The impact of VCB this afternoon was significant, as it was the reason for VN-Index breaking the morning session low but also the reason for the index to recover and close at the day’s high. Although no stock could replace VCB today, the combined effect of the slight increase in many blue-chip stocks was enough to help VN-Index have its highest weekly gain since the end of January 2023. Foreign investors switched to net buying in the afternoon session, and the best-performing stocks were supported by foreign demand.

VN-Index reached its lowest point in the afternoon session today at 2:05 PM, dropping nearly 5 points. That was also when VCB “plunged” to the bottom, down 2.47%, before recovering to the reference level. The index made a good recovery of more than 10 points in just 30 minutes, closing the session above the reference level at 5.55 points (+0.44%).

Overall for the week, VN-Index increased by 3.8%, equivalent to +46.28 points. This increase was slightly lower than the 47.91-point gain in the last week of January 2023 before the Lunar New Year holiday. Moreover, the average liquidity on HoSE this week reached 21,720 billion VND per session, slightly lower than the record level in the week when the index reached its peak in September last year (24,664 billion VND per session).

The weak upward momentum of VN-Index today was partly due to the need for blue-chip stock prices to compensate for the decrease before the late 30-minute increase. At the bottom of the index, the breadth recorded 207 gainers against 262 losers, but VN30-Index recorded the deepest drop of 0.55% and the number of declining stocks was 6 times higher than the number of advancing stocks. By the end of the session, this basket had 19 gainers and 7 losers with a 0.1% increase.

Among the pillar stocks, only VHM showed a significant increase, closing up 1.27%. At the morning session closing, VHM only increased by 0.12%. As this stock has a smaller market cap than BID, despite only increasing by 0.94%, BID is still the stock contributing the most points. CTG, GAS, VIC are other stocks in the Top 10 by market cap that increased, but with a very small margin. HPG, VPB, VNM, TCB are declining stocks. This differentiation prevented VN-Index from breaking out and maintained the positive week-long gain.

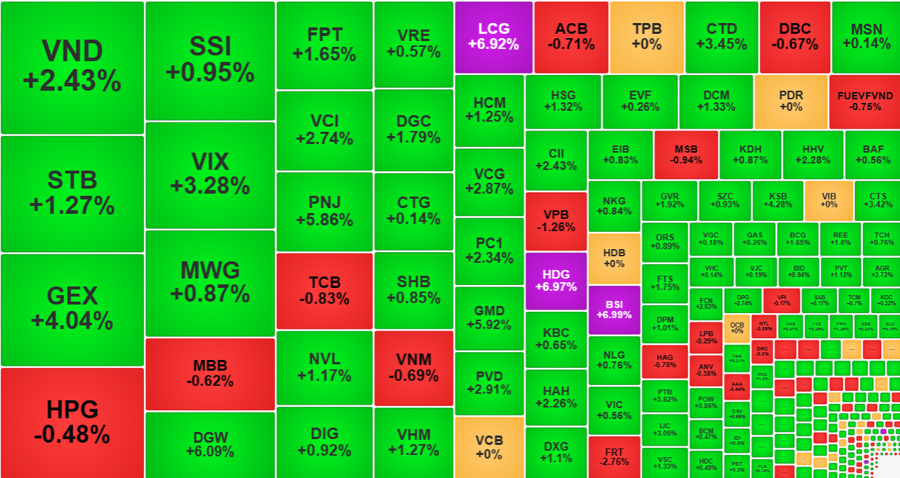

Certainly, trading in the stock market was much better than what VN-Index showed. The market breadth on HoSE at the end of the session was 293 gainers and 182 losers. Among them, 96 stocks increased by more than 1%, nearly 30 stocks in this group had a trading volume of over 100 billion VND. LCG, HDG, BSI even hit the daily ceiling with very large trading volumes. DGW, GEX, VIX, PNJ, CTD, GMD are mid-cap stocks with trading volumes of hundreds of billion VND and price increases of more than 3%.

Foreign investors unexpectedly made enthusiastic net buying. The total value of new purchases on HoSE in the afternoon session reached 1,405.8 billion VND, selling 1,082.7 billion VND, resulting in net buying of 323.1 billion VND. In the morning session, this group had net selling of 122.3 billion VND. Some securities stocks were pushed up strongly by foreign investors, such as SSI with net buying of 128.9 billion VND and a 0.95% increase in price, VIX with net buying of 127.8 billion VND and a 3.28% increase in price, VCI with net buying of 81.7 billion VND and a 2.74% increase in price, VND with net buying of 77.1 billion VND and a 2.43% increase in price. The group also bought 139.1 billion VND at MWG, but the buying value accounted for only about 20% of the trading volume, and MWG’s price increased by 0.87%. STB, GEX, DGW, LCG, DGC, CTD are stocks that performed very well and all have a significant net buying presence by foreign investors.

The market is repeating a state where the index is stagnant but stocks are performing better. Large blue-chip stocks do not have decisive momentum, except for VCB in the first 3 sessions of the week, the rest has only small fluctuations. On the other hand, mid-cap stocks are performing better, as Midcap increased by 1.43% today, Smallcap increased by 0.84%, and VN30 only increased by 0.1%. Among the 96 stocks that closed up by more than 1% today, VN30 only contributed 4 stocks.