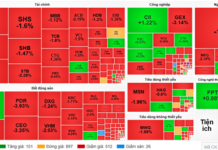

Four out of five large-cap stocks in the market this morning belong to the real estate group. The VNREAL index on the HoSE floor exploded 1.91% while the VN-Index only increased 0.33%. 6 out of 10 stocks that pushed this index are also real estate ones. Foreign investors are making large net purchases in KBC, DIG, NLG, KDH…

The cash flow is moving strongly in the first trading session of the week, although it cannot clearly support the VN-Index. The reason is that the group of stocks with the largest market capitalization plays a decisive role and not every real estate stock is large enough. VIC increased 0.77%, VHM increased 0.91% which is weak in this group.

The VNREAL index on the HoSE floor representing the top 40 real estate stocks closed the morning session with a 1.91% increase with 32 stocks rising and 5 stocks falling. The turnover of this group reached 2,689 billion VND, accounting for about 20% of the total trading value on HoSE.

The cash flow is clearly pouring into real estate stocks, although the attractiveness of each stock varies. The 4 most active stocks in the market are DIG with 957.4 billion VND, price increased by 3.63%; KBC with 646.1 billion VND, price increased by 5.45%; NVL with 442.7 billion VND, price increased by 1.73% and NLG with 432.8 billion VND, price increased by 6.89%.

The group of stocks with an increase of more than 2% includes dozens of other stocks such as ITC, HD2, HDC, KDH, TCH, SCR, QCG, DXS… Many stocks in this group also have hundreds of billions of VND in liquidity.

There is no specific information to support the real estate group, this is a price effect due to the circulation of cash. The banking group has decreased its trading volume, accounting for only about 16.5% of the total trading volume on HoSE, much lower than real estate and the lowest market share in 8 weeks. MBB is the only stock in the banking group to enter the Top 10 liquidity market (rank 8); STB ranked 13th and CTG ranked 15th. This group has only 9 out of 27 stocks that increased in price, only CTG significantly increased by 1.4%. The red side includes VCB, BID, ACB, TPB… the pillars.

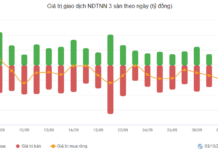

The ability to maintain the attractiveness of the cash flow is helping the daily liquidity to be very high. HoSE successfully matched 13,682 billion VND this morning, an increase of 24.4% compared to the previous session. Overall with HNX, the total turnover of the 2 floors increased by 22% to reach 14,901 billion VND.

VN-Index is currently lacking leading pillars when VCB and BID, two largest stocks in terms of market capitalization, are in the red. VIC, VHM, HPG, GAS increased weakly. Although the index increased by another 4.13 points, it still could not surpass the peak on February 29. VN30-Index even decreased by 0.06% despite having 15 stocks increased/13 stocks decreased. The influence from the pillars is quite clear.

However, the market is not inferior, the breadth of HoSE at the end of the morning session recorded 279 stocks increased/156 stocks decreased. VN-Index touched the bottom at 10:40 am to lose about 1.7 points, but the breadth was still positive with 226 stocks increased/198 stocks decreased. Thus, the market has ignored the decreasing factor from the pillars.

Currently, HoSE has 99 stocks increasing over 1% with liquidity accounting for 48.3% of the total exchange value of the floor. Up to 20 stocks in this group have liquidity over 100 billion VND. This is a signal of proactive demand pushing prices very well. There are only 32 stocks that decrease by more than 1%, of which only a few stocks have large liquidity such as DBC decreased by 1.68% with a transaction of 156.2 billion VND, EVF decreased by 1.56% with 121.2 billion VND, DGC decreased by 1.05% with 207.7 billion VND…

![VPBank Proudly Presents G-DRAGON 2025 WORLD TOUR [Übermensch] IN HANOI as Title Sponsor](https://xe.today/wp-content/uploads/2025/10/screen-sho-2-218x150.png)