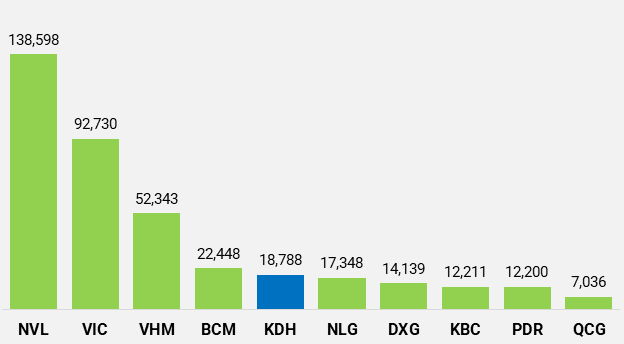

Compared to the beginning of the year, the inventory level of KDH has increased by 3 notches, from 7/10 to 10/10. KDH surpasses NLG, DXG to stand behind NVL, VIC, and VHM in the ranking.

|

Top 10 listed real estate companies with the highest inventory value as of the end of 2023 (Unit: Billion dong)

Source: VietstockFinance

|

|

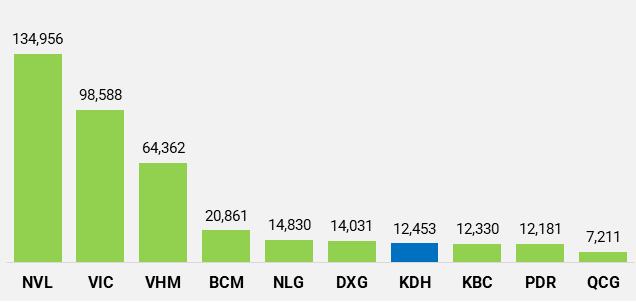

Top 10 listed real estate companies with the highest inventory value as of the end of 2022 (Unit: Billion dong)

Source: VietstockFinance

|

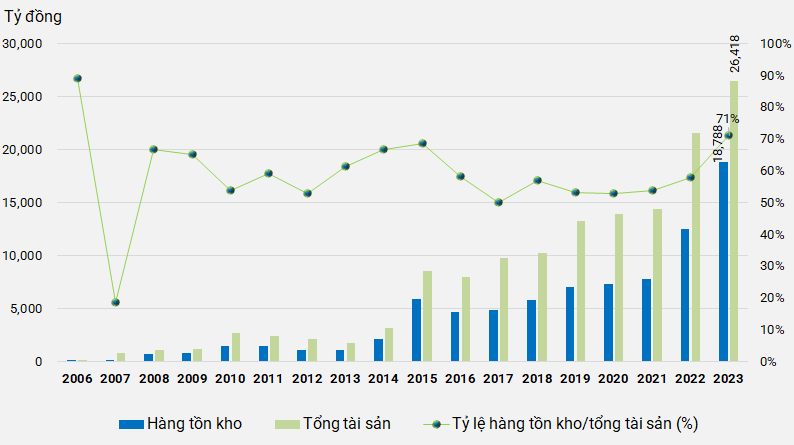

With a huge inventory level, the asset scale of KDH has exceeded the milestone of trillion US dollars, reaching 26.4 thousand billion dong.

Over the past 2 years, KDH’s inventory has increased significantly. In 2022, inventory exceeded 12 thousand billion dong, an increase of more than 60% compared to the previous year; by 2023, it increased over 50%, while during the period 2019-2021, this target only increased by 4 – 5% per year. This is the result of KDH’s process of accumulating not a small amount of land and projects through the acquisition of enterprises in the industry.

Inventory and total assets of KDH from 2006 – 2023

Source: VietstockFinance

|

At the end of 2022, KDH had 13 directly-owned subsidiaries and 16 indirectly-owned subsidiaries. One year later, the number of indirectly-owned subsidiaries increased by 1, to 17 companies, while the number of employees in the subsidiary group decreased from 342 to 258, corresponding to a decrease of more than 1/4.

What does the inventory include?

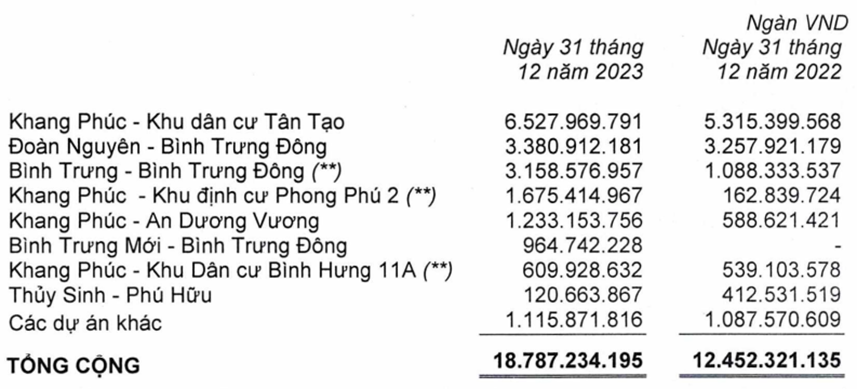

As of the end of 2023, the record inventory of KDH mostly consists of unfinished construction real estate in developing residential projects with a value of nearly 18.8 thousand billion dong.

KDH publicly announced this list of 8 projects, accounting for a total inventory of nearly 17.7 thousand billion dong. Among them, Khang Phuc – Tan Tao Residential Area – has the highest value with more than 6.5 thousand billion dong, followed by Doan Nguyen – Binh Trung Dong project with nearly 3.4 thousand billion dong, Binh Trung – Binh Trung Dong project with nearly 3.2 thousand billion dong. This is also the project with the fastest increase in inventory, tripled compared to a year ago, contributing significantly to the expansion of this account balance surplus.

In addition, the Khang Phuc – An Duong Vuong project also doubled its inventory, reaching over 1.2 thousand billion dong. In addition, the list also includes 1 new project that appeared this year, which is Binh Trung Moi – Binh Trung Dong, with nearly 965 billion dong.

KDH’s inventory

Source: Business reports

|

The increase in inventory has led to a net cash flow used in KDH’s business activities of nearly 1.6 thousand billion dong. In return, KDH received nearly 3.2 thousand billion dong from investing in other units, but still has to repay principal debt of over 4.5 thousand billion dong. The loan repayment amount only meets 4.1 thousand billion dong. As a result, the financial operating cash flow is negative nearly 300 billion dong.

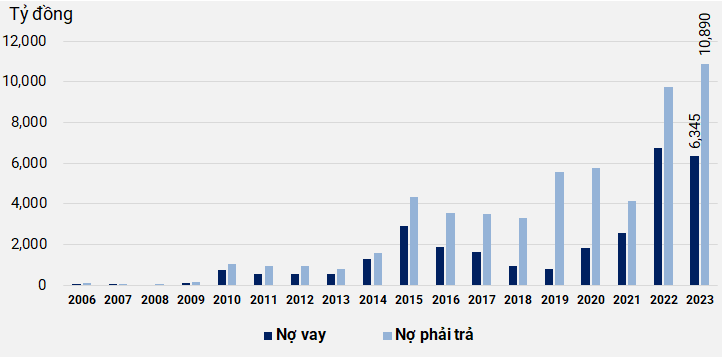

KDH’s repayable debt in 2023 first exceeded 10 thousand billion dong, the highest ever. In this figure, loan debt accounts for 58%, equivalent to over 6.3 thousand billion dong.

Source: VietstockFinance

|

According to the information disclosed in the financial statements, there are 3 KDH projects being mortgaged at VietinBank (HOSE: CTG) and OCB. Specifically, the land use rights in Phong Phu commune, Binh Chanh district and the property rights arising from the land use rights transfer contract in the project are mortgaged at VietinBank for a loan of 1,067 billion dong, interest rate 10.5%/year, to finance the Binh Chanh project, HCMC.

The property rights arising from land use rights transfer contract in Binh Trung Dong ward and Cat Lai ward, Thu Duc city are mortgaged for a loan of 1,695 billion dong at OCB, to finance the Binh Trung Dong residential area.

The property rights arising from the residential area project 11A, Binh Hung commune, Binh Chanh district are mortgaged for a loan of 995 billion dong, also at OCB, to finance the extended Le Minh Xuan project and residential area 11A and Tan Tao urban center – Zone A. Residential area 11A is also used as collateral for a loan of nearly 500 billion dong at OCB, to contribute capital.

In addition, the property rights arising from the extended Le Minh Xuan project (with unfinished construction costs of nearly 933 billion dong) are mortgaged for 2 loans with a total value of 989 billion dong at OCB, to finance the Tan Tao urban center – Zone A.

Other than that, there is a large enterprise with a turnover of more than 1,000 billion VND. For more detail, please visit this link.

Origin of the mega project

The project with the highest inventory value of KDH is Khang Phuc – Tan Tao Residential Area (commercial name Mega Township) formerly owned by Binh Chanh Construction Investment Corporation (BCCI). However, after 10 years, from 2007 to 2017, when completing the acquisition of BCCI and changing its name to Khang Phuc Business Investment Company Ltd., KDH officially became the investor of the city gateway urban area in Western HCMC, covering an area of 320ha, with an announced investment capital of 3.2 thousand billion dong in 2017. By the end of 2022, KDH said that the project is still completing its legal status and the inventory value has now doubled the initial investment capital.

The second project is Doan Nguyen – Binh Trung Dong (commercial name Emeria) with an inventory value of 3,381 billion dong, covering an area of over 6ha, located in Binh Trung Dong ward, Thu Duc city. The Doan Nguyen project is located next to KDH’s Clarita Binh Trung Dong project.

The project was acquired by CapitaLand in 2018 for 1,380 billion dong for 86 million shares (equivalent to 100% of the charter capital) of BCLand Investment Construction JSC. At this time, BCLand holds 100% of the charter capital of Doan Nguyen Real Estate Company Ltd. – the investor of the 60.7ha project in Binh Trung Dong ward, district 2 (old). CapitaLand plans to build 100 townhouses and complete them in 2021. Before going to CapitaLand, the project belonged to KDH. In 2013, due to difficulties in the real estate market and business situation, KDH transferred 99.99% of the capital of Doan Nguyen Company.

In 2021, CapitaLand divested its stake in the Doan Nguyen – Binh Trung Dong project, and BCLand was dissolved. Doan Nguyen changed hands to Phuoc Nguyen Real Estate Investment Corporation.

In March 2022, through its subsidiary Thuy Sinh Real Estate Investment Business Company, KDH completed the transfer of 336 million shares, equivalent to 60% of Phuoc Nguyen’s capital for 620 billion dong, thereby indirectly owning 100% of Doan Nguyen (as Phuoc Nguyen holds 100% of the capital). Thus, after only 4 years, the project value has doubled.

The third is Binh Trung – Binh Trung Dong (commercial name Clarita) with an inventory value of 3,159 billion dong. The project covers an area of 5.8ha, KDH plans to develop villas and townhouses right on Vo Chi Cong street, Binh Trung Dong ward, Thu Duc city.

Khang Phuc – Phong Phu 2 Residential Area (formerly The Green Village) with an inventory value of 1,675 billion dong covers an area of 133ha and is oriented by KDH to develop the Phong Phu 4 urban area, Binh Chanh district. The planning is mainly low-rise houses and apartments. This is also a project that KDH acquired from BCCI in 2017 with a land clearance volume of over 44%, it is still completing its legal status.

KDH raised 1,400 billion dong of bonds in 2022 to lend to Khang Phuc Residential Company, in order to pay for the costs of the Tan Tao residential area – Zone A and The Privia projects.

Similarly, another project acquired from M&A is Khang Phuc – An Duong Vuong (commercial name The Privia) with an inventory value of 1,233 billion dong. This is a rare project with fast progress as it broke ground in mid-2022 and was officially launched at the end of November 2023. During this period, the last 3 months were also the period that KDH recorded a sharp increase in the prepayment of real estate transfer money from 895 billion dong to 2,350 billion dong, equivalent to an increase of 1,455 billion dong. The Privia is being mortgaged at VietinBank, with the bank guaranteeing a maximum amount of 2,460 billion dong.

Khang Phuc – Binh Hung 11A Residential Area (commercial name The Solina Binh Chanh) with an area of 16.4ha has an inventory value of 610 billion dong, an increase of about 200 billion dong compared to when KDH acquired it in 2017. The company plans to develop a complex residential area, providing high-end apartment products with 4 towers, 97 townhouses, 93 semi-detached villas, and 28 garden villas. According to this plan, the capital scale will be much higher than the inventory value. Up to now, the project is still in the process of completing its legal status and is being mortgaged for loans with a total value of nearly 1.5 thousand billion dong at OCB.

Binh Trung Moi – Binh Trung Dong is a new project on this year’s financial statement of KDH. It is likely that this is a project located in the cluster of Binh Trung projects, developed on adjacent land to the Clarita and Emeria projects in Thu Duc. The project is expected to include townhouses, villas, and apartments…

Thu Minh