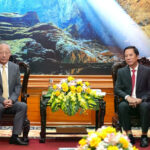

Yuya Hasegawa, a cryptocurrency market analyst at Japan’s Bitcoin exchange Bitbank, has made a statement about the price of BTC.

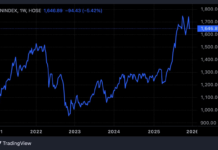

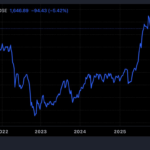

Bitcoin continues its hot streak, ending February with a rapid price surge. However, according to analysts, investors should be cautious in March.

Yuya Hasegawa, a cryptocurrency market analyst at Japan’s Bitcoin exchange Bitbank, warns that recent price volatility seems too fast and too large to sustain next month.

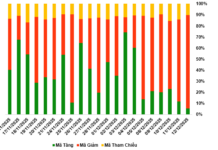

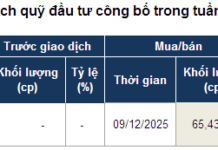

The analyst said, “Money flowing into bitcoin ETF funds seems to be accelerating and overwhelming technical signals.”

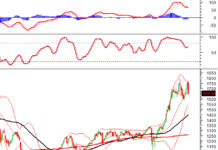

Analysts believe that the combination of strong price volatility and increasing trading volume could signal a trend reversal.

He advises investors to be patient and cautious in the coming weeks. Hasegawa adds, “In the short term, prices may rise even higher, but it may soon become difficult to continue as the market starts to develop a cautious sentiment.”

Data from CryptoQuant shows unrealized profit rates reaching sky-high levels following last week’s price surge.

According to CryptoQuant research director Julio Moreno, the metric currently stands at 32%, signaling a price correction when it reaches around 40%.

CryptoQuant also reveals an increase in long positions opening costs in the futures market during the recent recovery, which analysts say historically indicates an impending BTC price correction.

David Dương, Head of Institutional Research at Coinbase, notes that March historically poses risks in both traditional and cryptocurrency markets.

For example, some people receive dividends during this time to pay taxes.

Despite these warnings, analysts suggest that Bitcoin’s long-term interest rates indicate that BTC can still go up.

Dương tells CNBC, “March will mean stocks going sideways in a narrow range before we see the next uptrend.”

Hasegawa notes that the Federal Reserve’s Term Funding program expires on March 11th and current concerns surrounding the New York Community Bancorp may cause price volatility in March.

“There is still the risk of contagion to small banks in the region. Another banking crisis could see the Fed deploying an entirely new liquidity pumping program, but if the crisis develops large enough to destabilize the stock market, it could also affect the cryptocurrency market,” he said.

Last year, the regional banking crisis served as a major catalyst for Bitcoin, pushing BTC up nearly 30% in March 2023.

While Bitcoin’s supply tightens after the halving event on April 22nd, the structure of Bitcoin remains strong this year, with demand fueled by the expected launch of new ETF funds.

Despite some resistance on the price chart in March, Dương says BTC could reach new all-time highs sooner than expected as we enter 2024.