On the global market, the USD-Index dropped 1 point this past 2 weeks, to a low of 103.96 points.

The price of USD in the international market has decreased due to expectations that the US Federal Reserve will postpone interest rate cuts.

Specifically, according to the minutes of the January 2024 meeting, Fed members want to see more evidence that inflation is cooling towards the 2% target sustainably before cutting interest rates. Some officials are concerned that progress on inflation may stall. Overall, this meeting minutes reinforces expectations that interest rates will remain high in the near future.

Recent data also shows that consumer and production prices in the US are higher than expected, which also dispels speculation of an early interest rate cut.

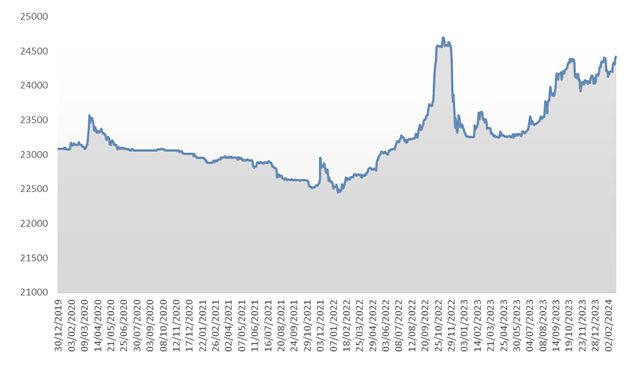

In contrast to the USD-Index’s movements, on the morning of February 26, the central exchange rate of the Vietnamese dong against the USD increased by 48 dong, to 24,004 dong/USD, after 2 weeks. At this level, the central exchange rate returns to the threshold of 24,000 dong after leaving this level for nearly 1 month.

The State Bank of Vietnam (SBV) keeps the spot buying rate unchanged at 23,400 dong/USD. Meanwhile, the selling rate has increased by an additional 48 dong/USD compared to February 12, to 25,154 dong/USD.

|

USD buying rates at banks since the beginning of 2020 until February 26, 2024

Source: VCB

|

Meanwhile, in the past 2 weeks, the USD exchange rate listed at Vietcombank has increased by 350 dong/USD in both directions, to 24,480 dong/USD (buying) and 24,850 dong/USD (selling).

In mid-October 2022, the USD exchange rate at Vietcombank reached a peak of 24,692 dong/USD (buying) and 24,872 dong/USD (selling). This is also the highest USD exchange rate that Vietcombank has listed since 2000.

Therefore, the current bank exchange rate is still 212 dong/USD higher in the buying direction and 22 dong/USD higher in the selling direction compared to the historical peak.

In a recently published macroeconomic report, Vietcombank Securities (VCBS) stated that foreign currency demand has started to increase due to improvements in import-export activities, pushing up transaction exchange rates at the banking system with an increase of over 1% at certain times. At the end of January, the VND depreciated by about 0.72% against the USD.

In addition, the interest rate environment continues to hit a new low, putting constant pressure on exchange rates while the DXY remains at a high level. Therefore, the possibility of a VND depreciation will still exist, and the exchange rate movement will depend largely on foreign currency supply at each point in time, influenced by factors related to direct and indirect investments, remittances, etc.

Khang Di