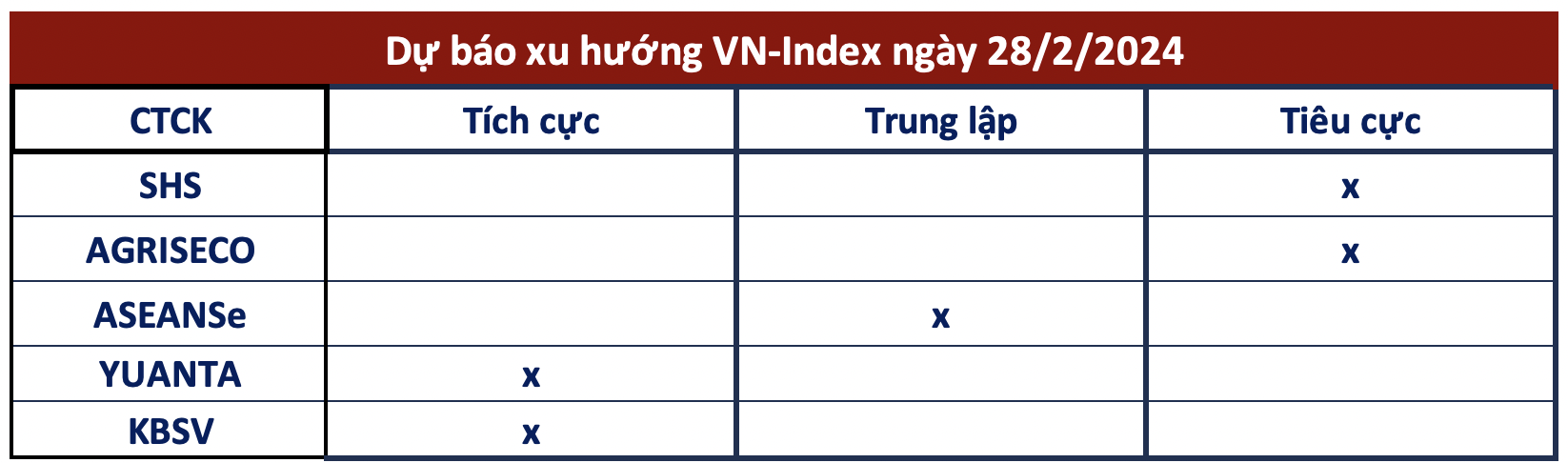

The approaching towards the 1,250 point level made many securities companies predict that the market will have to face the risk of correction, and investors are also advised to trade cautiously and avoid chasing the market. Conversely, some experts still express a positive view on the continued upward trend of the market.

SHS Securities short-term evaluation of the market, although recovering, but the VN-Index is approaching the strong resistance level of 1,250 points, so the market will continue to have unpredictable movements in the coming time, with strong resistance level, the market needs to have consolidation and accumulation before breakthrough. Currently, SHS does not highly regard the ability of VN-Index to exceed 1,250 points soon.

The company recommends short-term investors not to chase after buying in the rising sessions and can consider gradually taking profits in stocks that have reached the target in the current stage because the risk of the market in short-term decline is high.

Similarly, Agibank Securities believes that VN-Index is likely to continue its sideways or downward trend in the short term due to pressure from the important resistance level around 1,240 – 1,250 points; the exchange rate risk still exists and the discrepancy between VN30F1M and VN30 Index futures contracts continues to remain negative.

Therefore, investors are recommended to continue reducing the proportion of ownership in rising sessions back to the mentioned resistance level. Only open buying again for stocks in the VN30 group and leading stocks when VN-Index has a correction around the notable support level around 1,200 points.

Asean Securities states that the market will continue to maintain a trend towards the 1,240-1,250 point range. However, caution is needed with the risk of profit-taking pressure that can return at any time.

AseanSe recommends investors to maintain caution, take advantage of fluctuations to restructure their portfolios, and only buy when the market returns to retest the 1,200-1,220 point area, actions of chasing after buying and aggressively increasing the proportion will no longer be prioritized. The recommended proportion is 60-65% of stocks.

Taking a more positive view, Yuanta Securities believes that the market may continue to rise and VN-Index may retest the 1,245 point level in the next session. At the same time, the market is still in a period of strong positive volatility and the decreasing short-term risk shows that the VN-Index has the possibility of soon surpassing the 1,245 resistance level in the upcoming sessions, new buying opportunities are increasing.

Yuanta recommends that investors can consider re-purchasing and increasing the proportion of stocks at a high level in the portfolio, especially pay attention to large market capitalization stocks.