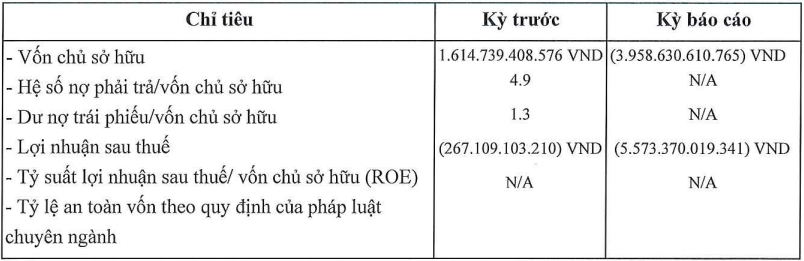

With a whopping loss at the end of December 31, 2022, Nhật Quang Company’s owner’s equity is nearly minus 3.959 trillion VND, while it was positive at the beginning of the year with nearly 1.615 trillion VND.

|

Nhật Quang’s 2022 Business Results

Source: HNX

|

In 2021, Nhật Quang Company issued the NQRB2124001 bond with a total value of 2.150 trillion VND. According to the plan, this bond will mature on January 20, 2024. However, the company was unable to pay the principal and interest to the bondholders.

On January 23, 2024, the company sent a notification to HNX regarding the inability to make any payments related to the bond due to insufficient funds.

Notably, the collateral for this bond is a part of The Spirit of Saigon project, also known as the Ben Thanh Quadrilateral. This project includes office spaces, commercial areas, service apartments, 6-star hotels, and hotel offices, located on a prime piece of land measuring 8,537.4m2 in District 1, Ho Chi Minh City.

The project is developed by Saigon Glory Company Limited, but Saigon Glory is also facing cash flow difficulties, leading to delayed payments of interest and principal on multiple bonds. In early February 2024, the company was able to negotiate a 1 to 2-year extension for 10 bonds.

Is there a connection to the businessperson who acquired 6,000m2 of prime land at 2-4-6 Hai Ba Trung?

In addition to the Ben Thanh Quadrilateral project, Nhật Quang Company is also involved in another “prime land” project in Ho Chi Minh City.

Nhật Quang was established in October 2014 with a charter capital of 500 billion VND, with Saigon Star Infrastructure and Real Estate Investment Joint Stock Company holding 49%, and individuals Nguyen Thi Minh Hai and Do Phuong Nam each holding 25.5%. The Chairman of the Board and Legal Representative is Ms. Ly Thi Thanh Truc.

Afterward, Nhật Quang underwent several changes in legal representatives, most notably the appearance of Mr. Hua Kien Quoc as the Chairman of the Board and CEO and the legal representative in December 2020, which remains unchanged to this day. At the time of Mr. Quoc’s appointment, Nhật Quang’s charter capital significantly increased from 500 billion VND to 1.950 trillion VND.

It is worth noting that Mr. Quoc is related to Mr. Ngo Van An, the businessperson behind the acquisition of 6,000m2 of prime land at 2-4-6 Hai Ba Trung, District 1, Ho Chi Minh City.

Specifically, Mr. Quoc is a founding shareholder of Maxsky Joint Stock Company, established in January 2017 with a charter capital of 1,276 billion VND. Mr. Quoc, Mr. Ho Hoang Thinh, and Ms. Lam Mieu Quyen each contributed 5.016%, while DK1 Investment Joint Stock Company held the remaining 84.953%. The company is led by Mr. Ngo Van An as CEO and legal representative, who is also the head of DK1 Investment Joint Stock Company.

Subsequently, Mr. Quoc held this position from April 2017 to July 2018 before transferring it to Ms. Truong My Tran, coinciding with the full divestment of DK1 Investment Joint Stock Company’s capital. The three remaining individual shareholders split the capital equally, with each holding 33.33%. Later, the company changed its name to Lucky Point Joint Stock Company, and in January 2020, Mr. Quoc returned to his original leadership position.

Regarding Mr. Ngo Van An, he was the Chairman of the Board and legal representative of Quang Truong Me Investment Joint Stock Company. The company was previously known as Saigon Pearl Investment Joint Stock Company, established by Sabeco and other enterprises to implement a high-rise building project at 2-4-6 Hai Ba Trung, District 1. Specifically, the company had a charter capital of nearly 485 billion VND, with founding shareholders including Ha An Trading and Service Investment Joint Stock Company (25.5%), Me Linh Investment Joint Stock Company (25.5%), Attland Joint Stock Company (23%), and Sabeco (HOSE: SAB) (26%). Mr. Bui Cao Nhat Quan from Novaland was named as the CEO.

However, Sabeco later divested its capital in the project company through a competitive auction among the remaining shareholders. The authorities believed that Sabeco’s divestment violated several regulations.

In addition, Mr. An has also held positions as CEO or Chairman of multiple real estate companies, such as Me Linh Square Investment Joint Stock Company, Trade Wind Investment Joint Stock Company, Golden Hill Investment Joint Stock Company, Alpha King Asset & Real Estate Management Company Limited, Dong Sai Gon Project Development Investment Joint Stock Company, Duc Khang Investment Joint Stock Company, Alpha Dreams Real Estate Joint Stock Company, Capitaland Tower Company Limited, Alpha Residence Company Limited, and others.