PVC has just been approved to issue over 21 million shares.

PetroVietnam Chemical and Services Joint Stock Company (stock code: PVC) has just been approved by the Hanoi Stock Exchange (HNX) to add new PVC shares listing from February 28, 2024.

Specifically, HNX approved PVC to list additional common shares, with a par value of 10,000 VND/share, with the form of issuing additional shares to the public.

The number of additional listed shares is 21,195,000 shares, the value of additional listed shares (according to par value) is over 211.9 billion VND.

After adding more than 21 million shares to the listing, the total number of listed shares of PVC will increase to 81,194,463 shares. The total value of listed shares (according to par value) is over 811.9 billion VND.

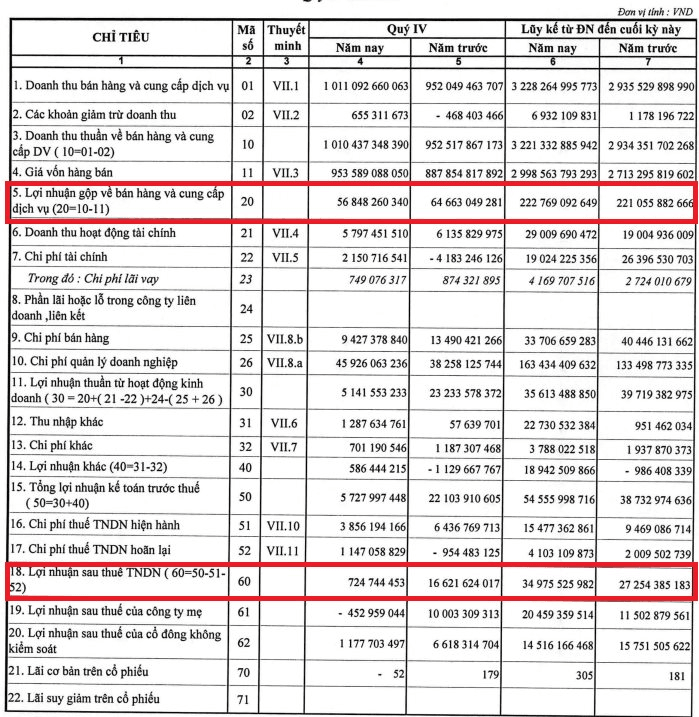

In terms of business performance, according to the consolidated financial statements in Q4/2023, PVC reported a profit after tax of 724 million VND, a decrease of 95.64% compared to Q4/2022. The reason comes from the cost of goods sold and business management costs that increased significantly compared to the same period.

For the whole year of 2023, PVC recorded net revenue of 3,221 billion VND (an increase of 9.78%). However, the cost of goods sold increased by 10.51% to 2,998 billion VND, resulting in gross profit of only 222.7 billion VND, an increase of 0.78% compared to 2022.

Financial activities brought in revenue of 29 billion VND, an increase of 52.64%; Other profits brought in 18.9 billion VND, while in 2022 it was a loss of 986 million VND.

In addition, in 2023, this petroleum enterprise has achieved significant reductions in operating costs such as: Financial costs of 19 billion VND, a decrease of 27.93%; Sales costs of 33.7 billion VND, a decrease of 16.66%; Business management costs of 16.3 billion VND, a decrease of 87.76%.

As a result, PVC recorded a profit after tax in 2023 of 34.9 billion VND, an increase of 28.33% compared to the previous year.

As of December 31, 2023, the total assets of PVC are 2,427 billion VND, an increase of 8% compared to the beginning of the year. Short-term assets are 2,255 billion VND, an increase of 9.28%.

The payable debt of this petroleum company by the end of 2023 is 1,377 billion VND, a decrease of 2.43% from the beginning of the year. Short-term debt is 1,358 billion VND, a decrease of 1.38%.

In the stock market, in the morning session on February 28, PVC stock is trading at 14,800 VND/share, an increase of 1.37% compared to the previous trading session.