|

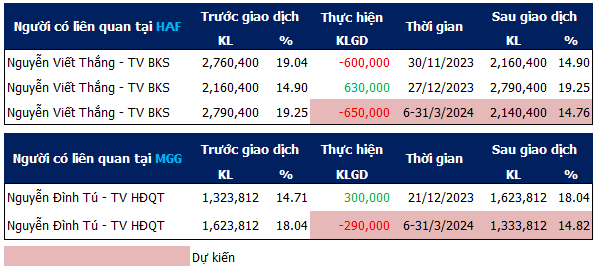

Statistics of stock transactions for HAF and MGG of Wall Street Stock

Source: VietstockFinance

|

In particular, WSS wants to divest 650 thousand shares of HAF during the aforementioned period. If the transaction is successful, WSS‘s ownership ratio in HAF will decrease from 19.25% to 14.76%, equivalent to 2.14 million shares. Currently, Mr. Nguyen Viet Thang – Deputy General Director of WSS is a Member of the Board of Directors of HAF.

At the same time, WSS also wants to sell 290 thousand shares of MGG to reduce its ownership ratio from 18.04% to 14.82% (1.33 million shares). Mr. Nguyen Dinh Tu – Chairman of the Board of Directors of WSS is a Member of the Board of Directors of MGG.

In the morning session on March 1st, the HAF stock was trading around 24,500 VND/share, while the MGG stock was trading around 33,000 VND/share. Based on these price levels, it is estimated that Wall Street Stock could earn more than 25 billion VND from these two transactions.

In 2023, Wall Street Stock generated 95 billion VND in revenue, nearly tripled from the previous year. Among them, the main source of revenue comes from the gain on financial assets recognized through profit or loss (FVTPL) of nearly 82 billion VND, the held-to-maturity (HTM) investments of nearly 6 billion VND, and advisory services of over 2 billion VND.

The net profit in 2023 reached over 1 billion VND, compared to a loss of nearly 19 billion VND in the previous year.

| Business results of Wall Street Stock |

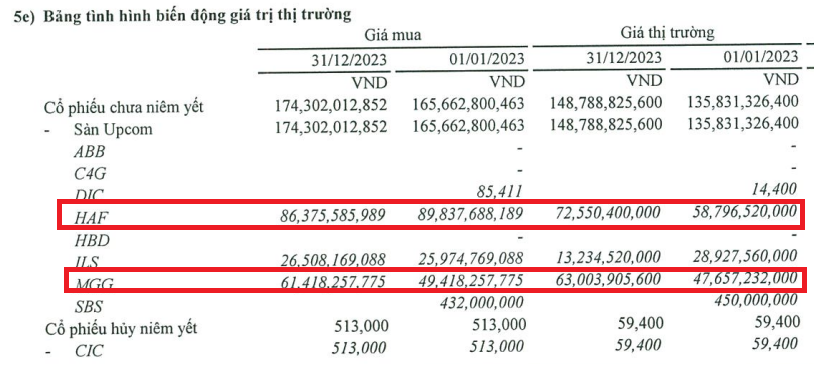

At the end of 2023, the investment in HAF shares was valued at over 72 billion VND at market price, while the original price (purchase price) was 86 billion VND. This implies that Wall Street Stock is currently facing a temporary loss of 14 billion VND. As for the investment in MGG shares, it is valued at 63 billion VND at market price, with an original price of over 61 billion VND, resulting in a temporary profit of 2 billion VND.

Source: Company’s Financial Statements

|

On March 21st, WSS will finalize the list of shareholders attending the annual General Meeting of Shareholders 2024. The ex-dividend date is March 20th.