This item is iron and steel. According to data from the General Department of Customs, in January 2024, Vietnam spent over $1.6 billion to import various types of iron and steel products, an increase of 20% compared to December 2023 and a 77% increase from the same period in 2023.

Of that amount, Vietnam imported nearly 1.5 million tons of iron and steel, with a value of about $1.1 billion, an increase of 151% in volume and 102% in value compared to January 2023. This is the seventh consecutive month that Vietnam’s imports of iron and steel have exceeded 1 million tons, and it is the highest level to date.

In January 2024, Vietnam spent over $1 billion to import iron and steel from China. Photo: TL

According to the General Department of Customs, Vietnam mainly imports all kinds of iron and steel products from China. Specifically, in January 2024 alone, Vietnam spent over $1 billion to import this item from the Chinese market, an increase of $181 million, or 22%, compared to December 2023. This figure is 2.4 times higher than the same period in 2023 and accounts for 63% of the value of Vietnam’s imports of various types of iron and steel products.

Overall in 2023, Vietnam’s exports of various types of iron and steel reached nearly 11.13 million tons, with a value of $8.35 billion, an increase of 32.6% in volume and 4.5% in value compared to 2022. It is clear that Vietnam can produce and export millions of tons of iron and steel.

So, the question arises: why does Vietnam have to spend over billions of dollars to import iron and steel from the Chinese market?

Why is Chinese iron and steel attractive to Vietnamese businesses?

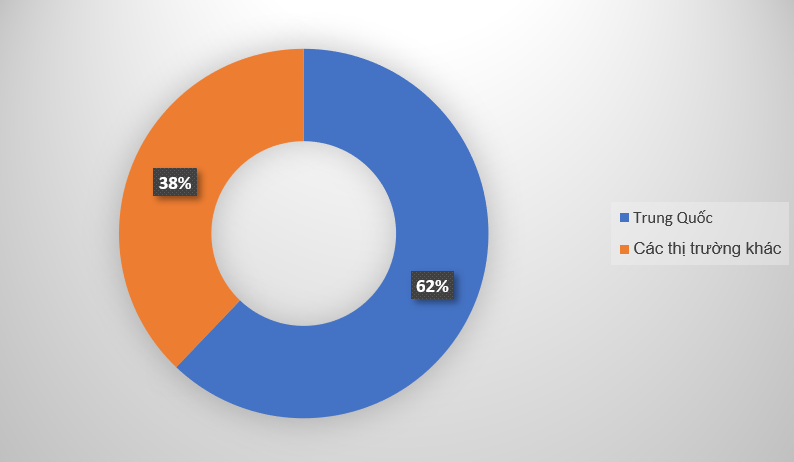

Structure of iron and steel imports from China and other markets. Chart: MH

In 2023, the volume of iron and steel imported from China to Vietnam reached 8.2 million tons, equivalent to over $5.6 billion, an increase of 63% in volume and 14% in value compared to 2022. This figure accounted for 62% of the total volume and 54% of the total import value of iron and steel in the country.

According to experts, the reason Vietnam spends billions of dollars to import Chinese iron and steel is because this commodity is much cheaper in the populous country than in the domestic market and other markets. This also puts significant pressure on domestic iron and steel producers, forcing them to hold back production.

In addition, the increased imports of iron and steel are due to many civil businesses in Vietnam currently stockpiling goods in preparation for the recovery and the return of real estate projects.

Furthermore, according to Plo, Mr. Do Duy Thai, CEO of Vietnam Steel Corporation, shared that investment projects in key transportation infrastructure and social housing projects will increase, leading to an expected increase in demand for iron and steel in 2024. At the same time, due to the reduction in bank loan interest rates, domestic enterprises can now borrow to import goods.

The iron and steel industry of Vietnam has gone through a relatively difficult year with a stagnant market. However, with positive signals in the final months of 2023, the iron and steel industry in Vietnam is showing signs of recovery.

Excessive steel imports from China are putting pressure on domestic iron and steel producers. Illustrative image

According to the Vietnam Steel Association (VSA), steel consumption in 2024 is expected to increase by 6.4% to nearly 21.6 million tons. Of that, exports of finished and semi-finished steel are forecasted to increase by 12% to nearly 13 million tons.

The iron and steel industry of Vietnam is predicted to recover with growth, extending the profitability recovery of companies in the industry.

The World Steel Association (Worldsteel) pointed out that global steel demand reached 1.81 billion tons in 2023 and is expected to increase by 1.9% to 1.85 billion tons in 2024. ASEAN’s steel demand is expected to increase by 5.2% in 2024. This is a positive signal for Vietnam as ASEAN is currently the world’s largest steel export market, accounting for 32% of the export market share, while the EU and the US rank second and third, accounting for 28% and 9%, respectively.

Article reference sources: Customs, VSA, Worldsteel