Rendering of a section of the Friendship – Chi Lang expressway. Source: baodauthau.vn

|

In this project, Lizen Joint Stock Company (HOSE: LCG) proposes an investment ratio of no more than 25%.

A month ago, the Lang Son provincial People’s Committee approved an adjustment to the project, changing it to a Build-Operate-Transfer (BOT) model. Specifically, the project’s phased implementation period has been adjusted from 2023 to 2026 (previously 2023 to 2025) with a new total investment of approximately VND 11 trillion, reducing VND 150 billion compared to the previous approval.

The project requires investors and businesses to arrange more than VND 5.5 trillion, accounting for 50.13% of the total investment, including approximately VND 1.1 trillion in equity. The financing and other legally mobilized capital sources amount to around VND 4.4 trillion.

The remaining portion involves state capital participation of about VND 5.5 trillion, accounting for 49.87%. This includes VND 3.5 trillion from the central budget and VND 2 trillion from the provincial budget. The payback period for the Huu Nghi – Chi Lang border expressway project has been adjusted to 25 years and 8 months instead of the previous 29 years and 6 months.

Under this resolution, the Board of Directors also approved other important matters. Specifically, regarding capital investment, LCG will make additional investments in machinery and equipment with an approved total investment of no more than VND 211 billion, authorizing the investment committee to approve based on the company’s production and business situation.

In addition, LCG will repurchase 45% of the charter capital of LCE Gia Lai Renewable Energy Investment Joint Stock Company for a total value of VND 75 billion, and continue to seek partners to transfer 100% of the capital of this company.

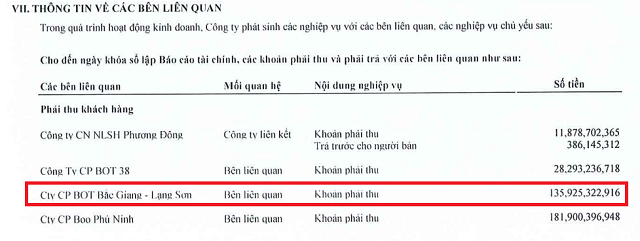

In terms of addressing debts, the VND 122 billion that BOT Bac Giang – Lang Son Joint Stock Company still owes to LCG has been approved to be converted into capital contributions. This is a company in which LCG holds a 19.5% stake (as of June 30, 2023) with an initial investment of over VND 378 billion.

Amount receivable from BOT Bac Giang – Lang Son until the end of 2023. Source: LCG

|

Regarding the debts of Vina2 Investment and Construction Joint Stock Company, the Board of Directors authorized the Board of Directors as the sole authority to decide on the acceptance of the transfer of 23 apartments in the high-rise complex, condominiums, and commercial services of the De Dong resettlement area in Quy Nhon City, Binh Dinh Province, of which Vina2 Investment and Construction Joint Stock Company is the project’s investor.

Vina2 Panorama De Dong project topping-out earlier this year. Source: Vina2

|

An amount receivable of VND 33 billion from Vina2 Investment and Construction Joint Stock Company appeared on LCG’s financial statements since 2021. At that time, LCG provided unsecured loans at an interest rate of 8% per annum. By the end of 2022, the interest rate was adjusted to 5% per annum, with maturity in accordance with the plan on June 30, 2023.

Amount receivable from Vina2 Investment and Construction Joint Stock Company. Source: LCG

|

Regarding ongoing real estate projects, LCG agreed to adjust the capital source to invest in the construction and completion of the technical infrastructure system of the Long Tan residential area in Dong Nai Province from VND 150 billion to VND 250 billion.

As for the Ly Thuong Kiet residential area project in Lam Dong Province, the Leadership Board approved an adjustment to the implementation schedule, adding 12 months from the date of the decision of the Lam Dong Provincial People’s Committee regarding the extension of the land use time.

In this session, the Board of Directors also approved the implementation of the issuance of over 3.4 million LCG shares under the Employee Stock Ownership Plan (ESOP), accounting for 1.8% of the outstanding shares. LCG currently holds over 2 million treasury shares.

Accordingly, employees and long-term laborers who have made significant contributions to the company’s production and business activities will have the right to purchase shares at a price of VND 10,000, and be restricted from transferring within one year from the end of the issuance period.

LCG expects to earn over VND 34 billion, and the execution is likely to take place in the first quarter of 2024 – second quarter of 2024. The funds will be added to the working capital to meet the operational and business investment needs of the company.