In 2023, the fertilizer industry experienced an outstanding 39% increase, surpassing the 12% growth of the VN-Index. It is worth noting that this is the fourth consecutive year that the fertilizer industry has recorded a superior growth compared to the VN-Index.

Small-cap stocks within the industry had the strongest price performance in 2023, following a negative trend in 2022. Some notable examples include LAS with a 95% increase, BFC with a 68% increase, and DCM with a 34% increase. In contrast, DPM experienced a 4% price decrease.

Companies producing NPK fertilizers, such as LAS and BFC, had better price performance compared to other companies in the industry in 2023. This can be attributed to the deeper price decrease of their stocks in 2022 and their relatively stable profits in 2023. These companies also benefited from better inventory control compared to urea-producing companies.

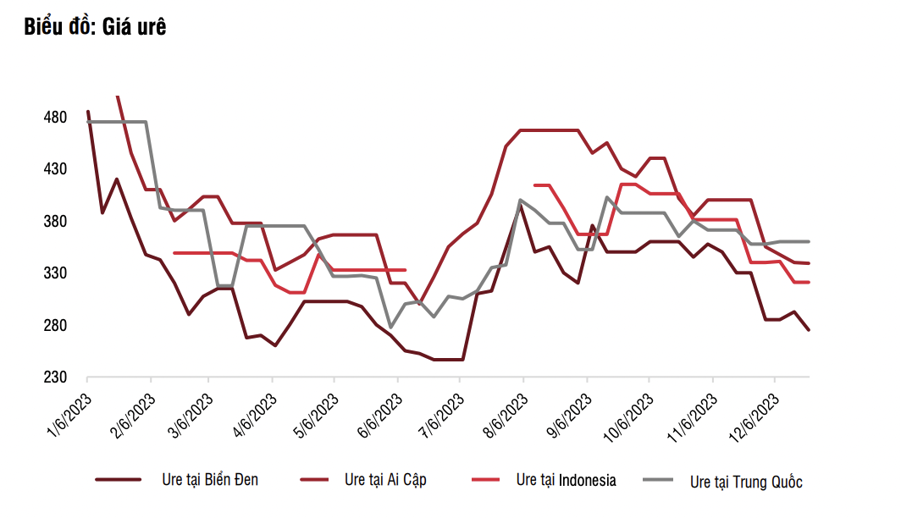

In the 2024 outlook report, SSI Research expects the average urea price in 2024 to increase at a low double-digit rate, influenced by various factors.

Firstly, in terms of urea demand, according to USDA and FAO, most cereal crop areas saw a reduction in 2023 due to unfavorable weather conditions, leading to decreased fertilizer demand. Lower crop yields raised concerns about food security in densely populated countries such as China and India, which together account for approximately 18% of the global population according to the World Bank.

Therefore, it is expected that the planted areas of major crops will increase in 2024 to compensate for the low production in 2023. According to the Food and Agriculture Organization (FAO), the production of major agricultural commodities is expected to increase in the 2023-2024 season, including maize (up 4.5%), soybean (up 7.3%), and rice (up 1%). The prices of agricultural commodities (excluding rice and sugar, which increased significantly in 2023) are also recovering, driving increased agricultural planting in the future.

Meanwhile, natural gas and coal prices are expected to remain stable in 2024, fluctuating between a 5% decrease and a flat performance. The prices of these commodities could increase if conflicts escalate in the Middle East.

The profitability outlook for the commercial fertilizer segment is expected to improve in 2024. Both DPM and DCM reported losses in the commercial fertilizer segment in the first half of 2023 due to a sharp decrease in fertilizer prices. With fertilizer prices hitting bottom in the second half of 2023, it is expected that the commercial fertilizer operations will turn profitable from the second half of 2024.

For DCM, depreciation expenses are expected to significantly decrease in 2024 as the urea plant’s depreciation will be fully absorbed by Q4/2023. The annual depreciation cost of the plant is 1.2 trillion VND, so it is forecasted that DCM’s plant depreciation cost will decrease significantly (900 billion VND) in 2024.

For DGC, it is expected that the 2024 profit will recover along with the prices of related phosphorus-based raw materials used in fertilizer production, semiconductors, and other industrial products. Fertilizer demand will recover due to increased agricultural planting (as mentioned above), while semiconductor demand may rebound due to the demand for electronic devices, electric vehicles, IoT, and AI.

The estimated profit of fertilizer companies in 2024 is expected to increase by 40% compared to the same period. The valuation of fertilizer companies is higher than the P/E ratio of the 2021-2022 period of 6x, but still lower than the average P/E ratio of the 2015-2020 period of 12x.

Factors supporting stock prices include prolonged conflicts in the Middle East, which may disrupt natural gas sources and urea supply in the region. This will create opportunities for other urea-exporting countries, including Vietnam.

The government may consider changing the value-added tax status for fertilizer manufacturing from “non-taxable” to “5% value-added tax”. This issue is expected to be discussed in the National Assembly session in May 2024 and could be approved in the next National Assembly session (October 2024) at the earliest. If the draft is passed, the expected change will take effect from July 2025 in the best-case scenario.

As a result, DPM and DCM will greatly benefit as each company could be refunded 10% of the value-added tax for natural gas input costs, which currently account for approximately 70% of total production costs.