The vigorous implementation of Decree 100 on handling alcohol concentration violations when driving has strongly impacted the alcoholic beverage industry, not to mention the decreasing trend of alcohol consumption among consumers. In addition, the retail channel is facing difficulties in terms of rent prices.

The result is a gloomy picture in the alcoholic beverage market. The total revenue of beer businesses in 2023 decreased by 11% to nearly 45.7 trillion VND. After-tax profits fell even more drastically, with a decline rate of over 23%, reaching less than 5.1 trillion VND. Net revenue of Sabeco and Habeco – the two giants of the Vietnamese beer industry – decreased by 13% and 7.7% respectively.

However, a different scenario is taking place in the e-commerce channel.

A new direction for beer businesses

According to a recent report by YouNet ECI, a TMĐT data analysis company, the revenue of the alcoholic beverage group on online platforms still grew by 12% in the last 6 months of 2023 compared to the previous 6 months, despite the first 6 months of the year being the peak period for the industry due to the lunar new year festival.

Beer businesses on these platforms achieved a total revenue of 35.1 billion VND in 2023. Although this figure is still relatively modest compared to the overall market capacity of beer, YouNet ECI emphasized the importance of the growth rate in the second half of the year compared to the first half.

Among the 3 platforms that YouNet ECI collected data from – Shopee, Lazada, and Tiki, Shopee emerged as a very important sales channel for the alcoholic beverage industry, especially beer.

Comparing the two halves of 2023, the contribution percentage of GMV (Gross Merchandise Value) of the alcoholic beverage industry on Shopee increased from 22.9 to 50.4% (a 146% increase), while the contribution percentage of Lazada and Tiki decreased to 35.5% and 14.2% respectively in the second half of the year compared to 35% and 25% in the first half.

Looking deeper into the picture on Shopee with 2 sub-categories – wine and beer, YouNet ECI pointed out that the beer category grew by 154% between the first half and the second half of 2023, reaching 88.7 billion VND from 34.9 billion VND. The wine category also almost doubled, from 6.6 billion VND to 13.8 billion VND.

In the popular price segments of the beer industry (from 260,000 – 600,000 VND and from 600,000 – 1,300,000 VND), the contribution percentage of mall shops (official stores) is extremely high, accounting for over 80%. This indicates that consumers highly value credibility factors.

Taking advantage of all the above “favorable conditions”, Sabeco made a simple yet effective move: opening an official store on Shopee.

Immediate effectiveness demonstrated through Sabeco’s oldest brand

There are differences in the market share of the beer industry between offline and online channels. Heineken, Carlsberg, and Sabeco are three names appearing in the top 4 market shares in both sales channels, but their order is different. Specifically, Sabeco is experiencing positive growth in market share on online platforms.

Considering the business efficiency of beer industry leaders in the last 6 months of the year compared to the first 6 months, only Sabeco has achieved positive growth of 4.8% in market share on the online channel, while the rest have all decreased, with Heineken and Carlsberg declining by 4.5% and 2.3% respectively.

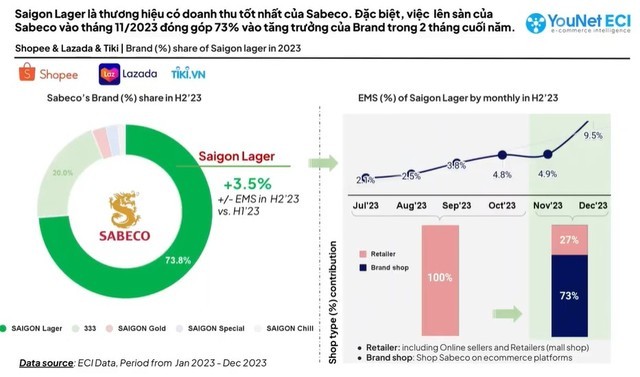

To understand the reason why Sabeco achieved significant growth in market share on the online channel in the last 6 months of 2023, YouNet ECI conducted an in-depth analysis on Saigon Lager – Sabeco’s oldest and most famous brand, which also generates the highest revenue.

Compared to the first half of 2023, the market share of Saigon Lager in the second half of the year increased by 3.5%. And if we look at the changes in Saigon Lager’s market share in the last 6 months of the year, there is a noteworthy development.

The market share of this product increased consistently each month, but not dramatically. However, from November to December, the growth rate suddenly jumped from 4.9% to 9.5%, almost double.

YouNet ECI states that the main reason for this significant increase is the appearance of Sabeco’s official store on Shopee.

Positive business results of Saigon Lager brand on online platforms.

Sabeco opened its official store in November 2023. Prior to that, all of Saigon Lager’s revenue on Shopee came from online sellers, but their contribution percentage has now dropped to only 27%. 73% of the brand’s revenue comes from the official Shopee channel.

At the end of 2023, Saigon Lager ranked 6th among the best-selling alcoholic beverages on online platforms.

“After opening the official store on Shopee, Sabeco quickly adapted to the e-commerce environment, launching many vouchers to stimulate consumer demand and combining with promotional programs, such as opening a can to win a prize.

Based on feedback from those who have made purchases at the official store, it can be seen that Sabeco is doing very well in factors such as good price, fast shipping… since their appearance on the platform from November 2023 until now,” evaluated Mr. Nguyen Phuong Lam – Head of TMĐT Market Analysis Department at YouNet ECI.

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)