Image of some products of Cholimex Food

|

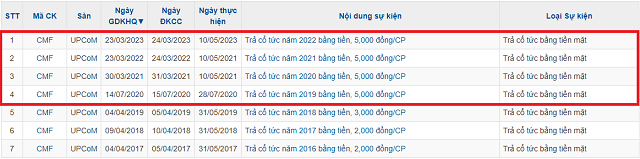

With 8.1 million outstanding shares, CMF needs 40.5 billion VND for dividend payment, expected to be conducted on May 10, 2024. Therefore, with this latest dividend payment, CMF shareholders will enjoy a cash dividend ratio of up to 50% for the fifth consecutive year.

However, the ownership structure of CMF is quite concentrated. Currently, CMF has 3 major shareholders including Cholon Import Export and Investment Corporation (CHOLIMEX, UPCoM: CLX) holding 40.72% of capital, Masan Food Co., Ltd. holding 32.83%, and Nichirei Foods Inc (based in Japan) holding 19%. Accordingly, these 3 organizations could receive dividends of 16.5 billion VND, 13.3 billion VND, and 7.7 billion VND from CMF respectively.

|

CMF has made four consecutive years of cash dividends with a ratio of 50%

Source: VietstockFinance

|

Regarding the 2024 Annual General Meeting of Shareholders, CMF has not announced the specific time and location of the event. The meeting is expected to approve various important contents related to the 2023 business results and the 2024 plan.

CMF’s predecessor was the Export Processing Enterprise of District 5, established on June 2, 1983. On July 19, 2006, the company officially operated under the new name Cholimex Food Joint Stock Company with a charter capital of 30 billion VND. After several changes, by June 2011, the company’s charter capital increased to 81 billion VND. On November 30, 2016, the company first listed on UPCoM with a reference price of 90,000 VND/share.

CMF’s main business activities include manufacturing, processing, processing, and trading of food products, seafood for the domestic and export markets. Typical products include chili sauce, tomato sauce, fish sauce, soy sauce, spices, spring rolls, …

In terms of business performance, in 2022, CMF recorded net revenue of 3,219 billion VND, an increase of 28% compared to the previous year. After deducting the cost of goods sold and expenses, CMF’s net profit was 222 billion VND, an increase of 19%, and exceeded the annual plan by 20%. Overall, in recent years, CMF has continuously demonstrated improved revenue and profit.

| CMF’s business performance from 2018 to 2022 |

In the stock market, as of the session on March 1, 2024, CMF’s stock price reached 209,900 VND/share, an increase of over 19% in the past year, but the average liquidity was only about 250 shares/session. In 2024 alone, the stock price has increased by more than 3%.

| CMF’s stock performance in the past 1 year |