After a gap up opening, VN-Index gradually weakened and corrected below the reference level. The market closed on February 29 with a decrease of 1.82 points to 1,252 points, and liquidity continued to improve with a trading value of over 24.3 trillion VND on HOSE.

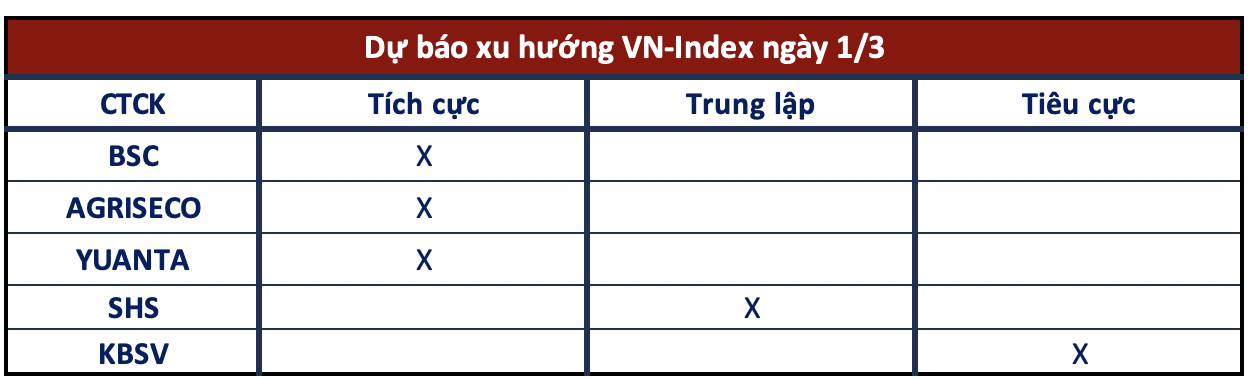

Analyses of the market in the coming sessions by securities companies have provided conflicting opinions. Many believe that VN-Index may reach new levels, but the possibility of prolonged fluctuations is not ruled out.

VN-Index goes up to 1,280-1,300 points

BSC Securities

Currently, VN-Index is pausing after three strong upward sessions. However, liquidity is returning and the rising trend of the index is heading back to the resistance zone of 1,280 – 1,300.

Agriseco Securities

With the upward trend in the medium and long term still dominant, VN-Index is likely to continue actively rising and aiming for the expected target zone around 1,275 – 1,280 points. Agriseco Research recommends that investors maintain a safe proportion of stocks/cash, with only a portion of short-term trading positions for stocks accumulating near the price floor with decreasing liquidity. Some notable sectors include securities, seafood, real estate, and construction.

Yuanta Securities

The market may continue to rise and VN-Index could approach the level of 1,268 points in the next session. However, there is increasing pressure for correction as bearish divergence signals are forming on technical indicators. If VN-Index cannot surpass the resistance level of 1,268 points in the next session, investors should temporarily stop buying new stocks. Nevertheless, the opportunity to buy in the short term continues to increase.

The market needs a strong sell-off

SHS Securities

In the short term, VN-Index is likely to continue to experience unusual fluctuations as it trades near the strong resistance zone of around 1,250 points. The market needs strong sell-offs and accumulation before it can reach higher price levels. In the medium term, the market is forming a wide accumulation channel within the range of 1,150 – 1,250 points. Currently, VnIndex is approaching the upper resistance of this accumulation channel.

KBSV Securities