Exactly six years ago today (1/3/2018), Binh Son Refining and Petrochemical Company Limited (BSR) stock was officially listed on the stock exchange carrying with it the many expectations of investors after a successful IPO that exceeded expectations. This stock made an impressive debut on the UPCoM exchange, rising by 40% to 31,300 VND/share, with lively trading activity.

Despite the smooth start, which seemed to pave the way for BSR’s success on the stock exchange, the reality did not meet expectations. This stock continuously declined and at one point reached less than 5,000 VND/share (end of March 2020), losing 84% from its peak. It took more than 4 years for investors who bought BSR shares on the listing day to break even, which was in mid-June 2022.

The short-lived joy quickly faded as BSR turned around after reaching its previous peak and once again plummeted. By mid-November 2022, the stock price had only reached 1/3 of its peak. From there, BSR gradually recovered, but the journey was quite rocky. Currently, the stock is trading at 19,900 VND/share, still 36% lower than its peak.

The corresponding market capitalization is about 62,000 billion VND (2.5 billion USD), which is nearly 31,000 billion VND lower than its market capitalization when it first listed 6 years ago. Nevertheless, BSR is currently the third largest company on the UPCoM exchange, after ACV and Viettel Global (VGI).

“Blockbuster” IPO

Looking back in time, the story of a company managing and operating the largest oil refinery in the country conducting an IPO attracted great attention from investors at home and abroad during the 2017-18 period.

At that time, BSR was truly a “blockbuster” as the IPO session attracted 4,079 participating investors, with nearly 652 million shares placed, 2.7 times the amount of shares available for sale. The auction session was successful, with all 241.56 million shares (equivalent to 7.79% of BSR shares) being sold at an average price of 23,043 VND/share. Among them, foreign investors won 147.8 million shares.

One of the foreign investors who won the auction was the Vietnam Opportunity Fund (VOF) – the largest fund managed by VinaCapital. According to VOF’s announcement, the fund bought about 10% of BSR shares in the offering round with a total value of about 25 million USD. The auction price of VOF was lower than the average price of the Binh Son Refining and Petrochemical Company Limited IPO at 23,000 VND/share.

At that time, VOF believed BSR operated in a potential market with a 33% market share, making it the most potential investment according to the fund’s perspective. However, just over 1 month after listing, BSR’s stock price dropped below the IPO price, and it took several years before it returned.

Unfinished plans

During its trading journey, BSR also missed many important plans, especially the State’s divestment plan. BSR has a charter capital of over 31,000 billion VND, corresponding to 3.1 billion shares, in which the Vietnam Oil and Gas Group (PVN) holds 2.86 billion shares (92.12%). According to the divestment plan, after the IPO, BSR will offer 49% of shares to strategic investors, thereby reducing the State ownership to 43%.

When officially becoming a joint stock company on July 1, 2018, BSR announced that there were 2 investors who submitted application documents to participate in the selection process of strategic investors, namely Petrolimex (Vietnam) and Indian Oil Corp (India). In addition, other investors such as Pertamina (Indonesia), Bangchak Corporation Public Company Limited (Thailand), etc., are also considering submitting application documents to participate in the selection process of strategic investors.

However, this plan is still unfinished and more than 92% of BSR shares are still held by the State shareholders. Unfavorable price movements, unattractive UPCoM exchange, etc., could be the reasons why BSR faces difficulties in selling shares to strategic investors. It is expected to be more feasible if BSR shares are listed on the Ho Chi Minh Stock Exchange (HoSE).

In a report last August, BSC Securities Company assessed that if BSR is approved for listing on HoSE, it will help enhance the transparency of the company. In addition, listing on HoSE will also contribute to improving BSR’s access to large investors (both domestic and foreign).

However, BSR’s listing plan by the end of 2023 has been delayed. The company stated that although it has received the support of HoSE, the process is still hindered by a lack of specific guidance regarding the criteria related to the outstanding debts of its subsidiary BSR-BF. BSR is still awaiting a meeting with the State Securities Commission (SSC) to request further guidance and solutions to resolve this issue.

“The giant” with hundreds of trillion in revenue

Despite the many obstacles in divestment and listing, it cannot be denied that BSR is still one of the largest companies on the stock exchange in many aspects. This company manages and operates the Dung Quat Oil Refinery – Vietnam’s first oil refinery. The Dung Quat Oil Refinery started construction in 2005 with a total investment of 3 billion USD and went into operation in 2009. The refinery has an annual capacity of 6.5 million metric tons of low-sulfur crude oil.

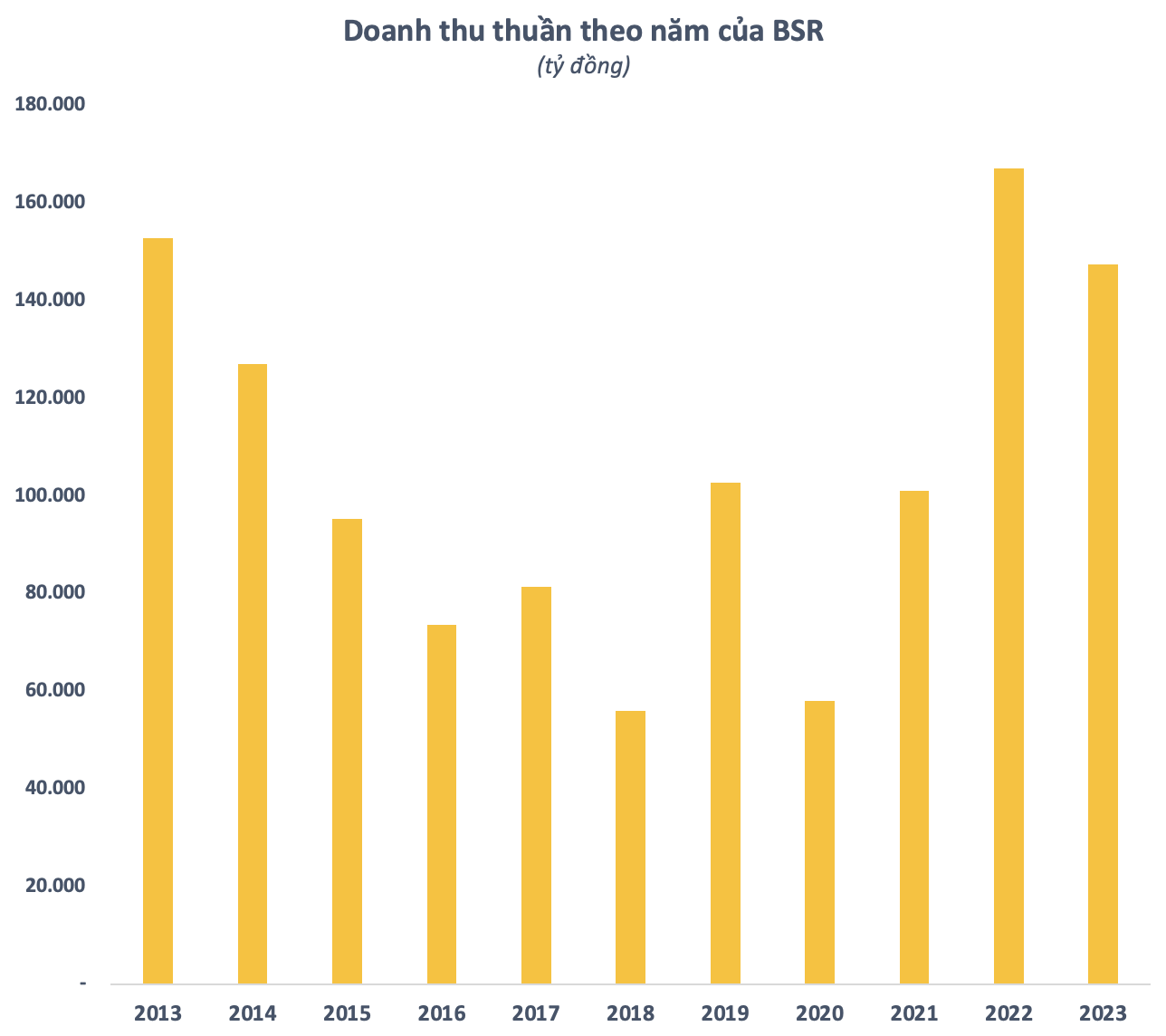

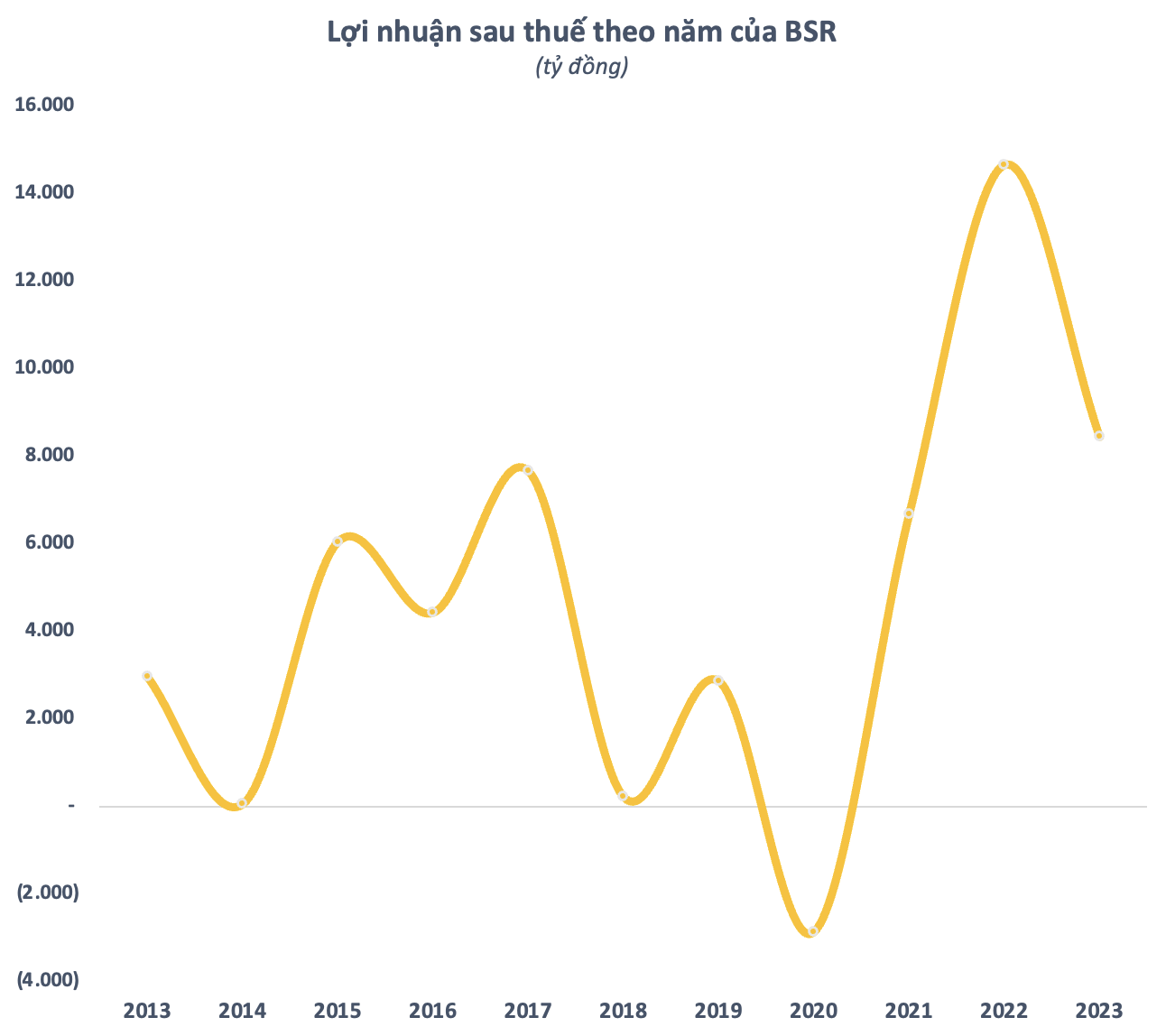

With a 1/3 market share in supplying petroleum products nationwide, BSR’s annual revenue is quite impressive. In 2023, the company generated 147,000 billion VND in net revenue, a nearly 12% decrease compared to the previous year, ranking third on the stock exchange, only after Petrolimex and Vingroup. Net profit reached 8,455 billion VND, a 42% decrease compared to 2022 but still the second highest level since its operation.

In 2024, BSR aims to achieve consolidated total revenue of over 95,274 billion VND and after-tax profit of 1,148 billion VND. The planned dividend (parent company) is 3%, equivalent to 930 billion VND. Regarding total investment, the plan in 2024 will allocate nearly 1,298 billion VND, of which 994 billion VND is for basic construction investment, and the rest is for equipment and fixed assets procurement.

Regarding production targets, the total production volume of all BSR products is planned to exceed 5.7 million metric tons, including more than 2.28 million metric tons of Diesel oil, 1.73 million metric tons of RON 95 gasoline, and over 588,000 metric tons of RON 91/92 gasoline. All of these targets are lower than the 2023 plan. As for consumption targets, BSR aims to achieve a total consumption volume of 5.66 million metric tons.