The stock market on February 27 witnessed a surprising breakthrough in the steel stock group with the flagship stock Hòa Phát (HPG). This stock surged along with explosive trading, attracting the attention of investors. Just after about 1 hour of the first trading session, HPG had matched nearly 50 million shares, equal to half of the record trading session on November 18, 2022. With a broad spreading effect, stocks such as Hoa Sen (HSG), Nam Kim (NKG), SMC, VNSteel (TVN), Pomina (POM),… also increased sharply.

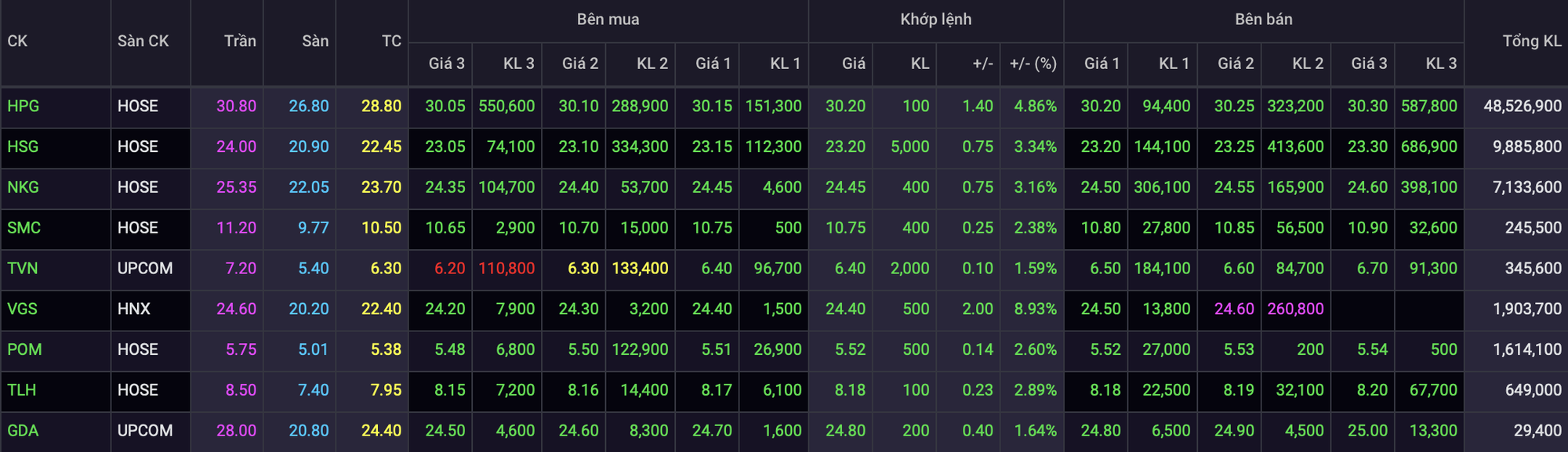

Steel stock trading at 10:30 AM, February 27

Before today’s session, the steel group had almost remained dull since the beginning of 2024. While VN-Index has increased by over 8% since the beginning of the year, steel stocks have almost “stand still”. The leading stock in the industry, HPG, is also the healthiest name but only with a modest increase of 3%, much lower than the general market. Previously, in 2023, the steel stock prices increased by an average of 58%, completely outperforming VN-Index (+12.2%) mainly thanks to the recovery of profits after reaching the bottom.

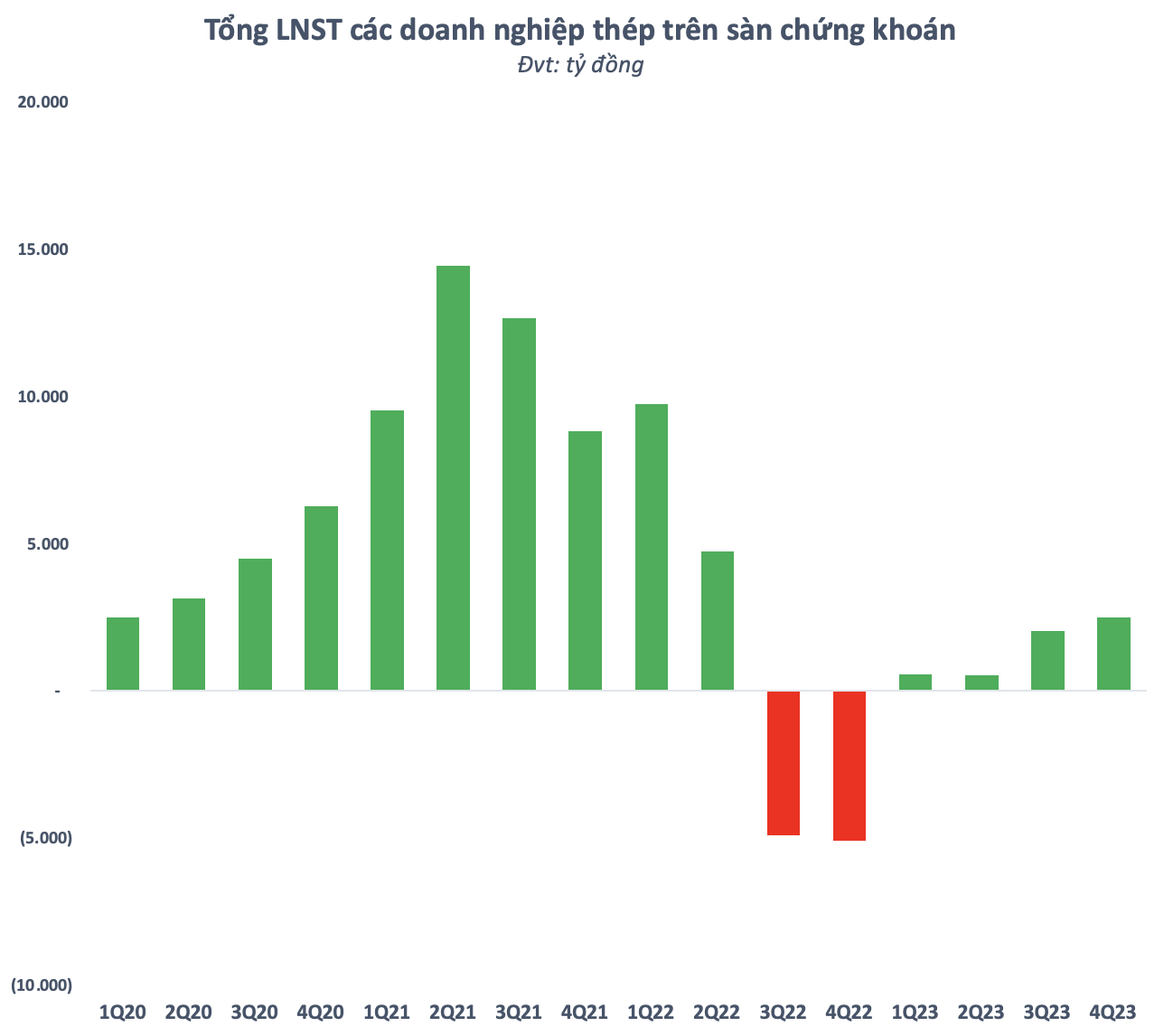

In a recent industry report, SSI Research evaluated that although the annual business results of the steel companies in 2023 have not strongly recovered, even decreased deeper than the business results in 2022, the quarterly profit has hit the bottom in the second half of 2022, earlier than most other industries.

According to estimates in the fourth quarter of 2023, the total profit of the steel industry reached about VND 2,500 billion, an increase of 22% compared to the previous quarter 3 and much more optimistic than the loss of over VND 5,000 billion in the same period in 2022. This is the second consecutive quarter of recovery in the profits of steel companies compared to the previous quarter and also the highest level in the past 6 quarters.

Compared to the same period in 2022, most steel companies have recorded strong profit recovery, especially Hòa Phát (HPG) with a net profit increase of nearly VND 5,000 billion. Many other companies also have profit recovery of hundreds of billion in the last quarter of 2022, such as Hoa Sen (HSG), Nam Kim (NKG), VNSteel (TVN), Tôn Đông Á (GDA),…

Regarding the prospects for 2024, SSI Research forecasts that total steel consumption can recover by more than 6% compared to the same period in 2024, in which domestic consumption reaches a growth rate of nearly 7%. The steel consumption will also be supported by macroeconomic conditions and a more vibrant real estate market. In the previous cycle, construction steel consumption in 2013 increased by about 3% compared to the bottom in 2012.

In addition, export volume can maintain growth thanks to positive global demand prospects. According to the World Steel Association, global steel demand is expected to increase by 1.9% in 2024, compared to 1.8% in 2023. Demand from developed economies is expected to grow by 2.8% in 2024 after decreasing by 1.8% in 2023. Meanwhile, demand from ASEAN countries (except Vietnam) is expected to increase by 5.2% in 2024, higher than the 3.8% in 2023.

The SSI Research analysis team expects the profits of steel companies to achieve a high growth rate in 2024 from the low level in 2023 thanks to improving consumption volume, especially for HPG and HSG, and the gross profit margin rebounding from the low level in many years as steel prices are likely to have ended the downward trend of previous years.