In the context of the thriving general market, shares of DGC Chemicals in Hoa Chat Duc Giang also had an impressive “acceleration” when unexpectedly increased limit up with trading volume exceeding the average of the past 20 sessions, thus closing at 107,000 VND. This is also the highest level of this stock in the past 20 months, since June 2022.

In fact, DGC has been on the rise for the past month with nearly 20% increase in value. Compared to a year ago, this stock has surged 2.1 times. The market capitalization of Duc Giang Chemicals has also increased by about 7,000 billion since the end of January 2024, reaching over 40,600 billion VND (~1.6 billion USD).

Looking back at history, DGC stock once recorded an unprecedented surge and reached its historical peak at 126,000 VND/share (on June 16, 2022). The price of DGC stock then increased thanks to the record-breaking business performance in 2022 due to the benefit from the price of the Russia-Ukraine tension. However, after reaching its peak profit, DGC’s business performance in 2023 began to decline as the selling price decreased along with the domestic and global market.

For the whole year of 2023, Duc Giang Chemicals recorded revenue of 9,748 billion VND, post-tax profit of 3,109 billion VND for shareholders of the parent company, decreasing by 33% and 44% respectively compared to the previous year. The stock price also “evaporated” more than half from the previous peak level and only began to recover from May 2023.

Expectations of benefiting from the semiconductor industry’s prospects

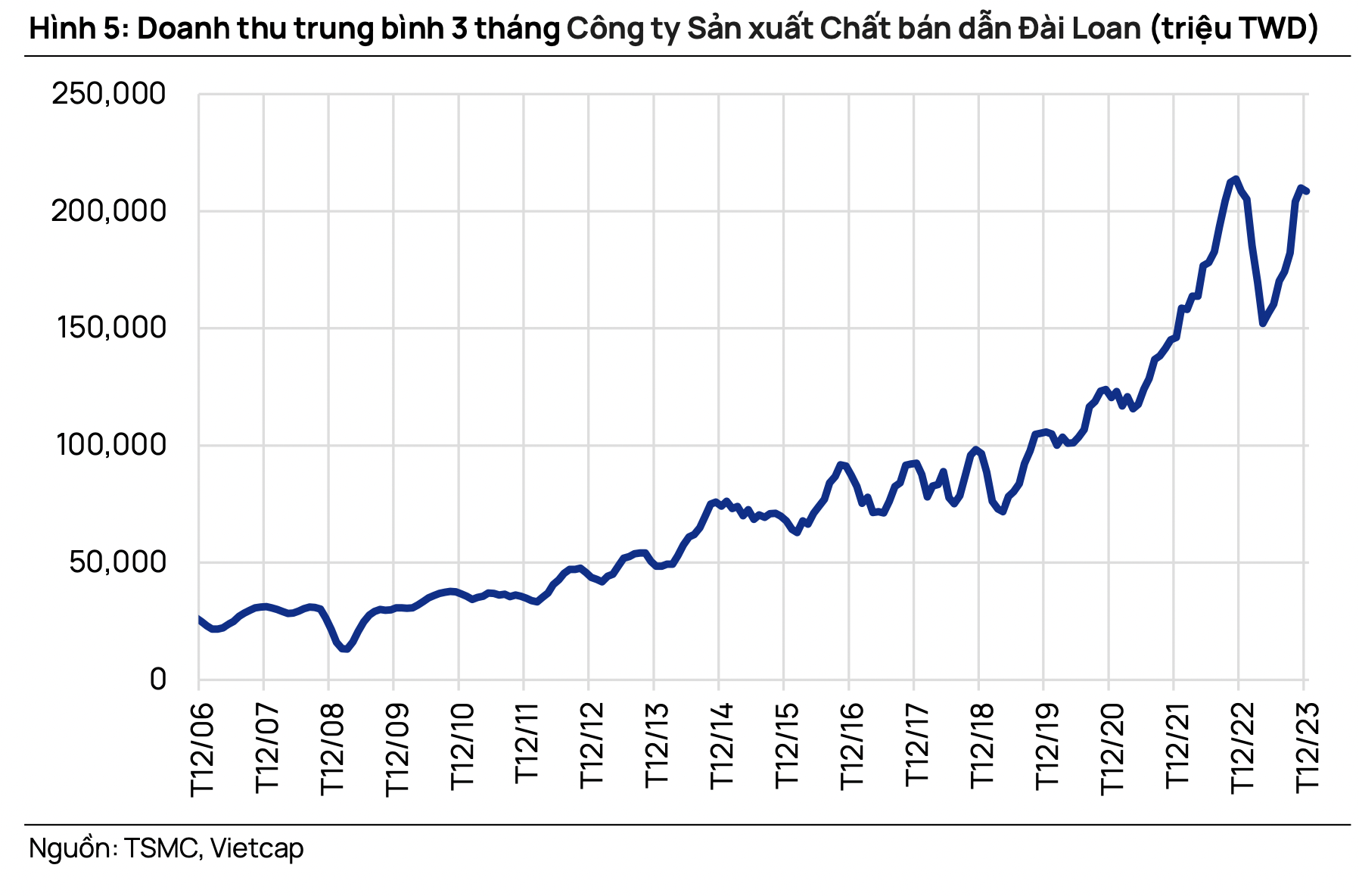

Many expectations believe that DGC will benefit from the prospects of the semiconductor industry in the coming time. Nikkei newspaper cited statistics from the World Semiconductor Trade Statistics (WSTS) of major semiconductor manufacturers, showing that the global semiconductor market in 2024 will increase by 13% compared to last year to 588.3 billion USD, surpassing the previous record of 2022. Forecasts from World Semiconductor Trade Statistics and Gartner also indicate that global semiconductor industry growth in 2024 will reach 11.8% and 18.5% respectively compared to the same period in 2023.

Gold phosphorus and phosphoric acid are important raw materials in the production of electronic chips, semiconductors. The prices of these two materials are predicted to become more positive as the semiconductor industry develops.

As the largest exporter of gold phosphorus in Asia, Duc Giang Chemicals (DGC) is expected to benefit greatly from this trend. The company’s leadership recently stated that by the end of 2024, Vietnam’s phosphorus demand will increase dramatically as new chip and battery factories in East Asia and North America diversify their supply sources outside of China.

SSI Securities estimated that DGC’s profit in 2024 will increase by 26% compared to the same period due to the strong growth of global semiconductor revenue and the fertilizer demand associated with the increasing demand for agriculture. According to the analysis unit, the gradual transition from gold phosphorus to higher value-added products (phosphoric acid) will increase Duc Giang Chemicals’ profit margin. Moreover, the construction of the Chlo-alkali plant (from the second quarter of 2024) will boost long-term profit growth for the company (expected from 2026). However, with the current DGC stock price on the market, SSI believes that it has already reflected the potential for growth in the next year.

A recent report by Vietcap also suggests that Duc Giang Chemicals is expected to put its new gold phosphorus plant into operation in the fourth quarter of 2023. The plant will expand its capacity by an additional 16% to meet the strong growth in order volume beyond the current capacity. Vietcap expects the industrial phosphorus chemicals (IPC) segment of DGC to perform well in 2024. The SEMI industry association forecasts that global semiconductor sales will increase by 12% in 2024. Combined with the stability of chip manufacturers’ inventory, the demand for industrial phosphorus chemicals is expected to increase in the future.

Accordingly, Vietcap expects IPC sales volume and price to recover this year. IPC sales volume (measured by phosphorus content) is expected to increase by 20% compared to 2023, reaching 68,888 tons. Vietcap revealed that DGC sold about 15,000 tons of IPC in the fourth quarter of 2023. In addition, DGC acquired a factory at the beginning of 2023, increasing its phosphorus capacity from 60,000 tons/year to 70,000 tons/year. Vietcap expects this plant of DGC to go into operation in mid-2024.

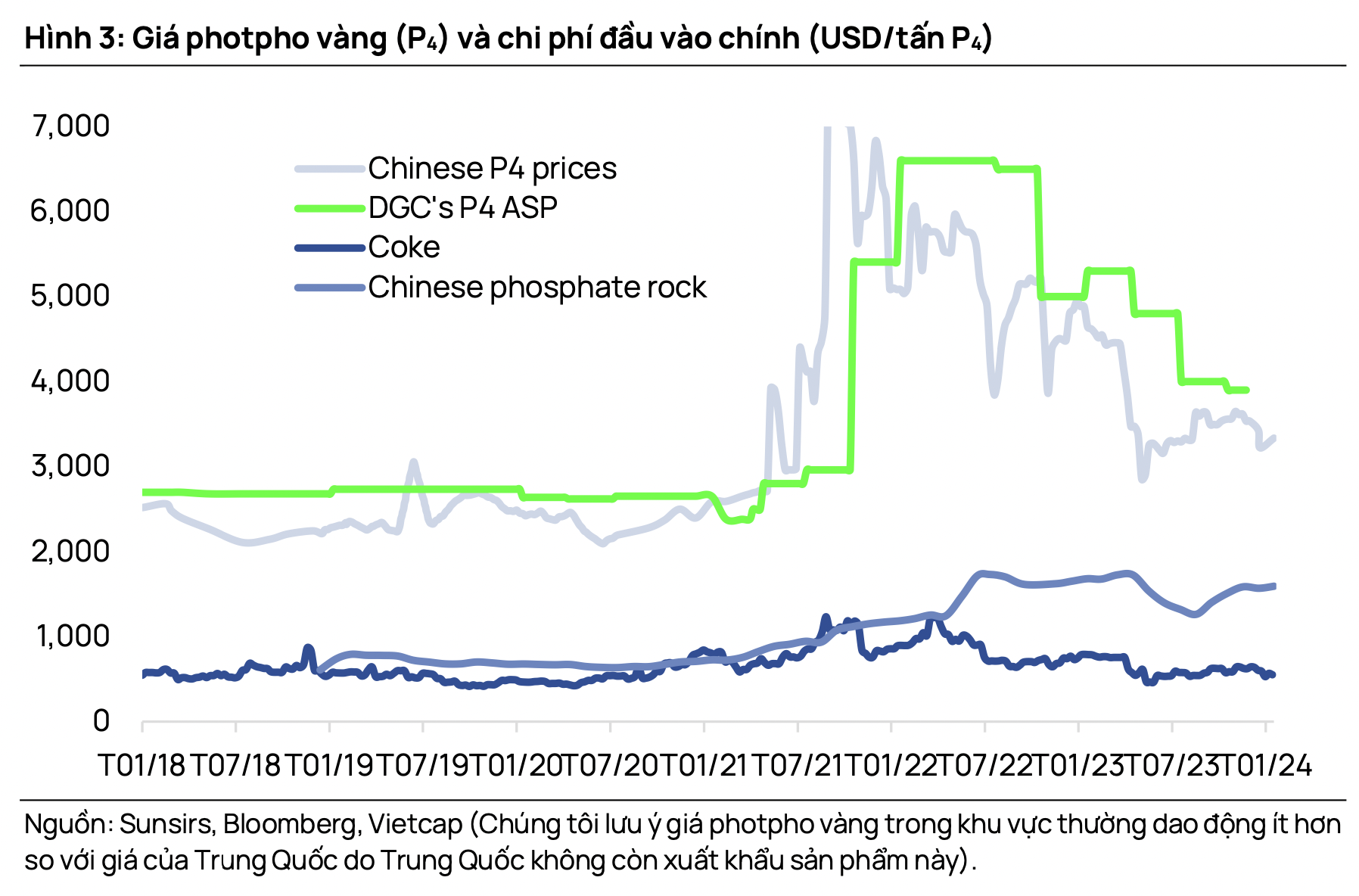

The average selling price (ASP) of DGC’s IPC has reached the lowest level in the past 3 years, which is 3,900 USD/ton of phosphorus content in the fourth quarter of 2023 according to Vietcap’s estimate. However, this securities company predicts that the average IPC selling price will recover and reach 4,300 USD in 2024 – almost unchanged compared to the level of 2023.

According to Vietcap, DGC will continue to gain market share in the IPC market in the medium term. DGC’s total IPC sales volume to Southeast Asia and the United States doubled in 2023 despite the weak global demand due to US companies diversifying their supply sources from China. DGC expects IPC demand in India to improve in the first quarter of 2024 after a weak fourth quarter of 2023. The demand from India affects the business results of DGC in the fourth quarter of 2023 while the demand in East Asia remains stable.

In addition, Vietcap expects new chip manufacturing facilities outside of China to benefit DGC because China is no longer exporting gold phosphorus (P4) while DGC accounts for nearly 1/3 of the total global P4 exports. Vietcap revealed that the owner of some EV battery factories being built in Japan and South Korea has expressed interest in purchasing P4 from DGC when they put their factories into operation in 2025.

Vietcap forecasts that DGC’s net profit could recover by 31% compared to 2023, reaching 4,087 billion dong in 2024.