In 2023, the global economy faced many fluctuations accompanied by unstable risks, which reduced the prospects of economic growth. However, domestic inflation is still controlled and tends to decrease. Overall for the year 2023, the core inflation and general inflation reached 3.25% and 4.16% respectively compared to the same period, lower than the government’s target of 4.5%.

Specifically, in the fourth quarter of 2023, GDP growth showed more progress compared to previous quarters, with an estimated increase of 6.72% compared to the same period. Overall for the year 2023, estimated GDP growth reached 5.05%, completing the National Assembly’s GDP target of over 5%.

In the latest report, Mirae Asset Securities evaluates the overall business performance in the fourth quarter, showing improvement and differentiation among industry sectors. As of January 31, 2024, the total net profit in the fourth quarter of 2023 grew by over 49% compared to the same period and increased by 16% compared to the previous quarter.

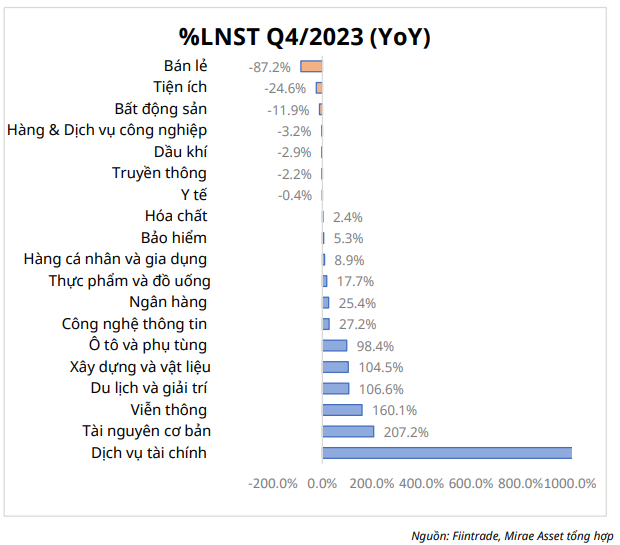

Among them, the sectors recording growth include Financial Services (+8,552% compared to the same period), Basic Resources (+207%), Telecommunications (+160%), Travel and Entertainment (+107%), Construction and Materials (+105%), Automotive and Parts (+98%), Information Technology (+27%), Banking (+25), Food and Beverage (+18%), Personal Care and Appliances (9%), Insurance (+5%), Chemicals (+2%).

On the other hand, the sectors recording declined profits include Health (-0.4%), Media (-2%), Oil and Gas (-4%), Industrial Goods and Services (-3%), Real Estate (-12%), Utilities (-25%), Retail (-87%).

Regarding the stock market, Mirae Asset Securities notes a slight recovery in the Vietnamese stock market in 2023, with the VN-Index increasing by 12.2% compared to the end of 2022. In 2023, the average trading value reached 15,120 billion VND, decreased by 11% compared to the same period. In December, the average trading volume and value reached over 694.2 million shares and 15,959 billion VND respectively, corresponding to an 8% decrease in average volume and a 4% decrease in average value compared to November 2023.

Based on the business performance in the fourth quarter of 2023, Mirae Asset Securities screened stocks with stable business results, maintaining good growth and having their own stories. The selection and evaluation are based on comparing the gross profit margin between the last two quarters and the last year to form a list of potential stocks with revenue and profit growth. At the same time, the stocks must meet the criteria for trading value, meaning the stocks need to have liquidity.

Among them, some stable sectors such as food, chemicals, insurance are considered relatively safe choices. In addition, the sectors that are gradually recovering with their own stories such as real estate, securities are also suitable choices when they are at attractive price levels.

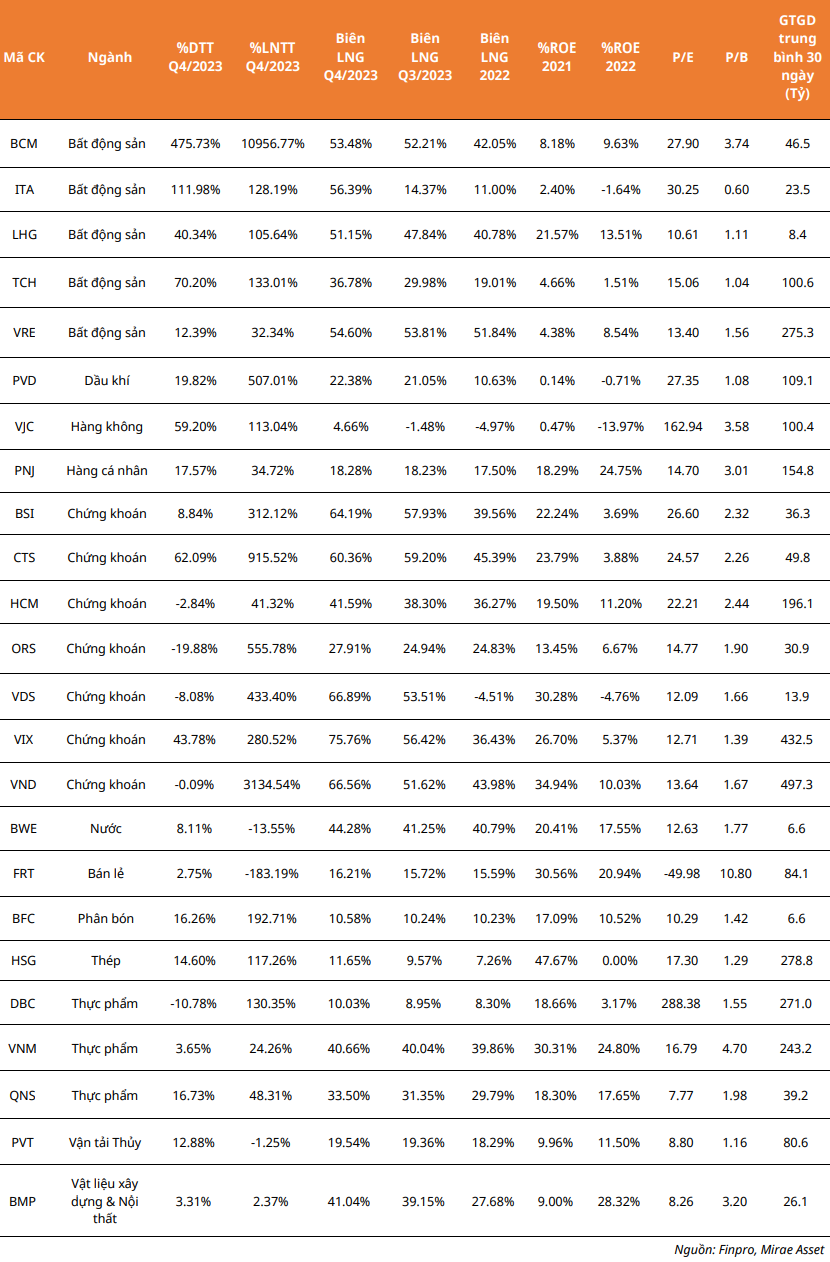

Mirae Asset Securities recommends 24 stocks in the “Super” group with the basic condition that the Q4/2023 gross profit margin is higher than the Q3/2023 gross profit margin and also higher than the 2022 gross profit margin.

These include companies in the real estate group (BCM, ITA, LHG, TCH, VRE); securities (BSI, CTS, VDS, HCM, VND, VIX…); or food (DBC, VNM); retail (FRT)…

Super Group: Basic condition: Q4/2023 gross profit margin > Q3/2023 gross profit margin > 2022 gross profit margin

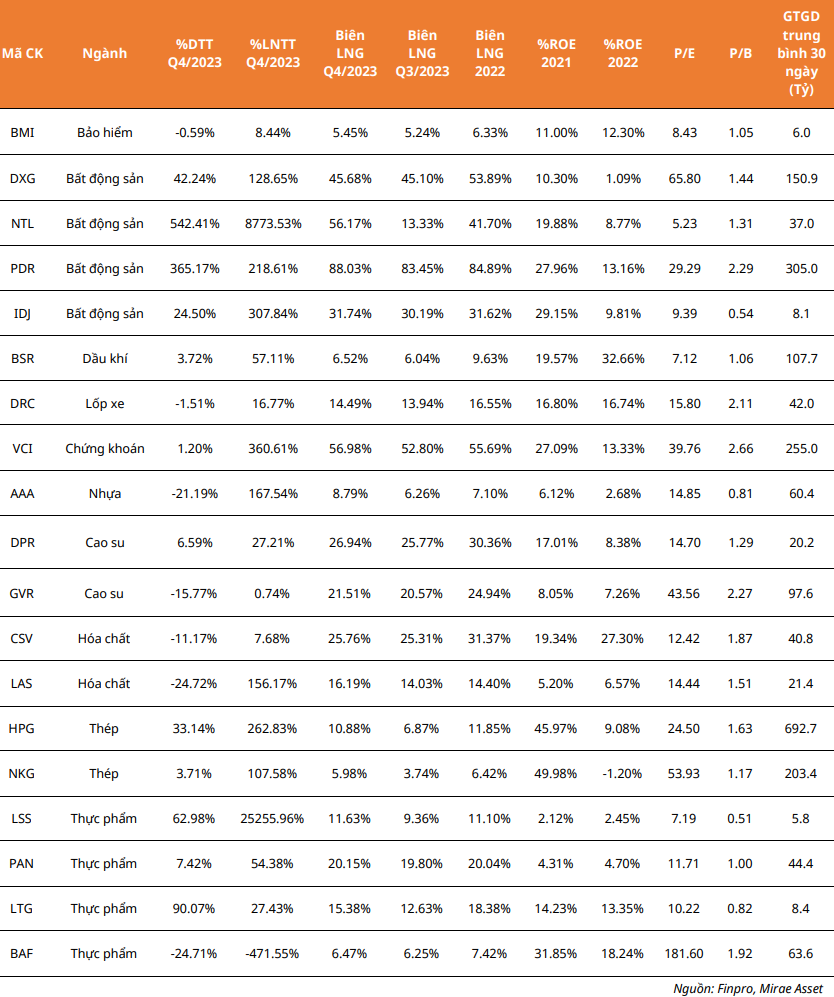

In addition, the analysis team also provides a list of 19 “Good” stocks with the basic condition that the Q4/2023 gross profit margin is higher than the Q3/2023 gross profit margin, including stocks in the real estate group (DXG, PDR, NTL, IDJ), oil and gas (BSR), insurance (BMI), steel (HPG, NKG), food (PAN, LTG, BAF, LSS)…

Good Group: Basic condition: Q4/2023 gross profit margin > Q3/2023 gross profit margin