According to the list of slow-paying Social Insurance (SI) units from 3 months (data calculated until January 31, 2024, updated UNC until February 20, 2024) announced by Ho Chi Minh City’s Social Insurance (SI) Agency, Thai Tuan Group Corporation is also on the list with 9 months of overdue insurance payments, equivalent to over 12 billion Vietnamese Dong.

This figure has decreased compared to the updated list until December 31, 2023. According to this list, Thai Tuan Group has delayed paying 10 months of SI with 13.4 billion Vietnamese Dong. Therefore, in the first month of 2024, this textile and garment company has paid 1 month of social insurance premium with over 1.4 billion Vietnamese Dong.

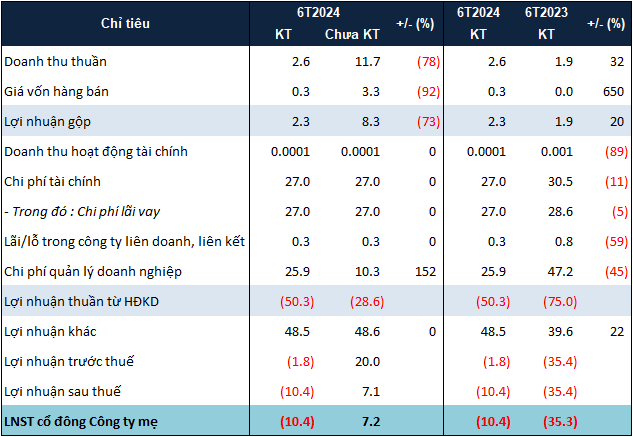

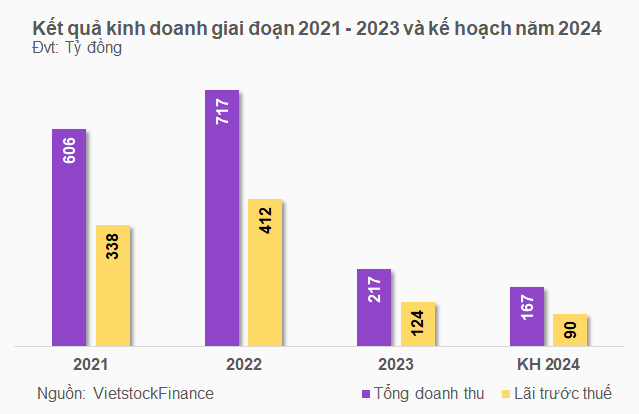

Not only facing insurance arrears, Thai Tuan’s business performance is also declining. Based on the latest financial update on the Hanoi Stock Exchange (HNX), Thai Tuan’s net profit in the first 6 months of 2023 is 449 million Vietnamese Dong, while in 2022, the profit was still 9.5 billion Vietnamese Dong. The return on equity (ROE) ratio is quite low at 0.02%.

As of June 30, 2023, the company’s equity was 2,001 billion Vietnamese Dong, increasing by 16% compared to the end of the previous year. The debt-to-equity ratio is 130.92%, equivalent to a payable balance of more than 2,620 billion Vietnamese Dong. Among them, the bond-to-equity ratio is 35.87%, equivalent to a bond payable of 717.8 billion Vietnamese Dong.

A Thai Tuan fashion store

Poor business performance has made Thai Tuan run out of money to pay back the bond. Therefore, the company has continuously extended the maturity of 2 outstanding bonds.

Specifically, bond TTDCH2122001 issued on April 12, 2021, with a face value of 300 billion Vietnamese Dong, a term of 18 months with an interest rate of 11% per year. The purpose of issuing this bond is to increase the scale of the issuer’s working capital, and to invest in programs and projects of the company.

Thai Tuan has changed the maturity date from October 12, 2022 to July 27, 2024, extending it by nearly 2 years compared to the original maturity date.

The collateral for bond TTDCH2122001 includes 20 million shares of Thai Tuan Group Corporation (with a total par value of 200 billion Vietnamese Dong); houses and land rights at 7, 8, 9 Trang Tu, Ward 14, District 5, Ho Chi Minh City, and 2.6 hectares of land in Duc Hoa district, Long An province (with a total value of 210 billion Vietnamese Dong, valued by Vietnam Asset Appraisal and Valuation Corporation).

As for bond TTDCH21222002, with a value of 500 billion Vietnamese Dong, the maturity date has been changed from November 20, 2022 to November 20, 2024, with an interest rate of 16.5% per year from November 20, 2022 to November 29, 2024. The bond’s term has been extended from 18 months to 42 months.

Thai Tuan has also added collateral for this bond, which includes 7 villas in the Cross Long Hai project (Ba Ria – Vung Tau) developed by Tan Thanh Trading – Tourism Investment Corporation (Tan Thanh Company). Moreover, the issuer has agreed on a repayment plan for principal and interest of the bond using other assets.