On February 28, the VN-Index recorded its 3rd consecutive point increase, gaining a significant 17.09 points to close at 1,254.55 points, officially surpassing the important resistance level of 1,250 points.

Meanwhile, the HNX-Index slightly decreased by 0.22 points to reach 235.16 points, and the Upcom-Index increased by 0.14 points to 90.54 points.

Market liquidity was not too vibrant, even lower than yesterday, with a trading value of over 25,441 billion dong across the three exchanges, of which HoSE accounted for over 22,400 billion dong.

The market was not too volatile, but the VN-Index still rose strongly and easily overcame the resistance level. This was due to the large-cap stocks and the strong growth of oil and gas stocks.

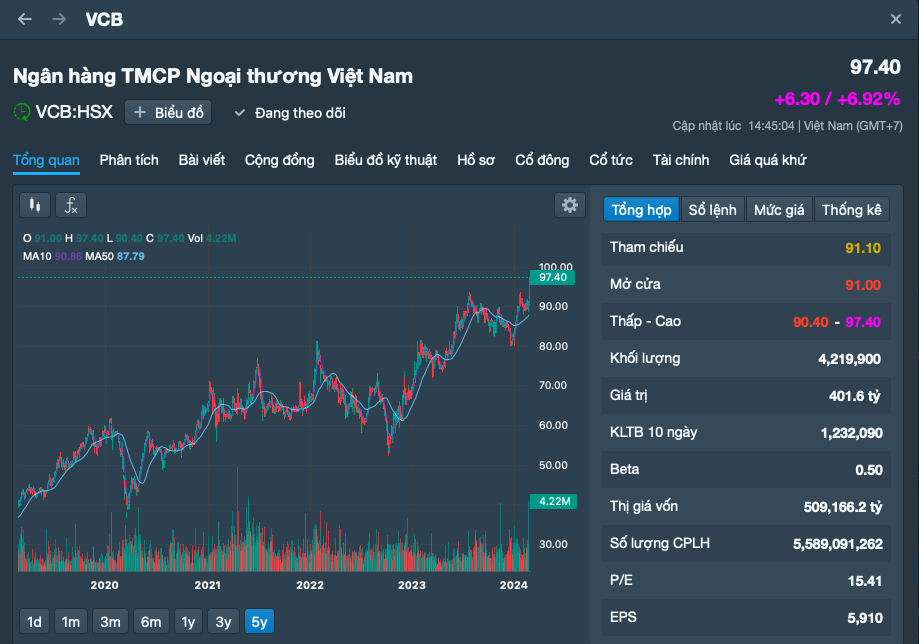

Notably, VCB shares of Vietcombank increased by the daily limit of 6.92% to 97,400 dong. This is also the highest price of this stock in history (calculated after the annual dividend distribution). The increase in VCB shares alone contributed 8 points to the VN-Index.

PVD shares also increased to their maximum range, leading the oil and gas stock group and creating highlights for the market.

Stocks closing in green at the end of February 28

Returning to the banking stock group, including VCB shares, many stocks in this group have reached or are near their historical peaks after a continuous strong growth period for the past few months, such as BID, ACB, HDB, MBB, NAB… This is also the group of stocks with the largest market capitalization.

After the strong growth period of banking stocks, many investors are wondering whether it is still a good time to buy. Mr. Hoang Thanh (from District 3, Ho Chi Minh City) stated that he does not have any banking stocks in his portfolio. He is considering whether to buy banking stocks to catch the wave of the shareholders’ general meeting season with positive information about business results and dividend distribution.

Many other opinions believe that banking stocks have already risen from the end of last year until now, and buying at this time might be risky to “buy at the peak”.

VCB shares of Vietcombank reach all-time high

Speaking to reporters from Bao Nguoi Lao Dong, Mr. Huynh Minh Tuan, Head of the Hanoi Branch – Brokerage Department, Mirae Asset, believed that the P/E valuation of the banking stock group is currently at a reasonable level after an average increase of about 20% over the past few months. Currently, this group of stocks still faces risks related to bad debts, so investors need to be very cautious when deciding to buy in.

Mr. Vo Kim Phung, Deputy Head of Analysis Department, BETA Securities Company, also believed that the price potential of banking stocks in 2024 is not much left. At the current price level, investors should limit buying in.

Economic expert, Prof. Dinh The Hien, believed that banking stocks have been rising in the context of economic difficulties and many other business sectors have not yet recovered strongly. Banks still have better prospects than other industries. Therefore, money has been pouring into this group of stocks in recent times.

“When investors are short-term trading, they do not care much about high or low prices, but pay more attention to whether the stock can continue to rise and bring profit after purchase. However, long-term investors look at the valuation, and with the current valuation of the banking sector, which is no longer cheap and has potential hidden bad debts, it will no longer be attractive,” stated Prof. Hien.