Saudi Aramco, one of the major oil producers in the Middle East, recently canceled over $10 billion worth of EPCI contracts to expand its massive Safaniyah oil field after a request from the Ministry of Energy to cancel the Maximum Sustainable Capacity (MSC) increase plan from 12 million to 13 million barrels per day by 2027.

According to Vietcap, the delay in Saudi Aramco’s expansion plan is due to the current spare capacity as it only produces 9 million barrels per day, therefore, no new investment is needed in the short term. Vietcap also noted that if investment is not continued, the current oil production capacity of 12 million barrels per day will decrease to about 10.5 million barrels per day by 2027, demonstrating the importance of expansion projects. Therefore, Vietcap believes that this investment is still necessary in the long run and can be reconsidered by Saudi Aramco.

In addition, Saudi Aramco mentioned that the initial capital allocation for production capacity increase will be shifted towards gas, liquids, and chemicals. Saudi Aramco will provide updated investment guidance in March 2024.

In a report by SSI Research, securities experts noted that the current growth cycle of the drilling industry is mainly driven by the strong increase in oil production from the Middle East, therefore any changes to this strategy could lead to a change in the current growth cycle of drilling industry.

While waiting for Saudi Aramco’s new strategy, Vietcap still maintains a positive outlook on global upstream spending led by the Middle East and Saudi Aramco, and an optimistic outlook for the stock of two upstream energy companies PetroVietnam Technical Services Corporation (PVS) and PetroVietnam Drilling and Well Services Corporation (PVD).

According to S&P Global, global spending on exploration and production activities is expected to grow at a compound annual growth rate (CAGR) of 4% during the period of 2023-2027.

In addition to oil, Saudi Aramco is pursuing opportunities in all energy sectors, including hydrogen and solar energy. Aramco announced in January that it has more than doubled the amount allocated for venture capital investments to $7.5 billion as part of the investment in new energy.

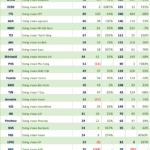

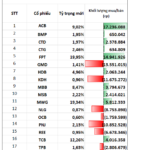

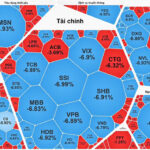

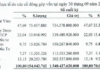

The stock market on February 28 unexpectedly witnessed a surge in trading in the oil stock group. Stocks such as BSR, PVS, PVB, PVT, PVC, PLX, OIL,… all soared with a widespread increase of over 2%. The most notable was PVD when the stock quickly went up to its highest level in 9 years.