On February 29, the Ministry of Finance held a dialogue on tax and customs policies and administrative procedures with Korean businesses for the years 2023-2024.

Various issues regarding taxes and overtime were discussed during the dialogue. Ambassador Choi YoungSam of South Korea in Vietnam raised concerns about double taxation on supplementary income from international transportation activities and delays in value-added tax refunds.

Representative of the Korea Chamber of Commerce and Industry (KoCham) also suggested that overtime wages exceeding the limit should not be included in the deductible costs for corporate income tax calculation. According to the suggestion, any overtime hours exceeding 200 hours per person per year should not be deducted when calculating corporate income tax.

“The regulation stating that the limit for overtime hours is 16 hours per month per person is causing difficulties for businesses. When businesses apply for overtime work to be included in the calculations for corporate income tax, local authorities do not approve. Meanwhile, many businesses have to let their employees work overtime to meet orders due to a shortage of workers. Therefore, we would like to ask the tax authorities whether overtime hours exceeding the limit can be included as deductible costs for corporate income tax,” the representative from KoCham asked.

In response to the concerns raised by businesses, Deputy General Director of the Tax Department Mai Son explained that the law stipulates that overtime hours should not exceed 200 hours and special jobs should not exceed 300 hours per person per year. Therefore, businesses need to find alternative solutions to balance legal requirements and ensure the health of their employees.

Dialogue conference between the Ministry of Finance and Korean businesses on tax and customs policies.

Cao Anh Tuan, Deputy Minister of Finance, confirmed that the Ministry has received and processed hundreds of documents from Korean businesses investing nationwide, relating to production activities in Vietnam. Examples include policies on value-added tax refunds, procedural obstacles, tax invoices in export processing zones, preferential tax exemptions or reductions for corporate income tax, and import-export taxes.

“The Ministry of Finance has promptly studied, proposed, and issued solutions in accordance with its authority to support the people and businesses in general, and Korean businesses in particular. The policies and solutions have great supportive value and unprecedented innovations,” said Tuan.

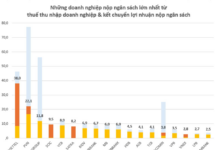

Korean businesses have contributed nearly 175 trillion VND in tax revenue over the past five years, despite the difficulties caused by the COVID-19 pandemic and the unfavorable global economic situation, according to Cao Anh Tuan. There are nearly 9,900 Korean investment projects in Vietnam, making Korea the leading country out of 144 countries and territories investing in Vietnam.

“Despite the difficulties caused by the COVID-19 pandemic and the unfavorable global economic situation, Korean businesses have contributed nearly 175 trillion VND to the state budget,” said Deputy Minister Cao Anh Tuan.

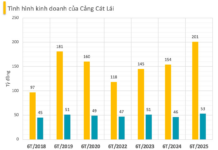

Samsung Group is one of the major Korean investors in Vietnam. During a meeting with Choi Joo Ho, General Director of Samsung Vietnam on February 28, Minister of Finance Ho Duc Phoc highly appreciated Samsung’s production and business results in Vietnam, particularly in terms of export potential and growth.

To date, Samsung’s total investment in Vietnam has reached over 22 billion USD. In 2024, Samsung expects to achieve a growth rate of 10%.