DGW has announced that borrowing is intended to supplement working capital, issue guarantees, open LCs for the purchase of goods/raw materials to serve the production and business operations of technology products, fast-moving consumer goods, and healthcare products of the Company.

Interest rates will be determined in accordance with the regulations of Techcombank for each period. Repayment sources from business activities and other sources of DGW.

Members of DGW commit to using all revenue and assets to prioritize repayment to Techcombank, according to the predetermined repayment schedule of individuals and other credit institutions. DGW also commits that, for any reason, if unable to repay the debt, it will voluntarily hand over all collateral assets to Techcombank for full authority to process debt recovery without causing any obstacles. Techcombank also has full authority to deduct money from DGW‘s account to collect debts at maturity.

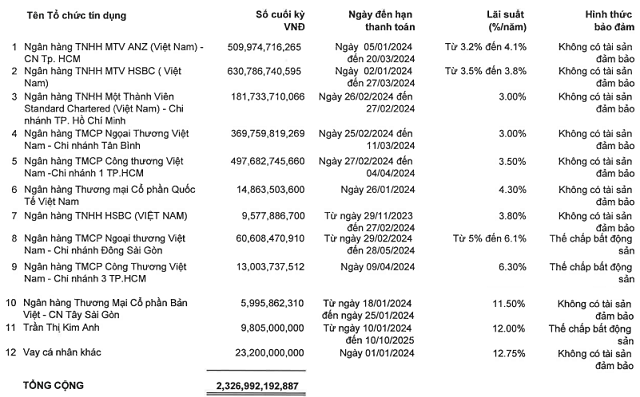

As of December 31, 2023, DGW‘s outstanding loans amounted to 2.327 trillion VNĐ, an increase of 19% compared to the beginning of the year, accounting for 31% of the total capital. Mostly short-term loans from banks such as Vietcombank, HSBC Vietnam, Standard Chartered Vietnam, ANZ Vietnam… mostly unsecured.

|

Details of DGW‘s short-term bank loans as of December 31, 2023

Source: Q4/2023 Financial Statements of DGW

|

In terms of business performance, in 2023, DGW‘s revenue reached nearly 19 trillion VNĐ, a 15% decrease and net profit of over 354 billion VNĐ, a 48% decline.

The two main activities, accounting for 74% of the revenue, are the sales of phones and laptops, which decreased by 25% and 16%, respectively. The remaining areas including office equipment, home appliances, and consumer goods, although growing, have a negligible impact on the overall results.

In addition, selling expenses increased by 31%, to 944 billion VNĐ, mainly due to increased advertising, promotions, and customer support. Interest expenses also recorded an increase of 23% to 122 billion VNĐ.

Declining net profit in Q4 for DGW due to cost pressures, total assets set a new milestone