In the updated proposal for the extraordinary Shareholders’ Meeting, Pomina JSC (HOSE: POM) provides more details about its comprehensive restructuring plan.

Under this plan, the company will contribute capital to establish Pomina Phu My Joint Stock Company along with a new strategic investor. The new company will utilize Pomina’s brand and distribution system.

The new company will have a charter capital of approximately VND 2,700-2,800 billion and bank loans of VND 4,000 billion.

|

With this plan, Pomina will terminate the business registration of Pomina 1 and Pomina 3. |

Pomina will contribute 35% of the charter capital, equivalent to VND 900-1,000 billion, and will contribute all the land, factories, and equipment of Pomina 1 and Pomina 3. Meanwhile, the new investor will contribute in cash.

However, the value of the two factories is much higher than the expected capital contribution from Pomina.

According to the asset appraisal results by AFC and Savills, the estimated tangible asset value of the two factories to be contributed to Pomina Phu My Joint Stock Company is VND 6,694 billion (excluding 10% VAT), of which the value of Pomina 1 is VND 336.4 billion and Pomina 3 is VND 6,357.6 billion.

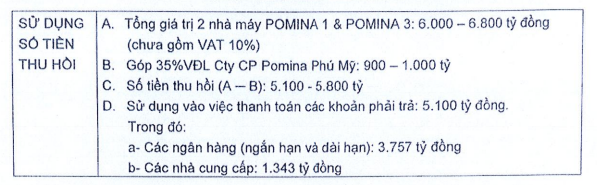

As for Pomina, they estimate the value of these two factories to be between VND 6,000 and 6,800 billion. Therefore, the company expects to recover around VND 5,100-5,800 billion after deducting the capital contribution to Pomina Phu My Joint Stock Company.

Pomina plans to use the recovered amount from the new entity to repay short-term and long-term debts to banks, pay debts to suppliers, and supplement working capital. They will repay approximately VND 3,757 billion to banks (short-term and long-term debts) and approximately VND 1,343 billion to suppliers.

In essence, this is no different from Pomina selling land, factories, production lines, and plants to the new investor and only contributing a portion of the capital. This restructuring plan is also different from the previous plan to issue 70 million shares to Japanese investors.

If new shares are issued, the strategic investor will directly contribute capital to Pomina, while Pomina will still control the company. In the new plan, Pomina must establish a new company and let the strategic investor hold the majority of the capital. Through the establishment of the new legal entity, the strategic investor will only be responsible for Pomina Phu My Joint Stock Company, not for any obligations related to Pomina Steel.

Currently, the identity of the strategic investor is still unknown, and the information will be announced at the extraordinary meeting tomorrow (March 1, 2024).

According to Pomina, the strong restructuring process, especially with the participation of a strategic investor, is a milestone marking an important turning point for the company. This strategic collaboration will provide the necessary capital for POM to restart its steel melting furnace.

It is expected that Pomina will restart the furnace in the fourth quarter of 2024 after a period of shutdown, to seize the comeback of real estate projects expected to recover strongly in the last months of the year.