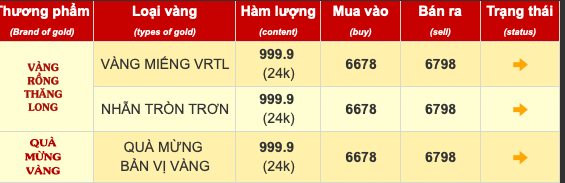

Today (3/3), the price of plain round rings reached nearly 68 million VND/tael. This is the highest level ever. Specifically, Bao Tin Minh Chau listed plain round gold rings at 66.78 – 67.98 million VND/tael for buying and selling. The buying and selling difference is at 1.2 million VND/tael.

(Screenshot).

Meanwhile, the price of 9999 plain round gold rings listed by Saigon Jewelry and PNJ Jewelry is lower, at 65.25 – 66.4 million VND/tael and 65.25 – 66.4 million VND/tael (buying and selling).

If compared to the beginning of 2024, gold ring buyers can earn a profit of up to 3.4 million VND/tael. Compared to about a year ago, gold ring buyers earned an estimated 19% profit, equivalent to about 10 million VND. This profit is higher than the current interest rate on savings.

On the other hand, after reaching nearly 81 million VND/tael, SJC gold prices declined. Specifically, Bao tin Minh Chau is currently listing SJC gold at 77.85 – 80.1 million VND/tael. Meanwhile, the listed price of SJC gold at Doji Group is 65 – 80.25 million VND/tael. In the Ho Chi Minh City market, the Mi Hong gold system lists SJC gold at 78-79 million VND/tael.

Regarding the domestic gold prices forecast, experts believe that with the scarcity of raw material supply, the gold price may continue to rise. On the other hand, people’s psychology of investing in gold as a form of asset accumulation when other investment channels have not had attractive profit margins.

From another perspective, the gold price may be adjusted depending on the operating scenario of state management agencies. Accordingly, in the case where the State Bank has not intervened in the gold market, the gold price may increase based on expectations of the US Federal Reserve cutting interest rates and the weak USD.

On the contrary, the gold price will tend to decrease when the gold supply increases as well as the policy of ending the SJC gold monopoly.

Mr. Ngo Thanh Huan, CEO of FIDT Investment and Asset Management Joint Stock Company, recommends that when the price of gold increases sharply by 5-10%, people should not pour money into buying gold. Instead, investors should buy gold during a sharp decline of 5-10%. Because if you chase after the increasing gold price, you may fall into the peak chasing situation.

According to Mr. Huan’s prediction, the highest increase in gold price in 2024 is only at the threshold of 85 million VND/tael. Mr. Huan also recommends that in the investment portfolio of 2024, gold should be maintained at around 10%.