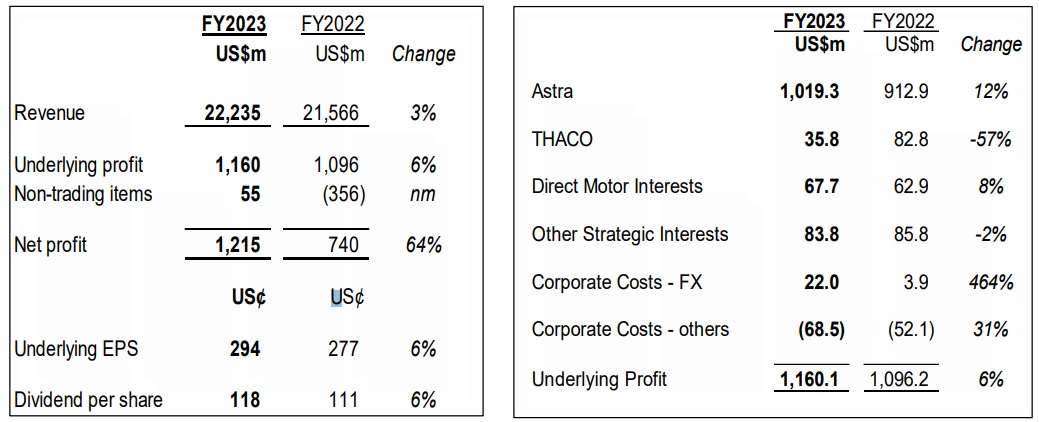

JCC achieved a successful year in 2023. According to the recent financial announcement, the Group achieved revenues of over 22.2 billion USD (approximately 547 trillion VND) in 2023, a 3% growth compared to the same period. Net profit increased significantly by 64%, reaching over 1.2 billion USD. Earnings per share (EPS) reached 2.94 USD, and dividends per share (DPS) reached 1.18 USD, both growing by 6%.

|

JCC’s business indicators in 2023

Source: JCC

|

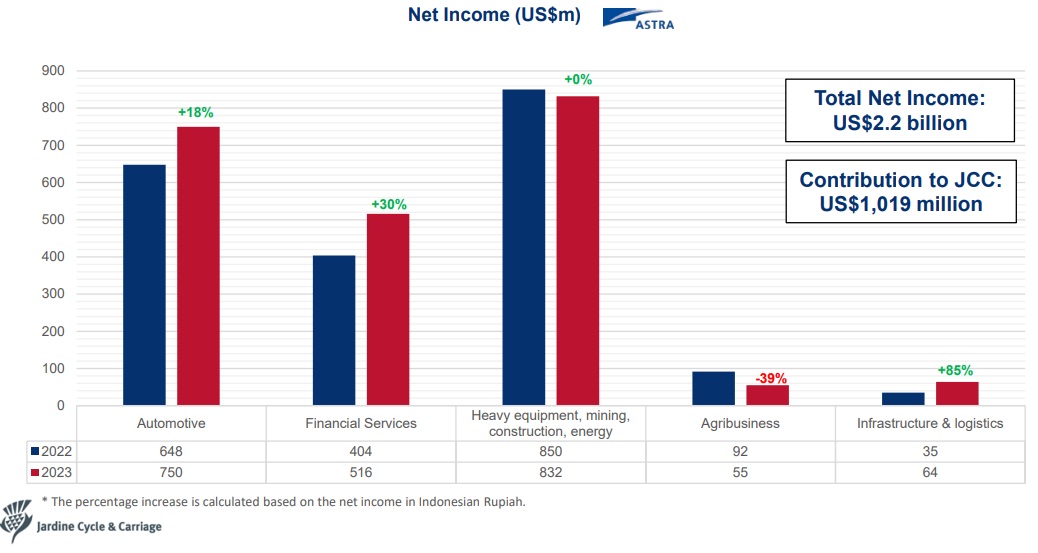

The main contribution to this growth came from the profit from Astra International (Astra) – a diversified conglomerate ranging from cars, financial services to agriculture and real estate, in which JC&C owns 51%.

In 2023, Astra brought in over 1 billion USD in profit for JCC, a 12% growth, accounting for 84% of the Group’s net profit. The automotive segment of Astra reported a profit of 750 million USD, an 18% increase compared to the previous year. The infrastructure and logistics segment recorded the highest growth of 85%, reaching 64 million USD.

|

Astra is the largest contributor to JCC’s growth

Source: JCC

|

Direct Motor Interests (profits from investments in car businesses) ranked second, with nearly 68 million USD (an 8% growth), thanks to the increased profits at Tunas Ridean (Indonesia) and Cycle & Carriage Bintang (Malaysia). However, the Singapore market declined by 24% due to a decrease in new car registrations and used cars, amid tightened vehicle registration deadlines and increased competition.

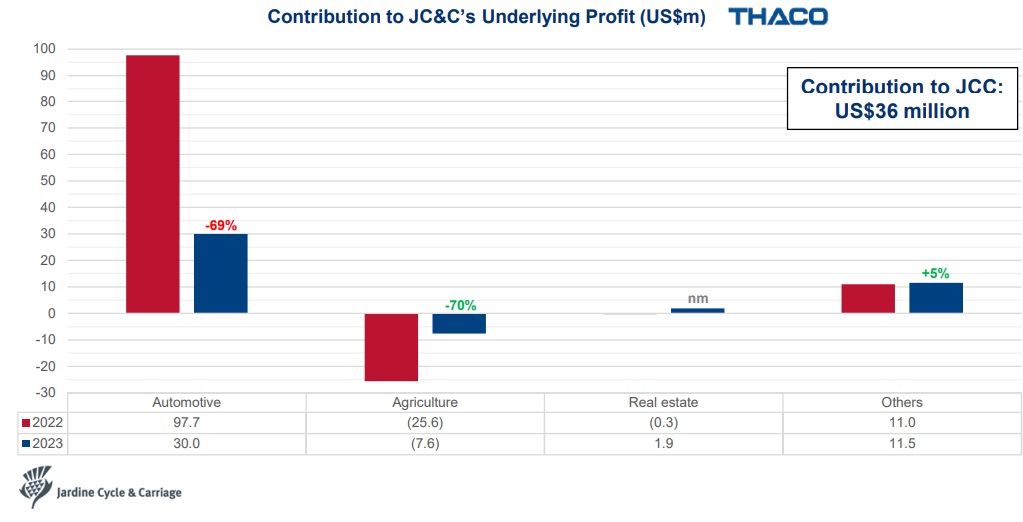

In fact, most of JCC’s investment sectors experienced profit growth, except Thaco – where JCC holds a 26.6% stake. In 2023, Thaco’s contribution decreased by 57% to only 36 million USD, mainly due to a 69% decline in the automotive segment, reaching 30 million USD. According to JCC, this decline was caused by the slowdown in economic growth, which weakened purchasing power, and increased competition. The positive point is that the agriculture segment reduced losses to only 7.6 million USD (compared to a loss of 25.6 million USD in 2022).

|

The automotive segment of Thaco recorded a sharp decline in profits

Source: JCC

|

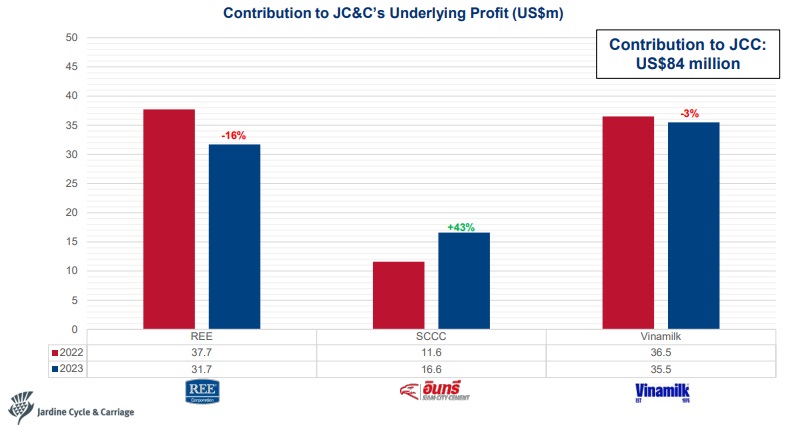

Profits (dividends) from other strategic investments also decreased slightly by 2%, to nearly 84 million USD. Among them, investments in REE (Electrical and Refrigeration Engineering) and VNM (Vinamilk) both saw a decrease in profits, to 31.7 and 35.5 million USD respectively, corresponding to a decrease of 16% and 3%. JCC stated that REE’s decrease was due to unfavorable weather conditions, which reduced profits in the renewable energy sector. As for Vinamilk, despite a decrease in dividend distribution, the company actually achieved a 4% profit growth due to cost control and revenue growth.

Siam (SCCC), where JCC holds a 49.9% stake, brought in 17 million USD in net profit, a 43% increase. However, it was affected by the increase in deferred income taxes when Sri Lanka raised taxes in 2022. Excluding this impact, SCCC’s contribution may be lower than the previous year by about 1%.

|

Contribution of JCC’s strategic investments in 2023

Source: JCC

|

JCC is an investment company of Jardine Matheson Group (Jardines) in Southeast Asia, with Jardines holding a 76% equity stake. In the Vietnamese stock market, Jardine’s name is also well-known among investors, as it has penetrated the “S” shaped land more than 20 years ago and completed many notable deals, such as investing 1 billion USD to acquire a 10% stake in Vinamilk in 2017, and the registration to buy REE’s shares in 2022.

In Southeast Asia, Vietnam is one of Jardines’ four key markets, with a rich investment portfolio in various sectors including real estate, cement finance, automotive, infrastructure, and F&B retail.

Chau An (Source: JCC)