On March 1, Pomina Steel Corporation (stock code: POM) held an extraordinary general meeting to discuss the business restructuring plan, which included the establishment of a new legal entity with investors for a steel production project using blast furnace technology.

Pomina representatives said that cooperation with investors is still under negotiation and no final results have been reached yet. Due to security reasons, the company cannot disclose the identity of the investors at this time. The announcement is expected to be made during the annual general meeting at the end of April.

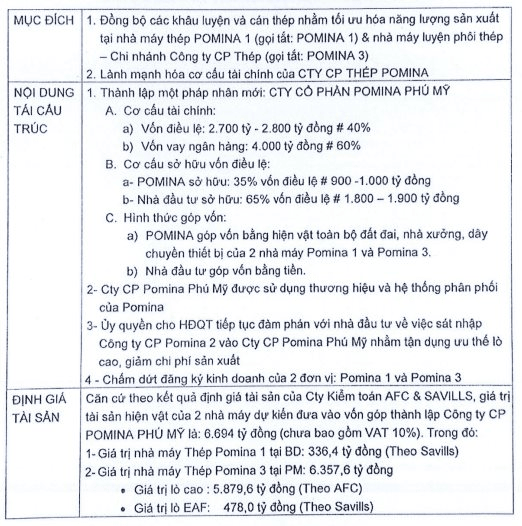

At the meeting, the most important proposal related to business restructuring was approved. Specifically, the company will establish a new legal entity called Pomina Phu My Joint Stock Company with a charter capital of 2,700 – 2,800 billion VND (equivalent to 40% of the investment capital for the project) and a bank loan of 4,000 billion VND (60% of the investment capital for the project).

In the charter capital of Pomina Phu My, Pomina Corporation will own 35% (equivalent to 900 – 1,000 billion VND) by contributing in kind all the land, factories, production lines, and equipment of Pomina plants 1 and 3. The remaining portion will be contributed by the investors in cash with a value of about 1,800 – 1,900 billion VND, accounting for 65%.

After establishment, Pomina Phu My will have the right to use the brand and distribution system of Pomina. In addition, the Board of Directors will continue to negotiate with investors regarding the merger of Pomina 2 company into Pomina Phu My in order to take advantage of the blast furnace technology and reduce production costs.

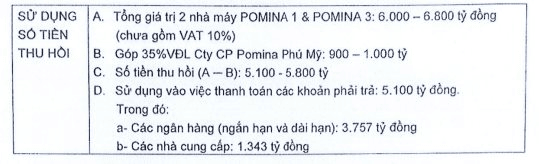

Based on the asset valuation results of AFC & Savills Audit Company, the fair value of the tangible assets of Pomina plants 1 and 3 is nearly 6,700 billion VND (excluding 10% VAT).

Therefore, after deducting the charter capital that Pomina contributes to the new legal entity (900 – 1,000 billion VND), the company will be able to recover about 5,100 – 5,800 billion VND. This amount is expected to be used to pay off bank loans (3,757 billion VND) and supplier debts (1,343 billion VND).

At the end of 2023, Pomina recorded a debt of over 8,800 billion VND, including over 1,615 billion VND payable to suppliers and 6,310 billion VND in financial loans. Of which, the company’s bank debt amounts to 5,765 billion VND.

Notably, Pomina has a loan of 300 billion VND from Dai Quang Minh Company (a member of Thaco Group) with an initial repayment deadline in October 2023.

As of December 31, 2023, Pomina has not been able to repay this debt and classified it as current liabilities. The collateral for this loan is over 66 million Pomina shares and all the rights arising from these shares, such as dividends, purchase rights…

Regarding this loan, at today’s extraordinary general meeting, Mr. Do Duy Thai, Chairman of Pomina’s Board of Directors, said: “This is a loan that arose at the beginning of 2023, it has been a long time and is not related to the current restructuring process “.

The company must follow procedures, be approved by the general meeting, and have the framework price before continuing negotiations with investors, and it is currently unable to disclose the investors.

The essence of Pomina’s restructuring plan is to transfer a significant amount of the “enormous” debt to the new legal entity along with the main two plants. The new partners, besides contributing nearly 2,000 billion VND in cash, will be financially responsible for Pomina Phu My for the new debt, estimated at 4,000 billion VND.