The consensus of strong pillars helps VN-Index officially surpass the resistance of 1,250 points – a strong barrier that has caused the index to retreat several times. VN-Index closed the session on February 28 with a 17-point increase to reach 1,254 – the highest level of the index in nearly 1.5 years, since September 2022. Looking further, VN-Index has also recorded the fourth consecutive month of gains with an increase of nearly 250 points since the October 2023 bottom.

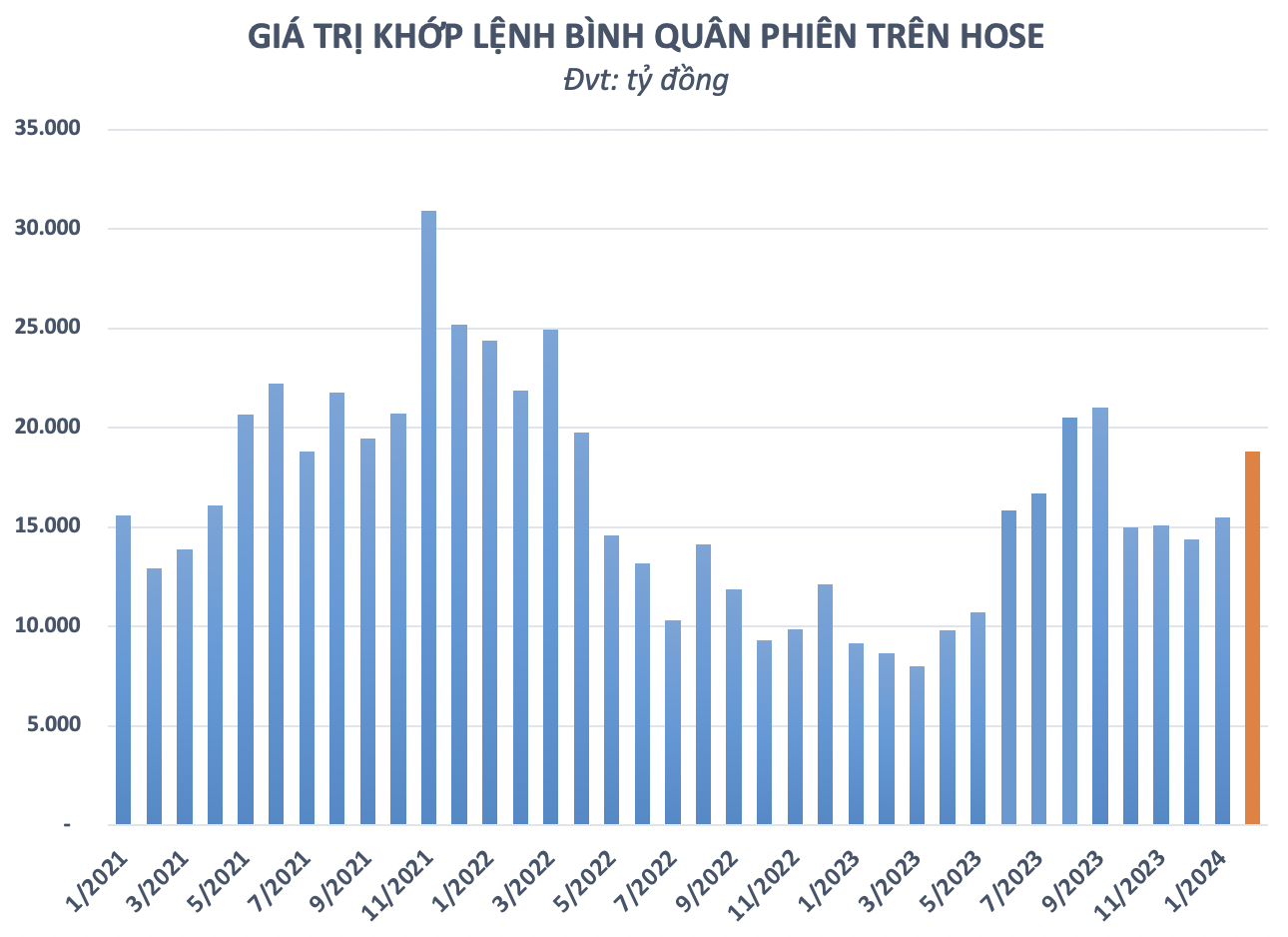

Notably, market liquidity has also improved significantly with the average trading value on HOSE exchange staying above 20,000 billion VND per session for the past 10 sessions. In total, the trading volume in February increased approximately 21% compared to the previous month and reached the highest level in nearly 5 months.

With the market breaking out of the 1,250-point resistance level, many positive outlooks suggest that VN-Index has created a solid foundation to reach new highs. However, there are also cautious views that VN-Index may repeat the scenario in September 2023 when it peaked at the 1,250-point level and then plunged sharply.

Multiple reasons for sustainable growth of VN-Index

From the perspective of Mr. Nguyen The Minh – Director of Securities Analysis at Yuanta Vietnam, the macroeconomic picture of 2024 has many bright spots that will support the sustainable growth of the stock market instead of rapid ups and downs like 2023. The recent acceleration of the stock market is believed by Yuanta experts to be driven by several positive factors.

Firstly, the upward trend of VN-Index is still positively influenced by international factors. International stock indices have been setting new highs, such as Nasdaq, S&P500, Dowjones, and particularly the Shanghai index, which has been increasing for many sessions despite concerns about the real estate debt crisis.

Secondly, the expectation of loose monetary policy and the consensus of the global and Vietnamese central banks have a positive impact on investor sentiment. On the other hand, domestic interest rates in 2024 have fallen to a level lower than the bottom of 2021, stimulating money to return to high-risk channels like stocks. Meanwhile, the risk of recession and crisis has decreased significantly compared to 2023, further enhancing investor confidence in the stock market.

Thirdly, the determination of the government to upgrade the market or put the KRX system into operation is also a bright spot that helps money enthusiastically return to the market.

The market has no reason to decline sharply

In fact, the positive momentum of the banking group has spread to other stock groups such as securities, steel, real estate, and food,… In general, large-cap stocks have taken turns leading, helping VN-Index soar strongly in terms of points.

“Many people are worried that the market will face difficulties at the 1,250-point level, but the influx of money into stocks is too strong and the market itself has no many reasons to decline sharply. The support level of 1,200-1,210 points is quite strong for upcoming adjustments. Because the market valuation after the recovery phase is still lower than the average since 2015 and the margin risk is not high when there is still a lot of room for lending as securities companies have increased capital significantly recently,” said Mr. Nguyen The Minh.

With the spread of capital in the salvation stock group, VN-Index will still have a good bounce up to the 1,300-point level, more positively to 1,414 points as the scenario put forward at the beginning of the year. Of course, there will be inevitable fluctuations during the upward journey, but experts believe that this is an opportunity to increase the proportion of stocks for short, medium, and long-term views.

Regarding the investment strategy at this time, Yuanta experts suggest that investors should accept higher risks. Opportunities still exist in some stocks that have just started to rise, such as steel, some real estate stocks, and securities.