Illustrative image

Oil prices rise strongly 2%

Oil prices rose 2% and had a weekly gain as traders awaited OPEC+’s decision on supply in Q2 2024, as well as facing new pressures from economic data from the US, Europe, and China.

At the close of trading on 1st March, Brent crude oil futures for May 2024 increased by $1.64 or 2% to $83.55 per barrel, and Brent crude oil futures for April 2024 expired on 29th February 2024 at $83.62 per barrel. West Texas Intermediate (WTI) crude oil futures for April 2024 rose by $1.71 or 2.19% to $79.97 per barrel. Overall for the week, Brent crude oil prices rose by 2.4% and WTI prices rose by over 4.5%.

Andrew Lipow, President of Lipow Oil Associates, stated that the market is focused on OPEC+’s expectation to continue voluntary production cuts in Q2 2024.

The decision to extend the production cuts by OPEC+ is scheduled to take place in the first week of March 2024, and each country is expected to announce their decision.

Natural gas prices in the US decline

Natural gas prices in the US declined due to increased fuel inventories and reduced heating demand, but natural gas prices had the strongest weekly increase in 1.5 months.

Natural gas futures for April 2024 on the New York Mercantile Exchange fell by 2.5 US cents to $1.835 per mmBTU.

Overall for the week, natural gas prices increased by 14.5% – the strongest weekly gain since 12th January 2024.

Gold prices reach 2-month high

Gold prices increased to the highest level in 2 months following weak economic data, reinforcing expectations of a US interest rate cut in June 2024.

Spot gold on the LBMA rose by 2.1% to $2,086.21 per ounce – the highest since late December 2023 and had a second consecutive weekly gain. Gold futures for April 2024 on the New York Mercantile Exchange rose by 2% to $2,095.7 per ounce.

Declining yields of US Treasury bonds and a weakening USD index after weak economic data made gold more attractive.

Copper prices rise, nickel prices decline

Copper prices rose after the USD weakened due to weakened manufacturing activity in China, the leading consumer, for the 5th consecutive month, increasing uncertainty about the demand prospects for the industrial metal.

Three-month copper futures on the London Metal Exchange rose by 0.3% to $8,521 per tonne.

Weakening US production data increased expectations of a US interest rate cut, putting pressure on the US currency, making the metal priced in USD cheaper when purchased using other currencies.

The official purchasing managers’ index (PMI) of China declined to 49.1 in February 2024 from 49.2 in January 2024 as factories closed during the month for holidays.

Nickel futures on the London Metal Exchange declined by 1.2% to $17,675 per tonne after reaching a 2-month high in the previous session.

Iron ore and steel prices continue to decline

Iron ore prices on the Dalian Commodity Exchange declined and had a second consecutive weekly decline as weak factory data raised doubts about the policy measures that the leading consumer – China – might introduce to support the economy.

Iron ore futures for May 2024 on the Dalian Commodity Exchange fell by 1.75% to 871.5 CNY (121.09 USD) per tonne. Overall for the week, iron ore prices decreased by 3.6%.

Furthermore, iron ore futures for April 2024 on the Singapore Exchange declined by 1.55% to 113.3 USD per tonne – the lowest since 24th October 2023. Overall for the week, iron ore prices declined by 4.7%.

Weakening manufacturing activity in China for the fifth consecutive month in February 2024 put pressure on policy-makers in considering further stimulus measures.

On the Shanghai Futures Exchange, rebar steel prices declined by 0.84%, hot rolled coil prices declined by 0.61%, cold rolled coil prices declined by 0.35%, and stainless steel prices declined by 1.1%.

Rubber prices in Japan increase

Rubber prices in Japan increased after 2 consecutive declines. It was supported by higher oil prices and a weakening JPY, but had the first weekly decline in 3 weeks.

Rubber futures for August 2024 on the Osaka Exchange rose by 3.8 JPY or 1.28% to 300.8 JPY (2 USD) per kg. Overall for the week, rubber prices declined by 1.22% after reaching a 7-year high in the previous week due to record high Nikkei index, limited supply in the leading producer – Thailand – and increased demand from tire manufacturers after the Lunar New Year.

Meanwhile, rubber futures for May 2024 on the Shanghai Futures Exchange rose by 15 CNY to 13,915 CNY (1,933.36 USD) per tonne. Rubber futures for March 2024 on the Singapore Exchange declined by 1.23% to 160.8 US cents per kg.

Coffee prices fluctuate

Robusta coffee futures for May 2024 on the London futures exchange rose by $48 or 1.6% to $3,143 per tonne. Overall for the week, coffee prices increased by 4%.

Robusta coffee exports from Vietnam in the first 2 months of 2024 increased by 16.2%.

In contrast, Arabica coffee futures for May 2024 on the ICE exchange declined by 0.6% to $1.833 per lb.

Raw sugar prices at nearly 2-month low

Raw sugar prices on the ICE exchange reached a nearly 2-month low due to concerns about prolonged oversupply.

Raw sugar futures for May 2024 on the ICE exchange declined by 0.6 US cents or 2.8% to 21.09 US cents per lb – the lowest since the beginning of January 2024 (20.96 US cents per lb). White sugar futures for May 2024 on the London exchange declined by 2% to 602.6 USD per tonne.

Soybean prices recover from 3-year low, corn and wheat prices decline

Soybean prices on the Chicago exchange increased due to buying activities to realize profits after hitting a 3-year low in the previous session. However, export reductions and abundant global supplies put pressure on prices.

Soybean futures for May 2024 on the Chicago exchange rose by 10 and a half US cents to $11.51 and a quarter per bushel. Corn futures for May 2024 declined by 18 and a half US cents to $5.57 and three-quarters per bushel. Corn futures for May 2024 declined by 4 and three-quarters US cents to $4.24 and three-quarters per bushel.

Palm oil prices decline

Palm oil prices in Malaysia declined due to profit-taking activities and cautious trading ahead of a major industry conference in Kuala Lumpur next week. However, palm oil prices had a weekly gain.

Palm oil futures for May 2024 on the Bursa Malaysia declined by 6 ringgit or 0.15% to 3,964 ringgit (835.67 USD) per tonne. Overall for the week, palm oil prices increased by 2.88%.

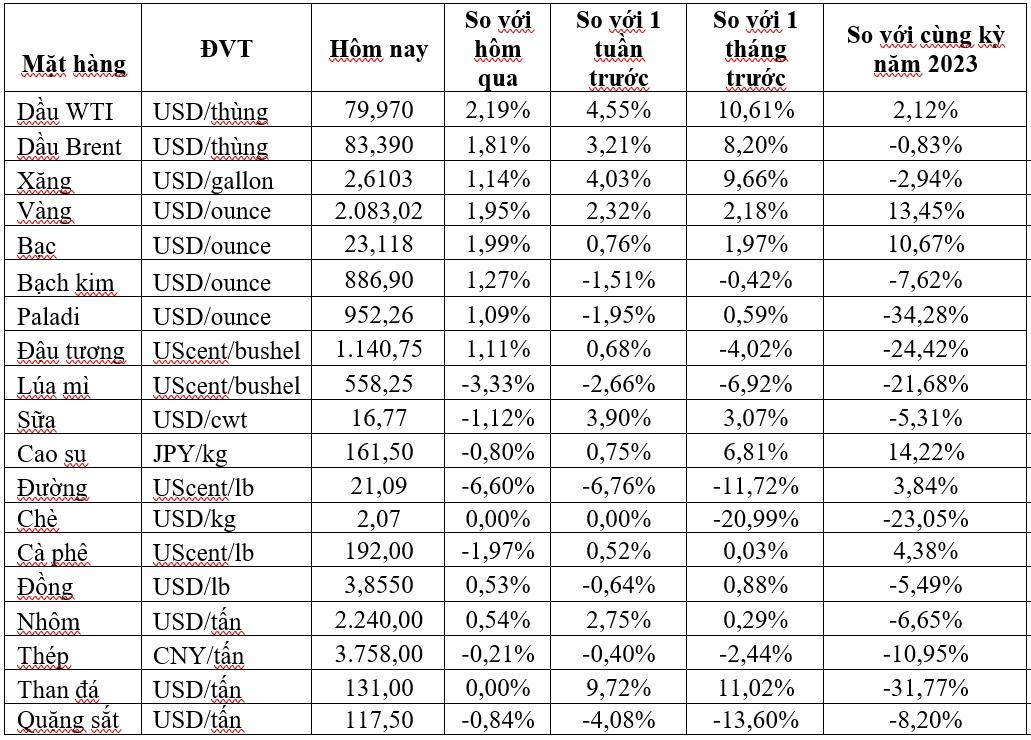

Prices of some key commodities in the morning of 2nd March