The Board of Directors of Vietcombank has agreed on a plan to increase capital through dividend payment in the form of shares from the remaining after-tax profit, reserve funds in 2022 to report to and seek opinions from the State Bank of Vietnam (SBV).

In 2022, Vietcombank’s separate audited after-tax profit reached over VND 29,387 billion. After setting aside the supplementary charter capital reserve fund (VND 1,470 billion), the financial reserve fund (VND 2,939 billion), and the reward and welfare fund (VND 3,291 billion), the Bank will use the remaining after-tax profit of VND 21,680 billion to distribute dividends in the form of shares to shareholders.

Thus, with Vietcombank’s current charter capital of nearly VND 55,891 billion and a dividend distribution value of over VND 21,680 billion, the estimated dividend distribution ratio in the form of shares is 38.79% of charter capital, equivalent to issuing an additional 2.2 billion shares as dividends (shareholders owning 1,000 shares will receive nearly 388 shares).

After completing the 2022 dividend distribution, Vietcombank’s charter capital will increase by VND 21,680 billion, reaching over VND 77,571 billion.

|

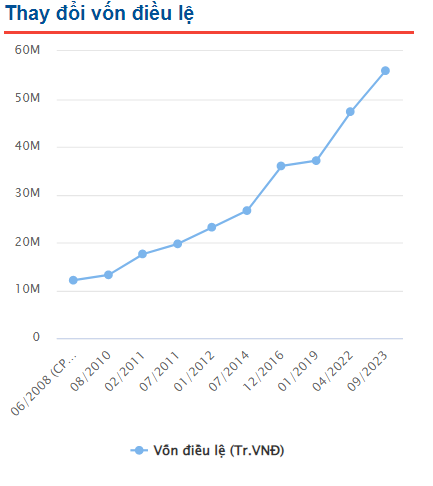

Vietcombank’s capital increase process

Source: VietstockFinance

|

In 2023, Vietcombank has completed the capital increase from the profit of 2020 and the remaining profit of 2019 with a rate of 18.1%, bringing the charter capital to nearly VND 55,891 billion.

|

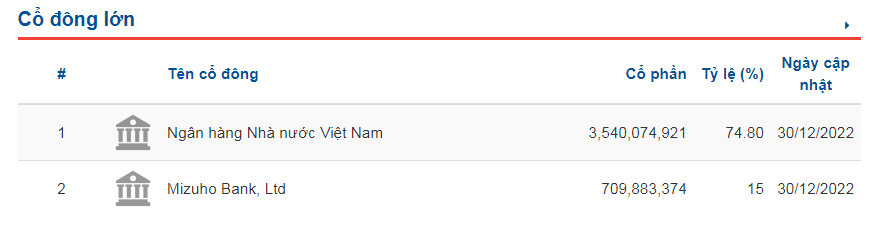

Major shareholders of Vietcombank

Source: VietstockFinance

|

According to the latest update (as of December 31, 2022), Vietcombank has 2 major shareholders, namely the SBV (holding 74.8% of capital) and Mizuho Bank (owning 15%).

With the aforementioned ownership ratios, after issuing shares as dividends to increase capital, the ownership ratios of the 2 major shareholders will remain unchanged, but the number of shares held will increase. Specifically, the SBV will hold over 5.8 billion VCB shares and Mizuho Bank will hold nearly 1.2 billion VCB shares.