In an updated extraordinary shareholders’ meeting proposal, POMINA Steel Joint Stock Company (code: POM) has provided more details regarding the comprehensive restructuring plan that will be presented for shareholders’ opinions.

Earlier in mid-February, Pomina planned to establish a new legal entity called Pomina Phu My Joint Stock Company. This entity is capitalized by POM’s contribution consisting of land, factories, and equipment, while strategic investors will contribute with cash.

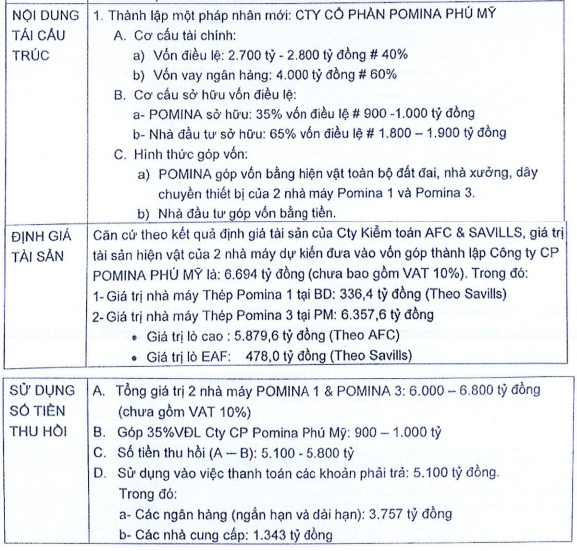

Specifically, the new company has a capital of about 2,700-2,800 billion VND (40%) and bank loans of 4,000 billion VND (60%).

Pomina will own 35% of the capital, equivalent to 900-1,000 billion VND. The capital contribution will be made with the entirety of land, factories, and equipment of Pomina 1 and Pomina 3 factories. Meanwhile, the new investors will contribute with cash and hold 65% of the capital (~1,800 – 1,900 billion VND).

With this plan, Pomina will terminate the business registration of Pomina 1 and Pomina 3 units. Meanwhile, Pomina Phu My Joint Stock Company will use the brand and distribution system of Pomina.

Notably, Pomina released the valuation of assets of the two factories expected to be contributed with capital, which is much higher than the capital contribution value.

According to the valuation results of AFC and Savills, the value of the assets of the two factories expected to be contributed to the establishment of Pomina Phu My Joint Stock Company is 6,694 billion VND (excluding 10% VAT), of which Pomina 1 factory is valued at 336.4 billion VND and Pomina 3 factory is valued at 6,357.6 billion VND.

Therefore, Pomina expects to recover approximately 5,100 – 5,800 billion VND after deducting the capital contribution to Pomina Phu My Joint Stock Company. The company will use the recovered amount to repay short-term and long-term debts to banks (3,757 billion VND) and debts to suppliers (1,343 billion VND).

Currently, information about strategic investors participating in the capital contribution to Pomina’s restructuring project has not been disclosed.

So in simple terms, Pomina is selling land, factories, and plants to new investors and contributing part of the capital, while the remaining amount is used to repay debts.

In addition, the new restructuring plan also differs from the previous one to issue 70 million shares to strategic investor Nansei (Japan) which was announced and temporarily suspended in late January 2024. If new shares were issued, the strategic investor would contribute capital directly to Pomina while the company still maintains control. In the latest plan, Pomina is required to establish a new legal entity and the strategic investor will hold a larger portion of the capital. The new strategic investor will also only be responsible for Pomina Phu My Joint Stock Company, with no obligations to Pomina.

Pomina Steel is headquartered in Binh Duong, focusing on the key segment of construction steel and targeting the key southern market.

According to POM, the strong restructuring process with the participation of a strategic investor is a significant milestone for the company. This strategic cooperation will provide the necessary capital for POM to restart its steel billet furnace.

It is expected that POM will resume operation in the fourth quarter of 2024 after a period of suspension to prepare for the strong recovery of real estate projects in the final months of the year.

This is expected to help improve the company’s business performance in the context of Pomina continuing to incur a net loss of 960 billion VND in 2023 and having many overdue debts, with the leader’s relatives continuously disinvesting.

As of December 31, 2023, Pomina Steel’s cumulative losses reached 1,271 billion VND, equivalent to 45% of the owner’s equity. Short-term debts are nearly 8,000 billion VND, of which short-term financial borrowings are nearly 5,500 billion VND.